Articles

ADXpress By Dr. Charles B. Schaap

In today’s market action, breakouts often move far before making the first retracement. Some power trend breakouts are like an “express” train departing from a train station-you either jump onboard quickly or you miss the train altogether. The ADXpress is an alternative entry strategy for fast moving breakouts. Generally, we trade breakouts by looking for new price highs/lows and an ADX above 25; and then we look to buy the first retracement back to the 20 EMA (ADXodus). But power trend stocks have stored up energy and can really fly once they breakout; sometimes the 20 EMA entry is too late. The ADXpress strategy is the answer to this problem and will ensure that you don’t miss the express train.

After a breakout, price often pauses, briefly forming a tight pattern of two to five narrow range bars near the 5 SMA or 10 SMA. The bars move more sideways than up or down and they may appear to form a mini flag. In the best uptrend patterns, price makes inside bars or slightly lower lows. In the best downtrends patterns, price makes inside bars or slightly higher highs. The ADXpress takes advantage of the best signals in ADX/DMI. The DMI is used to confirm the breakout with a crossover high and a rising ADX above 25 tells us the trend strength is strong in the direction of the DMI breakout. Just think of a train-once it is moving, it can slow down; but it can’t stop quickly. All aboard!

ADXpress LONG SETUP:

- 1. Price makes a 20 day high

- 2. The +DMI makes a crossover high

- 3. The +DMI makes a pivot low above 25.

- 4. ADX is above 15 and rising.

- 5. Price makes a two to five bar pause near the 5or10 SMA.

- 6. Enter long on pivot low reversal (up) in price.

ADXpress SHORT SETUP:

- 1. Price makes a 20 day low.

- 2. The -DMI makes a crossover high.

- 3. The -DMI makes a pivot low above 25.

- 4. ADX is above 15 and rising.

- 5. Price makes a two to five bar pause, near the 5 or 10 SMA.

- 6. Enter short on a pivot high reversal (down) in price.

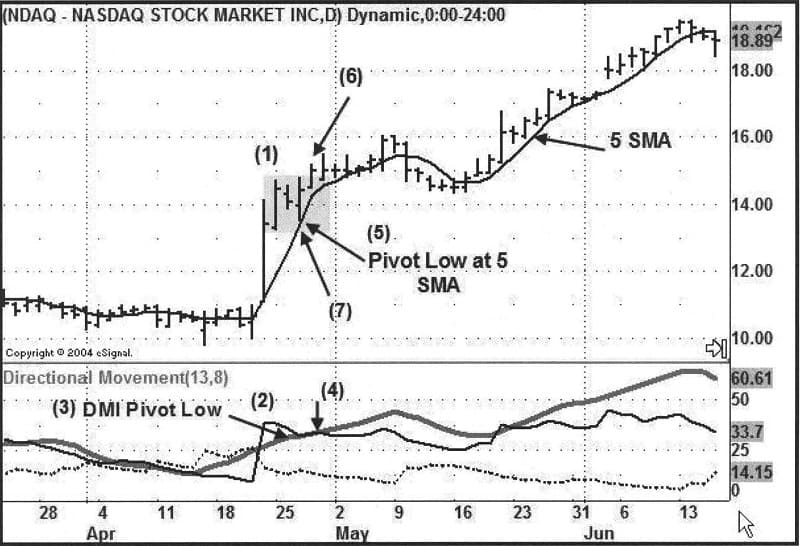

Figure 12.1 NDAQ-Daily

ADXpress LONG ENTRY:

- 1. Price makes a 20 day high.

- 2. The +DMI makes a crossover high.

- 3. The +DMI makes a pivot low above 25.

- 4. ADX is above 15 and rising.

- 5. Price makes a 2 bar pause, forming a pivot low at the 5 SMA.

- 6. Entry is made on a pivot low reversal (up).

- 7. The stop loss is placed under the low of the pivot low.

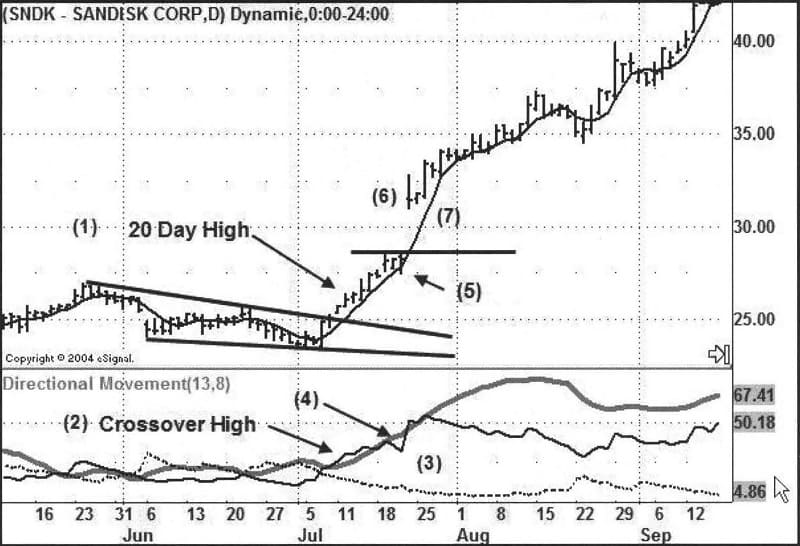

Figure 12.2 SNDK-Daily

ADXpress LONG ENTRY:

- 1. Price makes a 20 day high.

- 2. The +DMI makes a crossover high.

- 3. The +DMI makes a pivot low above 25.

- 4. ADX is above 15 and rising.

- 5. Price makes a 2 bar pause, forming a pivot low at the 5 SMA.

- 6. Entry is made on a pivot low reversal (up) which was a gap up.

- 7. The stop-loss is placed under the 5 SMA at the level of the gap up in price (tighter stop-loss due to gap).

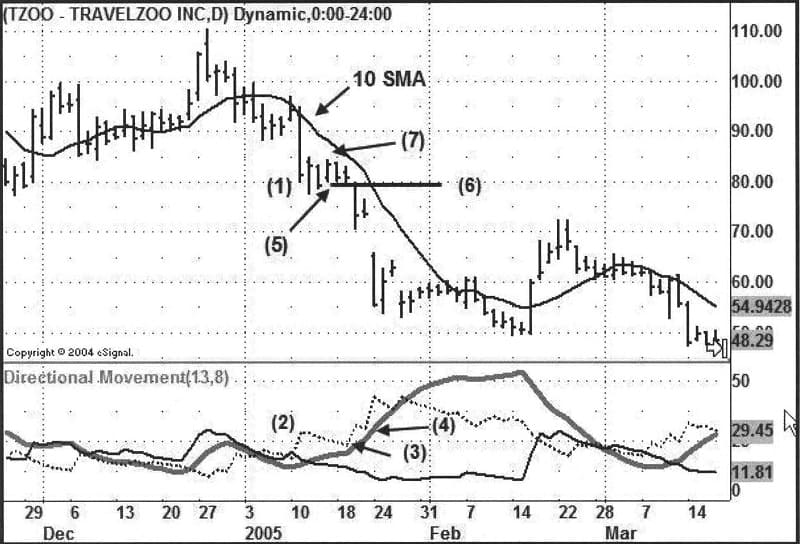

Figure 12.3 TZOO-Daily

ADXpress SHORT ENTRY:

- 1. Price makes a 20 day low on a wide range bar.

- 2. The -DMI makes a crossover high.

- 3. The -DMI makes a pivot low above 25.

- 4. ADX is above 15 and rising.

- 5. Price makes a retracement near the 10 SMA.

- Entry is made on the pivot high reversal (down).

- The stop-loss is placed above the pivot high.

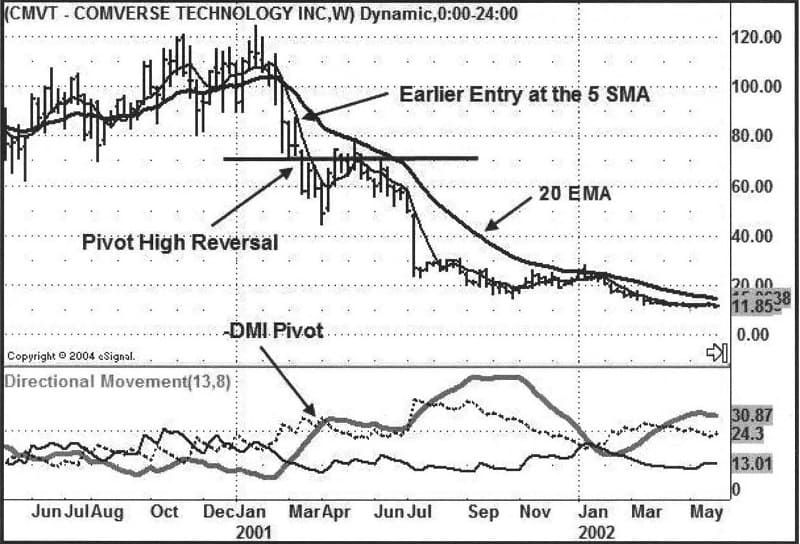

Figure 12.4 CMVT-Weekly

Suggested Books and Courses About Trading With Indicators

Forex Profits With MACD By Frank Paul

Original price was: $99.00.$31.46Current price is: $31.46.ADXpress SHORT ENTRY: Case Study

This weekly chart of CMVT shows a classic ADXodus entry at the 20 EMA. But an earlier entry was possible at the 5 SMA when the -DMI made a pivot low at 25 and price touched the 5 SMA. Power trend strategies using ADX/DMI always enter on a pivot that defines support or resistance. In this case, the earlier entry was not that beneficial when compared to the 20 EMA entry. But it is impossible to predict how far and fast prices will fall in any given situation. The important thing is to understand the trade mechanics, manage risk, and know what triggers a valid entry signal.

Figure 12.5 AMGN-Daily

ADXpress LONG ENTRY: Case Study

This daily chart of AMGN compares two different 20 day high breakouts. The first 20 day high (left) is not an ADXpress™ trade. After making a crossover high, the +DMI made a pivot low “under” 25, demonstrating a lack of express strength. One clue was the several narrow range bars after the breakout which represented range contraction rather than expansion. The second 20 day high (right) is an ADXpress™ long setup at the 5 SMA. We see wide range bars on the breakout, and the +DMI made a pivot low above 25. The 5 SMA has a steep slope. Price made a three bar pause before taking off again and gapping up.

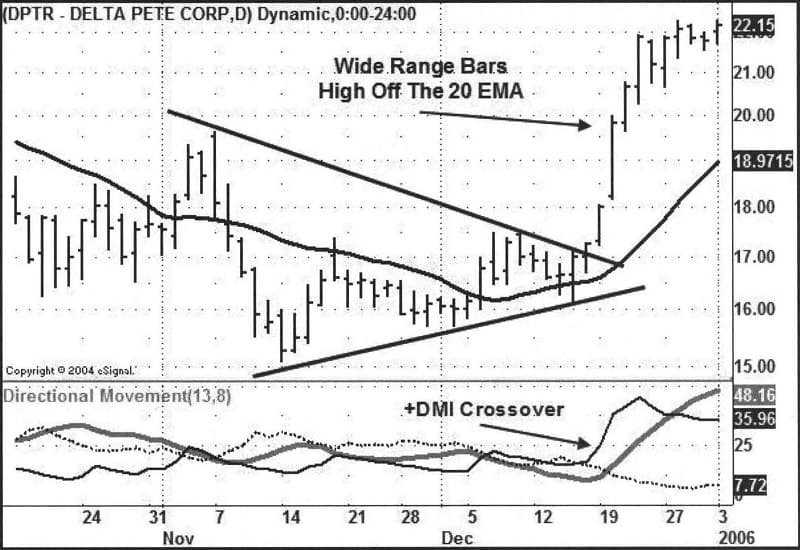

Figure 12.6 DPTR-Daily

ADXpress LONG ENTRY: Dual Timeframe Case Study

This daily chart of DPTR shows a consolidation triangle and a breakout to the upside. The breakout has wide range bars. There is a +DMI crossover high. But where is the entry? The stock has not retraced back to the 20 EMA yet, and prices have advanced over 30%. One option is to enter on a lower timeframe. This method is presented to reinforce the power trend principle of using multiple timeframes. Look at the next chart (Figure 12.7).

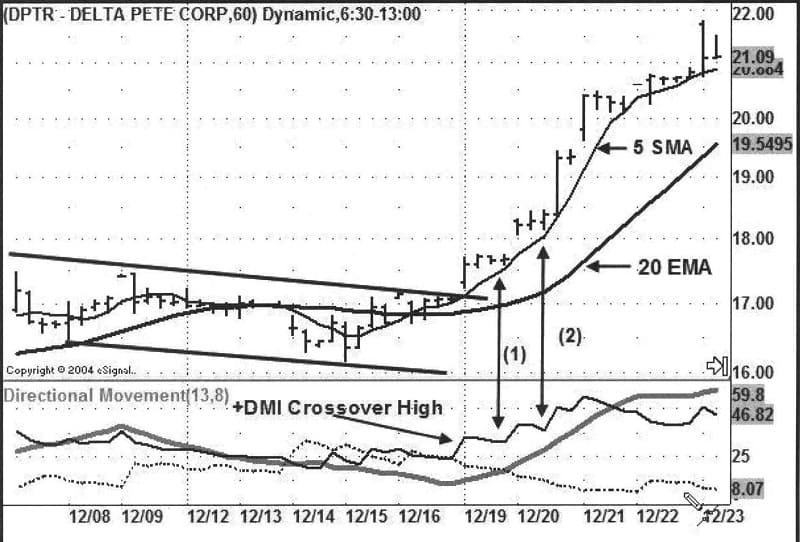

Figure 12.7 DPTR-Hourly

This is an hourly chart of the same breakout in Figure 12.6. We see the same features of price breaking above resistance and a +DMI crossover high. Even on the lower timeframe, prices have not retraced to the 20 EMA.

- 1. The +DMI made a pivot low above 25, and price made a pivot reversal at the hourly 5 SMA.

- 2. The +DMI made another pivot low above 25, and price made a second pivot reversal at the hourly 5 SMA.

The lower timeframe presented two optional entry points for the DPTR breakout. Even when playing for the bigger moves, there is no reason a lower timeframe cannot be used to make an entry.

One thought on “ADXpress By Dr. Charles B. Schaap”

Leave a Reply

You must be logged in to post a comment.

This information is priceless. Where can I find out more?