Articles

Investment Vs. Trading In Covered Call Writing By Jay Kaeppel

With the investment approach, shares of stock are viewed as rental property and calls are written to generate additional income from what is expected to be a longer-term stock investment. The trading approach involves executing buy/writes based on the possibility of generating a high annualized rate of return on a given stock/option combination. Which is better?

INTRO

It can be argued that covered call writing is the second-most commonly used option trading strategy, trailing only straight call and put buying. This is not surprising, since many investors assert that covered call writing is tantamount to collecting free money. While this is not actually true, in order to understand why this belief persists, let’s first look at what constitutes a covered call.

A covered call position simply involves buying and/or holding shares of stock and selling a call option against that stock position. For example, an investor might buy 100 shares of Ciena Corp. (CIEN) for $14.04 a share and then sell a call option with a strike price of $14. When he sells the call option, the option seller is paid a premium by the option buyer. In return, the option seller agrees to sell his shares of stock to the option buyer at the strike price of $14 a share if called upon to do so. In this example, the option seller received a price of $0.78 for the option, or a premium of $78 (each stock option is for 100 shares of the underlying security). The amount of premium received will vary based on several factors, including:

- The amount of time left until the option expires

- The volatility of the underlying stock

- The distance between the strike price and the current price of the stock.

The more time until expiration and/or the more volatile the underlying stock, the more premium an option writer will typically demand from an option buyer in order to assume the risk of writing the option in the first place. This is because the covered call writer assumes the obligation to deliver 100 shares of stock to the option buyer if the option is exercised at or before the time the option expires, no matter how high the stock may rise in price. In other words, the greater the risk associated with writing an option, the more premium the option seller will demand.

If the stock price is below the strike price for a given call option at expiration, that option will be exercised and the option seller called upon to deliver 100 shares of the underlying stock at the strike price. Using our earlier example, if the covered call writer holds CIEN stock through option expiration and the stock is at $14 a share at that time, then the option will not be exercised and the investor will retain his shares of CIEN stock. However, by having written the call option, the investor earns a profit of $74, calculated as follows:

- The stock declined from $14.04 to $14, resulting in a $4 loss (0.04 x 100).

- Because the stock price ($14) is not above the option strike price ($14), the option expires worthless and the investor gets to keep the entire $78 he received when he originally wrote the call.

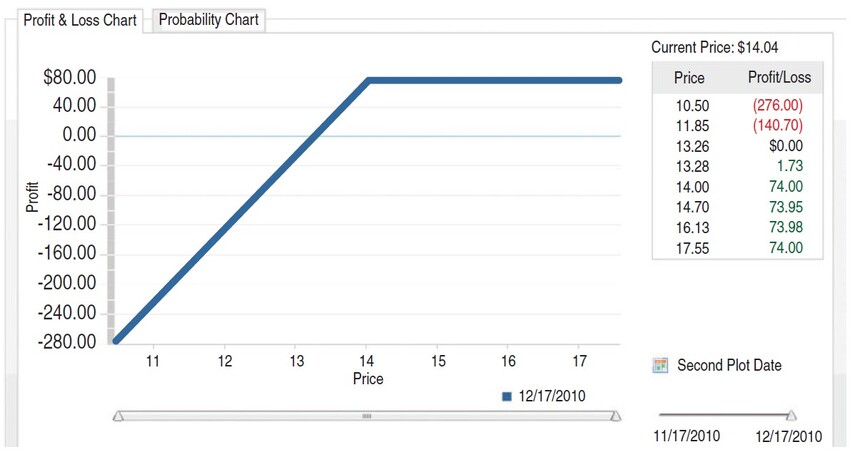

FIGURE 1: RISK CURVE FOR BUYING CIEN AT $14.04 AND SELLING DECEMBER 14 CALL AT $0.78. Note that above the strike price the upside potential is capped. This is because for every $1 made on the long stock position, there is $1 lost on the short call option position. In addition, note that the breakeven price for the combined position is lowered by the amount of premium received.

Figure 1 displays a risk curve for this position. Note that above the strike price the upside potential is capped. This is because for every $1 made on the long stock position, there is $1 lost on the short call option position. In addition, note that the breakeven price for the combined position is lowered by the amount of premium received. There are many potential factors to ponder when considering the prospect of writing a covered call, but first and foremost is the over-arching approach that an individual might choose to pursue.

MOST COMMON TACTICS TO COVERED CALL WRITING

There are several primary methods that an investor might adopt. Perhaps the most common are:

The investment approach: Shares of stock are essentially viewed as rental property. This approach involves selling calls against an existing or newly acquired stock position in order to generate additional income from what is expected to be a longer-term stock investment. This will often involve buying a stock and retaining ownership over several months or even years.

The trading approach: This tactic involves executing a buy/write using a particular stock/option combination in order to generate a high annualized rate of return on a single trade. This approach can lead to new positions being entered and exited as often as every month, depending entirely on the relative rates of return available after the previous position is exited.

Each approach has its own relative advantages and disadvantages, so let’s look at them separately.

THE INVESTMENT APPROACH

The investment approach to covered call writing involves either buying a new stock position and selling a call option against it, or simply selling a call option against a stock you already hold. In either case, when using this method the stock is viewed as an income vehicle or as a rental property. The hope is that over time, the price of the stock will rise. However, the other primary focus is on generating income from that stock holding on an ongoing basis in an effort to generate an above-average total return. “Total return” refers to the amount gained by the stock itself, plus any dividend income and any premiums received for writing call options against the stock. Several steps are involved in using this approach.

Step 1: Buy a stock you like (and plan to hold for a while). There are many possible reasons to choose a particular stock to buy and hold as an income vehicle. Ironically, “because you expect an immediate sharp price movement to the upside” is not one of them. This is so simply because selling a call option against a stock — if done so in a ratio of 100 shares of stock to one call option — has limited upside potential, as shown in Figure 1. This is a result of the fact that the investor gives up the upside potential for the stock above the strike price of the call option sold.

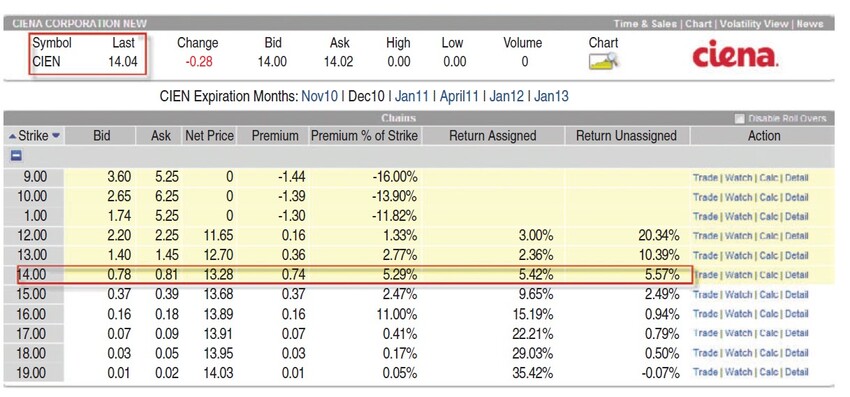

Step 2: Select an option to write against that stock. Typically, an investor will select the option that offers the highest rate of return. One way to make this determination is to consider the amount of premium received relative to the strike price of the option (see Figure 2). Options with three to six weeks left until expiration are typically the best choice because they will give up their premium more quickly than longer-term options simply because time decay — the rate at which an option gives up its time premium — accelerates as expiration draws closer.

FIGURE 2: OPTION “CHAIN” FOR CIEN DECEMBER 2010 CALL OPTIONS. Options with three to six weeks left until expiration are typically the best choice because they will give up their premium more quickly than longer-term options. There were 31 days left until the December 14 call option expired, so an investor entering this position has the potential to earn 5.58% in just 31 days.

Step 3: Assess the position’s potential return. See Figure 1. For a longer-term investment approach, the key is to make sure you are generating enough rental income to justify entering the position. To calculate the potential return, we simply divide the maximum profit potential by the net cost to enter the position (the net cost is the price of the stock minus the price of the option sold). As a rule of thumb, a value of 2% to 3% should be the bare minimum you will accept for selling a call with 45 days or less left until expiration.

Maximum profit potential can be calculated as follows:

- If strike price > stock price then maximum profit potential = (Strike price – stock price + option price x 100 x calls sold)

- If strike price < stock price then maximum profit potential = (option price – stock price + strike price) x 100 x calls sold

Net cost is calculated as:

- (Stock price x shares purchased) – (option price x 100 x options sold)

Potential % return is arrived at using this formula:

- (Maximum profit potential/net cost) x 100

For the CIEN example:

- Maximum profit potential = ($0.78 – $14.04 + $14) x 100 = $74

- Net cost = ($14.04 x 100) – ($0.78 x 100 x 1) = ($1,404 – $78) = $1,326

- Potential % return = ($74/$1,326) x 100 or 5.58%

At the time this example was created, 31 days were left until the December 14 call option expired. As a result, an investor entering this position has the potential to earn 5.58% in just 31 days. The potential rate of return will vary from stock to stock and option to option.

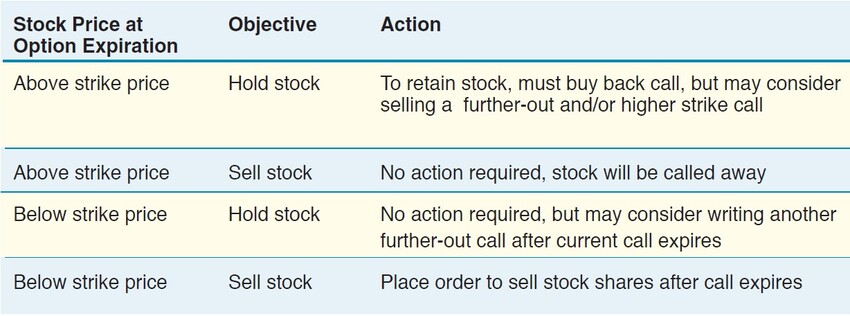

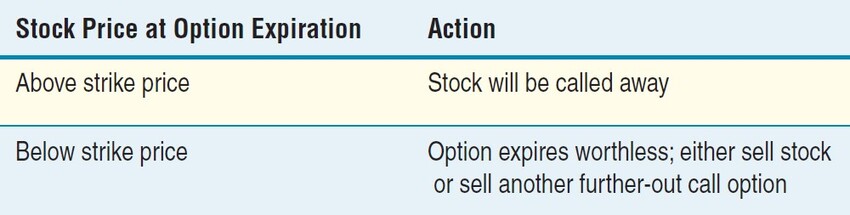

Step 4: Adjust the position as necessary. As option expiration approaches, an investor will need to consider whether the stock price is above or below the strike price of the option that was sold. There are a number of possible outcomes and actions. These are summarized in Figure 3.

FIGURE 3: INVESTMENT APPROACH ACTIONS AT OPTION EXPIRATION. As option expiration approaches, an investor will need to consider whether the stock price is above or below the strike price of the option that was sold. Here you see a number of possible outcomes and actions.

If the price of CIEN is above $14 a share when December options expire, then any call options with a strike price of 14 or less will automatically be exercised and the seller of those options required to deliver 100 shares of CIEN stock at the strike price. So if CIEN closed at $15 a share at the time of option expiration and an investor who sold the 14 strike price call takes no action prior to expiration, then his shares will be called away at $14 a share. As a result, in this example the investor would:

- Lose $4 on his stock purchase ($14 – 14.04 x 100)

- Keep the $78 he received for selling the call

As a result, he would earn $74 on his $1,326 investment (5.58%) in 31 days.

Suggested Books and Courses About Trading Options

However, if the investor wishes to hold CIEN for the longer term, then if the price of the stock is above the call strike price he will need to buy back the call option prior to expiration. With the stock at $15 a share, the 14 strike price call would be worth $1. Since each option is for 100 shares of the underlying stock, the investor would pay $100 to buy back the option. In this case, the investor would still make $74, calculated as follows. He would:

- Gain $96 on the stock ($15 – 14.04 x 100)

- Lose $22 on the option ($0.78 – $1.00 x 100)

- $96 – $22 = $74

If the investor wants to, he can roll into another option — that is, if the stock is at $15 near December option expiration, he could buy back the December 14 call and sell the January 15 call. From there he would simply repeat step 4 until such time that he no longer wishes to hold the stock. If at the time of option expiration the stock price is below the strike price for the option previously sold, then the option will expire worthless and the investor keeps the entire premium he received. If he chooses to, he can then write another call option against those same shares of stock.

THE TRADING APPROACH

Whereas the investment approach centers on a favored stock, the trading approach simply attempts to maximize long-term return by searching for stock/option combinations offering high potential returns without giving preference to any particular stock. So where the investment approach starts by looking for a stock that one already holds or is interested in buying, the trading approach simply says “Show me the money,” as in “Show me the buy/write combinations with the highest potential returns.” This process involves a slightly different set of steps:

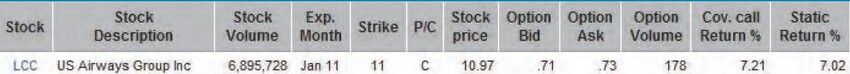

Step 1: Look for a stock/option combination that offers a high reward-to-risk ratio. Figure 4 displays the output of a screen looking for covered calls with high potential returns.

FIGURE 4: A HIGH POTENTIAL RETURN COVERED CALL IN US AIRWAYS (LCC). In the column labeled “Static return,” you can see that the position listed will generate a return of 7.02% if the stock is unchanged when the option expires.

In the column labeled “Static return,” you can see that the position listed will generate a return of 7.02% if the stock is unchanged when the option expires. While we are looking for high potential rates of return, I should mention a word of caution. Typically, higher option premiums reflect a higher level of risk. There are several things that can help mitigate some of the risk:

- For the trading approach, it is best to avoid selling options that expire after an upcoming earnings announcement. An unexpectedly unfavorable announcement can cause a sharp decline in the price of a stock. Since the covered call position has more downside risk than upside potential, it is best to avoid the danger of holding a covered call position through an earnings announcement.

- Look for a bid/ask spread on the option that is not too wide ($0.10 or less if the ask price is $1.00 or less, $0.20 or less if the ask price is greater than $1).

- Trading stocks that have a lower level of price volatility also reduces the risk of holding a position that drops out of the sky.

For the trading approach, it is important to consider the overall reward-to-risk profile of the combined position. While an investor using the investment approach may eschew using a stop-loss on the stock because it is a long-term hold, an individual using the trading approach should definitely look for a reasonable price level at which to place a stop-loss order for the stock. This leads to step 2:

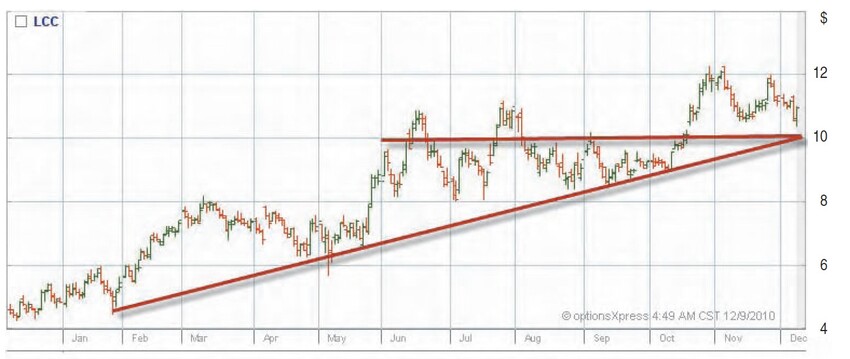

Step 2: Use a stop-loss on the stock with a contingent order for the option. In Figure 5, we see a bar chart for LCC stock. Using simple technical analysis, it would be reasonable to say that if this stock takes out the recent support at $10, then support has failed to hold and it is time to exit the stock. Let’s assume that a trader:

- Buys LCC stock at $10.97.

- Sells the January 11 strike price call option for $0.71.

- Places an order to sell the stock at $9.90 and a contingent order to buy back the option at the market if the stock is sold.

FIGURE 5: BAR CHART FOR LCC HIGHLIGHTS OBVIOUS AREA OF SUPPORT. Using simple technical analysis, it is reasonable to say that if this stock takes out the recent low of 9.37, then support has failed to hold and it is time to exit the stock.

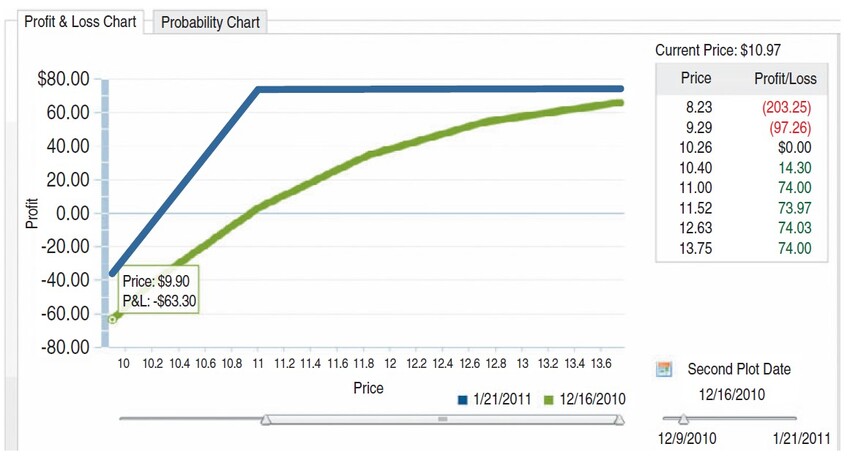

As a result, the trader will have the reward-to-risk profile displayed in Figure 6.

FIGURE 6: REWARD-TO-RISK PROFILE FOR LCC TRADE. Assume that the trader buys LCC stock at $10.97, sells January 11 strike price call option at $0.71, and places an order to sell stock at $9.90 or buy back the option if the stock is sold. The profit potential is $74 and the expected risk is $63.

In a nutshell, the trader has a profit potential of $74 and an expected risk of $63, assuming he is stopped out at $9.90 one week after entering the trade. From here, the trader must decide on an acceptable minimum reward-to-risk ratio and assess the likelihood that the trade will end in profitable territory. The ideal candidates have tight option bid/ask spreads and no earnings announcements prior to the time of option expiration and a reasonably nonvolatile underlying stock.

Step 3: Wait for stop-loss or expiration. Eventually, one of two things will happen. Either the stop-loss order for the stock will be triggered (as well as the contingent order to buy back the call option) and the entire position will be liquidated at a manageable loss, or the option will expire. If the option expires, it will do so either in-the-money (stock price below strike price) or out-of-the money (stock price above strike price). The implication of each is displayed in Figure 7.

FIGURE 7: TRADING APPROACH ACTIONS AT OPTION EXPIRATION. Here you see the implications of options expiring in-the-money or out-of-the-money.

Individuals using the trading approach should focus on selling options with two to six weeks left until expiration. These generally offer enough return to make trades worthwhile but also do not require the trader to hold the stock for an extended period of time.

INVESTING OR TRADING?

At this point, you might be expecting me to draw some conclusions and tell you which approach is better. However, there is no definitive answer. Each individual must consider the relative advantages and disadvantages of the two approaches discussed herein and decide which approach best fits with their own investment objectives and personal tolerance for risk.

Jay Kaeppel is the codeveloper of The MoneySteps covered call writing course (www.MoneySteps.com) with Tom Gentile, co-founder of Optionetics. An independent trader, Kaeppel writes a weekly column titled “Kaeppel’s Corner” for Optionetics. com and is the author of Seasonal Stock Market Trends: The Definitive Guide To Seasonal Stock Market Trading.