Articles

Low-Risk Trades Using Cup-With-Handle By Dale Glaspie

Here’s how a popular pattern can present trading opportunities in a bear market. The year 2008 marked the beginning of one of the worst economic crises of our country’s history. But just like all other economic crises, it too will come to an end, and when it does, those who have prepared will profit in a big way. How? Most stock traders have either traded or at least heard of the cup-with-handle formation. It has long been recognized as one of the most useful technical patterns, and I have been fascinated by the versatility it possesses from the time I started using it.

Like other bullish patterns, however, it fails sharply when the markets turn bearish. Thus, I began my quest for an indicator that would perform in a bear market the same way that the cup-with-handle performs in a bull market. As a result, I developed the inverted cup-with-handle and was pleased at how these two indicators worked to offer some of the best trades available. The problem is trying to find these little nuggets in a timely manner.

THE INVERTED CUP-WITH-HANDLE

By studying the relationship between the cup-with-handle and the inverted cup-with-handle formations, I discovered eight different trades, four associated with each formation. To make it easier to explain, I look at the cup-with-handle as one mother and the inverted cup-with-handle as another mother. Each of these parents have three offshoots called “handle,” “bounce off,” and “reversed.” I put a “C” in front of those associated with the cup-with-handle and an “I” in front of those associated with the in-verted cup-with-handle. So we have two families: one made up of cup-with-handle; CHandle, CBounceOff, and reversed cup-with-handle; while the other is composed of inverted cup-with-handle, IHandle, IBounceOff, and reversed inverted cup-with-handle.

A key factor is to remember that these children will move in the opposite direction of their parents. For instance, the cup-with-handle is a bullish trade, whereas her offspring are bearish ones. The inverted cup-with-handle is used in a bearish market, and her offspring will be some of the best bullish moves you will ever see. It is this latter group you need to learn about first, as they will make you a lot of money when the market turns around.

The second key factor is to know which trade to associate with the current market condition. For simplicity’s sake, I assigned each trade to one of the four phases of the cup-with-handle cycle: the bull market phase, the down transition phase, the bear market phase, and the up transition phase. Here I have broken down each phase with the trades associated with that phase:

- 1 Bull market phase: Cup-with-handle trade

- 2 Down transition phase: CHandle, CBounceOff, and the reversed cup-with-handle trades

- 3 Bear market phase: Inverted cup-with-handle trade

- 4 Up transition phase: IHandle, IBounceOff, and the reversed inverted cup-with-handle trades.

People get in trouble when they try to use a trade in the wrong market. For instance, a cup-with-handle works great in a bull market but when the market turns bearish, its failure rate will be very high. Trying to force it to work in anything other than a good bull market can be an expensive lesson. When you see breakouts beginning to fail on a consistent basis, it means the market is in a down transition phase and you must trade accordingly.

Suggested Books and Courses About Chart Patterns

Catching Trend Reversals By David Weis

Original price was: $129.00.$21.97Current price is: $21.97.Technical Stock Tading By Jared Wesley

Original price was: $350.00.$36.19Current price is: $36.19.Technical Analysis of Gaps: Identifying Profitable Gaps for Trading

Original price was: $22.36.$11.18Current price is: $11.18.Understanding Gaps: Profiting from the Opening Gap

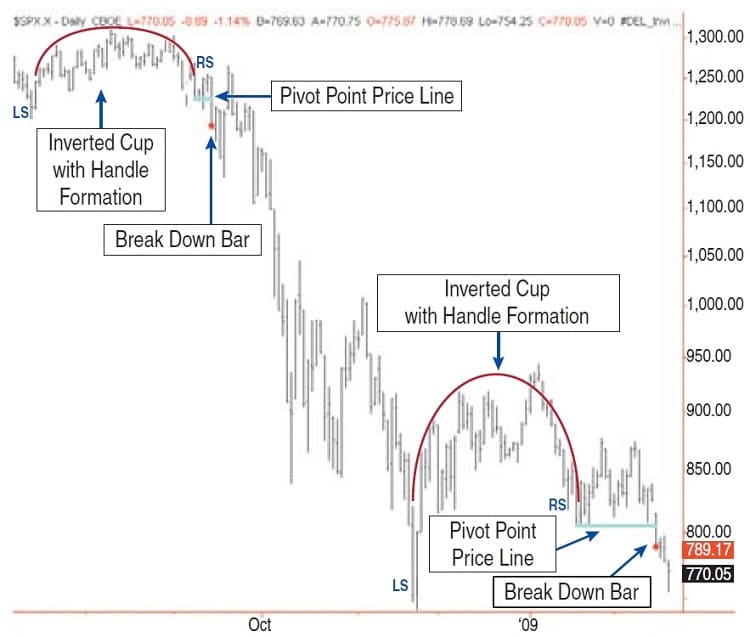

Original price was: $27.39.$13.70Current price is: $13.70.We are in a strong bear market that began in September 2008. The chart of the Standard & Poor’s 500 in Figure 1 is a good example of how the inverted cup-with-handle works in this market. The LS represents the bar that made up the left side of the inverted cup and the RS represents the right side. The red dot represents the closing price on the bar for the day the price broke down. The cyan line represents the pivot point price line, while the pivot point is the closing price on the bar that makes up the right side. A horizontal line extended to the right of this price (the pivot point price line) becomes a powerful support/resistance line. Once the price closes below this line on sufficient volume, we have a breakdown. This line will act as a support/resistance line for future trading. After a breakdown from the first formation, the price continued on down and completed a second inverted cup-with-handle formation. It broke down from the second formation a few days before this writing.

FIGURE 1: INVERTED CUP-WITH-HANDLE IN A BEAR MARKET. Note how low the price went when it broke down below the pivot point price line. In this case, another inverted cup-with-handle formation was completed.

REVERSED INVERTED CUP-WITH-HANDLE

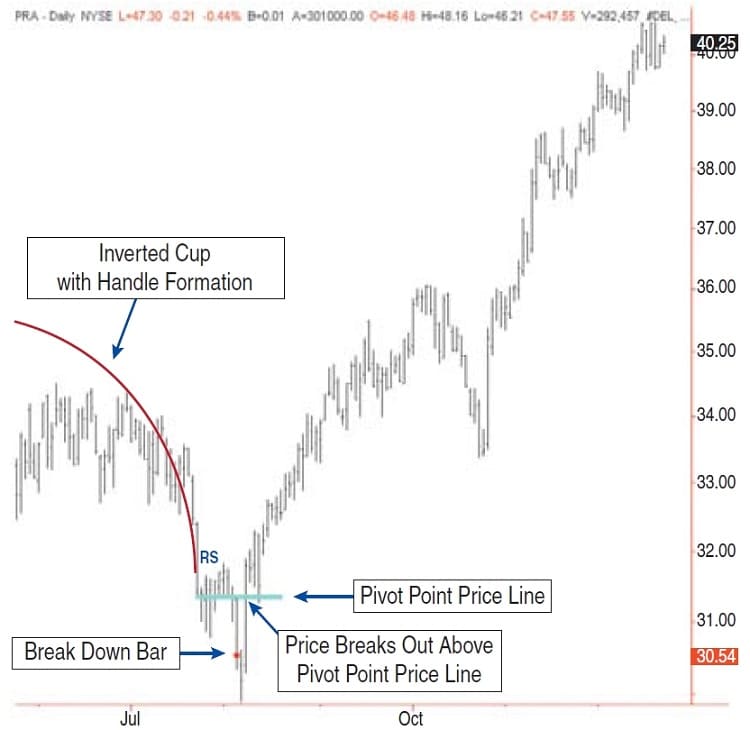

When the market turns bullish, the inverted cup-with-handle trade will begin to fail. The first indication of this market shift occurs when a breakdown in price turns back up in a few days and crosses above the pivot point price line, causing a breakout to the topside. Figure 2 is a good example of this. In the reversed inverted cup-with-handle trade, the trader can buy in after the price breaks out above the pivot point price line. This is a low-risk trade in a new bull market.

FIGURE 2: REVERSED INVERTED CUP-WITH-HANDLE. The inverted cup-with-handle trade will begin to fail when the market turns bullish. So in a new bull market the trader can use this pattern in the reverse by buying after price breaks out above the pivot point price line.

THE IBOUNCEOFF

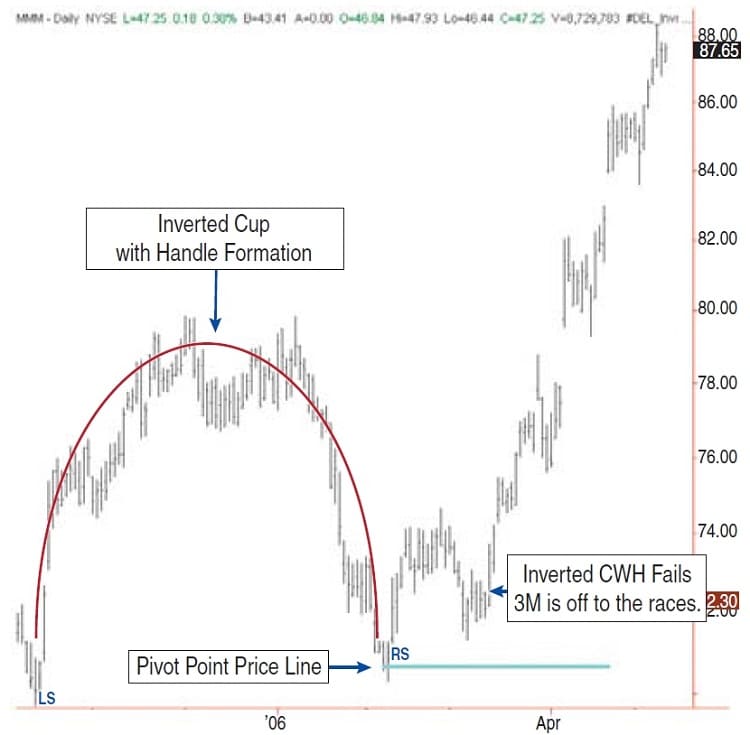

After completing the right side, the inverted cup-with-handle will form the handle portion, which in normal conditions will be a retracement up for a few days, then go sideways, then curve back down before breaking down. If the market turns bullish just before it breaks down, the price will appear to bounce off and take off to the upside (Figure 3). This will be a strong up move and can be the source of a good profit for those who are watching for it. As stated earlier, the pivot point price line will act as a strong support line when the market is trading above it. The IBounceOff trade will be a low-risk trade when the market has a bullish bias.

FIGURE 3: THE IBOUNCEOFF. If the market is turning bullish, the price will appear to bounce off the pivot price line and take off to the upside. This can be a source of good profit.

THE IHANDLE

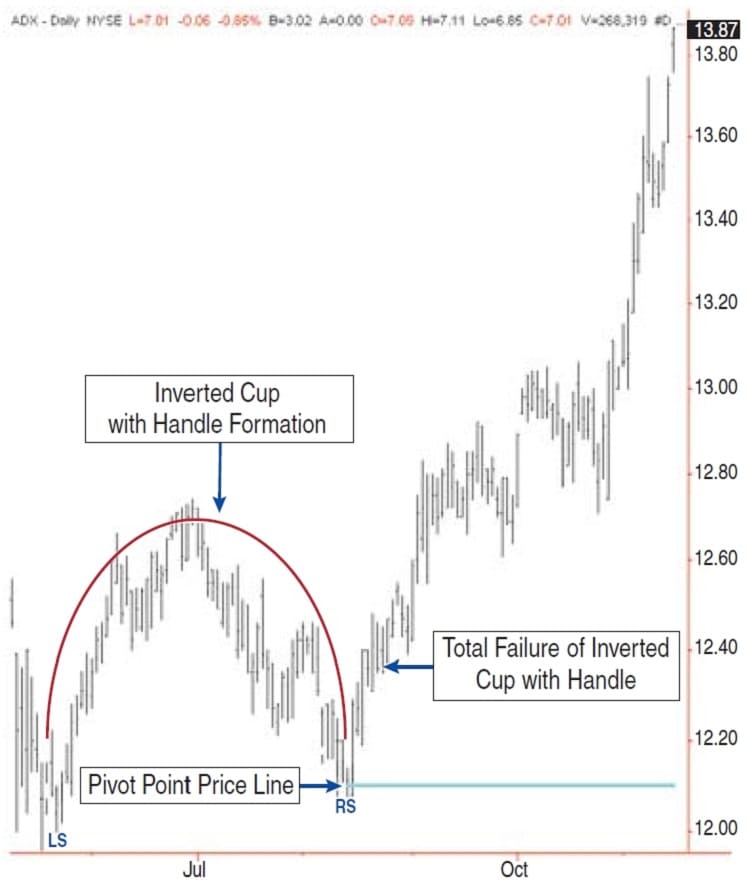

At the end of a strong bear market, there will be a large number of inverted cup-with-handles with setups, but there will be very few cup-with-handles with setups. As the market turns bullish, those inverted cup-with-handles just setting up will have a high rate of failure. They will fail to act as a normal inverted cup-with-handle. Instead, they will start climbing in price. The chart for Adams Express (ADX) in Figure 4 shows how the failure of the inverted cup-with-handle formation led to a large gain when trading the long side. This is typical of the inverted cup-with-handle formations that complete their setup during the early stages of a new bull market — that is, the up transition phase.

FIGURE 4: THE IHANDLE. Here, the failure of the inverted cup-with-handle formation led to a large gain when trading the long side.

CHANGE IN DIRECTION

When the end of a bear market is approaching, be ready to spot the up transition trades associated with the inverted cup-with-handle formation. They are big profit-makers that less-knowledgeable traders will know nothing about. If the market is bearish and shows signs that it could be ending shortly, it’s a good idea to start implementing those up transition trades. They will give you a leg up for some very profitable opportunities.

Dale Glaspie started trading commodities in 1982 and evolved into trading stocks using cup-with-handle formations.