Trading Articles

Candlesticks Can Protect Your Retirement By Stephen W. Bigalow

Millions of Americans work for good stable companies. So we think! Yet consider the twenty thousand plus employees that worked at Enron. September 2001, the atmosphere in the Enron offices was not any different than what it had been for the previous five years, robust and vibrant. People were proud to work there. The management policies made the daily business environment a place people looked forward to everyday. Everything was great, and there were no problems whatsoever.

The majority of Wallstreet analysts were recommending the stock. Top management was painting a rosy picture for the company’s future. New projects were being introduced. Money was flowing. The future looked great. Enron employees, like millions of other corporate employees around the world were immersed in the day-to-day activities of the corporation. How could they ever have known there was any trouble?

This could be the same description for thousands of corporations across the nation, across the world. So how does the individual employee protect themself from the unthinkable? What precautions can be taken that will alert you to something not being right in your own company? Something that was not detected by the “ diligent” Wallstreet analysts, the scrutiny of professional accounting firms, the safe-guards of your company’s management. The odds of another Enron debacle could be extremely minute. But can you afford to lose your retirement money, can you afford to be hit by the same ramifications that thousand of ex-Enron employees are facing today? There was a simple tell-tale indicator that could have saved peoples retirement accounts. Japanese Candlestick charts.

If you are not familiar with Japanese Candlestick analysis, it will be worth your while to learn how to use the charts. It is simple and easy. The visual illustration of what is happening in a company’s stock is clearly apparent on Candlestick charts. This simple, yet accurate depiction of what is the cumulative sentiment of the investment community reveals valuable information. For the employee, it cuts to the chafe as to whether investors are buying or selling the stock.

Japanese Candlestick signals are the result of hundreds of years of successful rice trading. Successful is really an understatement. The Honshu family refined the technique. Observing the highly accurate reversal signals not only made them wealthy, it made them legendary wealthy. Their influence is the basis of today’s Japanese investment philosophy, stemming from the observations derived in Candlestick analysis. The basic function of investing is to make money. However, few investors develop a trading program that put the probabilities in their favor. If searching for the “Golden Goose” of investment programs, the criteria would be simple; well researched, proven track record, and easy-to-identify reversal points.

All three of these elements are incorporated into Candlestick signals. Hundred of years of rice trading resulted in the identification high probability profitable trades. Make one assumption. The signals would not be around today if it were not for one convincing result. PROFITS! Candlestick signals exist today because of hundred of years of actual profitable trades. Not computer back testing. Not questionable results. Profits produced from utilizing the signals are the only reason we are witnessing these signals today.

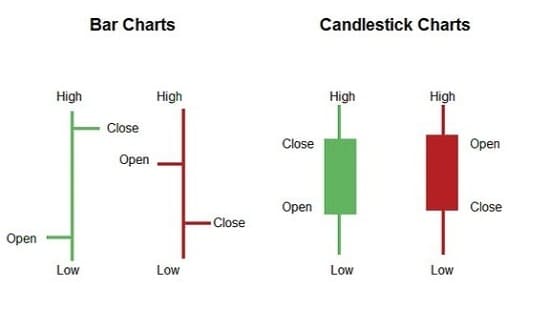

Reversal points were identified by rice traders using very simple charting techniques. You can take advantage of these clear profitable signals? Japanese rice traders used the same information found on a standard bar chart. The difference is that they put more weight on the open and closing prices as well as the high and the low of a time period. As illustrated in Figure 1, an open that is lower than the closing price creates a white candle. An open that is higher than the close creates a black candle. The positioning of these candles, with analysis of the colors of the candle, provides valuable information.

Learning how to use the signals correctly is now easy and can provide tremendous investment profits. Until recently, mastering the Candlestick technique had its draw-backs. First, there were very few places to go to learn how to use the signals effectively. That resulted in a lot of misinterpretation of the signals. This created a questioning of the effectiveness of the candlestick signal technique. However, websites such as www.Candlestickforum.com provide investors with a learning forum as well as being exposed to different degrees of candlestick analysis. Trying to master approximately 40 signals has been the major deterrent for the methodology becoming overwhelming popular during the past couple of decades in the U.S. Fortunately eight to ten of the signals will be responsible for 90% of the potential profits. This makes the learning process immensely easier.

Suggested Books and Courses About Candlestick Patterns

Trying to decipher what is corporate Rah-Rah and what is true facts becomes difficult when one is right in the middle of the forest. Also, the amount of loyalty demonstrated to the company usually has an underlying impact in ones career progress. However, maintaining ones retirement security is a high priority. It is easier to accumulate your own companies stock in your retirement account than trying to analyze alternatives. The company has been good to you. The stock price has been growing well. Owning the stock demonstrates your loyalty and dedication to the company. However, like all investment vehicles, your company stock can oscillate just like any other stock. There will be times when it is ahead of itself in price. There will be times that management makes mistakes in which direction to take the company’s growth. There will be times that the market in general is not favorable for being in any stocks.

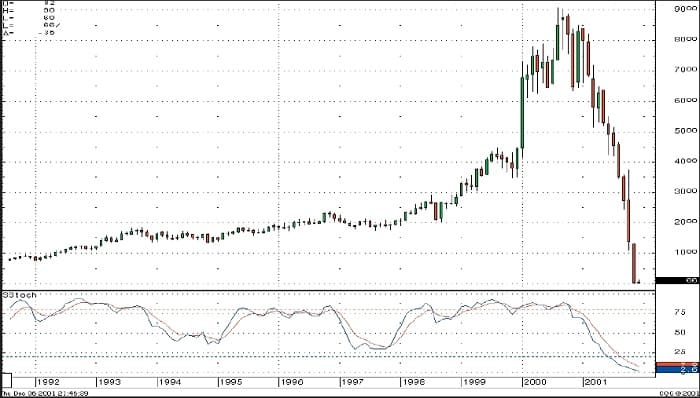

Japanese Candlesticks can act as a monitor for when an investor/employee should be accumulating stock or moving to other investments. Note in Figure 2, Enron’s monthly chart, that a Long-legged Doji signified that the current uptrend was over. The corresponding stochastics indicated that the stock price was overbought and starting to curl down. This would have been an indicator for employees to lighten up on their stock position in their retirement accounts and temporarily diversify to other investments. Would the Candlestick charts have projected the magnitude of the stock price pullback? Of course not. But it would have alerted investors and employees to reduce their positions until the stock became over-sold and a buy signal appeared.

Figure 2- The rosy picture of Enron’s future did not correspond with what the rest of the investment community envisioned. The situation with Enron has awakened the investment community to the pitfalls of Wallstreet analysis, professional accounting, and management stop-gap procedures not always alerting investors of problems. It magnifies the need to be diversified. At worst, it alerts employees that some due diligence is required in our own company’s stock. Working there day in and day out doesn’t always insure that the employees know everything that is going on. Having Candlestick knowledge is a tool that all investors should have in their arsenal.

Becoming familiar with Candlestick signals provide other powerful investment ramifications. The roaring bull market of the late 1990’s brought many inexperienced investors into the market. The huge growth of many 401k programs opened the eyes people who had not invested previously. The “technology boom” created the elusion that everything was going up and always would. Investing in the stock market was a place to make easy money.

The late 1990’s was the first time in the history of the Dow that double digit growth occurred more that two years in a row. Unfortunately, the “technology” crash of 2001 more than took back the gains produced in the prior four years. New dynamics entered the market. The “Buy and Hold” investment strategy may have been severely compromised. The resulting changes permanently altered how investors should look at the markets. Those changes could produce huge profits for the Candlestick analyst.

During the mid-70’s to the early 80’s, the “buy and hold” philosophy was preached under the guise that the market was under-valued and would eventually move prices towards their true value. This was a period during which the U.S. economy was struggling. Interest rates went sky high. The Japan auto manufacturers were producing much better product than the U.S. manufacturers. The U.S. manufacturing facilities were old. Modern plants in Europe and Asia were more efficient. New American industrial plants needed to be built to compete; yet the cost of money prohibited any new construction.

Slowly, technology started making U.S. manufacturers and service industries competitive again. The mid 80’s to the mid 90’s had an American economy that was again competitive in the world markets. Stock prices grew steadily. Technology was slowly being implemented into the production of American products. Quality increased, manufacturing costs were being controlled. Inflation was abated. The Dow moved from 1000 to 9000. The buy and hold strategy was a reasonable strategy.

Then in the mid 90’s, a duo dynamic developed. First, the availability of investor information became instantly available through the internet. The American public did not have to depend upon brokerage firms anymore for their investment information. They could access the information and interpret it for themselves. The “intelligent” analysis from stockbrokers and investment analysts was not required. The common man not only did not need investment advise, as it was doled out in the past, they could place their own transactions with out exorbitant commissions through discount brokers. The once popular adage, “ when the public is buying, it is time to sell.” dissipated. It became evident that the average investor was capable of making intelligent choices. During some severe one-day market crashes, it was the institutions bailing out at the bottom and the general public buying the bargains.

“Buy and Hold” may not be effective for the next market environment. Technology, despite its current blemished reputation, makes Candlestick analysis a must for the next few years. Consider what we have witnessed during the past five years. The markets roared, led by technology stocks. Although they got ahead of themselves and came plummeting back down, an important message was delivered. Up until five years ago, manufacturing pursued technology to develop new and innovative advances. When manufacturing needed to become more competitive, it went to research departments and companies to develop a better way to do things. However, a dynamic change occurred in the mid 90’s. Technology, with constantly improved computer tools, started to leap frog on itself. Technological improvements for manufacturing, medicine, software, and the service industries started to advance in geometrical proportions. Improvements were being made on improvements before they could get it to production.

Having knowledge about Candlestick signals now becomes more vital to investors performance. Sector stock trends may not have the long growth cycles anymore. It will become important to observe where and when funds are flowing to particular industries. This is the valuable aspect that Candlestick signals present to the investment community. Because technology stock prices are greatly reduced from their recent lofty heights does not mean that the results of the technology that each company produced is diminished. The speed to which new technology processes can change the face of an industry has not been abated. Technology is now pulling industry along versus industry having to push for better technology. It will be important to follow when each company has great growth potential and when new technology being introduced to a competitor can stop that growth rate. Fortunately, Candlestick analysis easily identifies when the buyers and sellers are coming into a stock price. Instead of one or two years or more of a leader of an industry being able to maintain their leadership position, technology may compress leadership positions into a six month to a year time frame.

Investment cycles may become relatively short. The buy and hold method could prove to be low returns in the future. Holding a stock that goes up 25% in six months, then back down to even over the next six months does not add any value to an investors portfolio. The best investment program in this technology-stimulated market may be to take profits after three, six, or nine months.

Candlestick charts are a great way to enhance returns for the fundamental research investors. Being the best research analyst in the world does not do any good if it requires sitting in a stock months or years before the rest of the market takes notice of what your analysis discovered. The Candlestick signals provide fundamental research analysts with two valuable functions. First, it develops a platform for the most effective timing to enter a position. Fundamental research can prepare an investor to be ready for good things to come in a particular company. Candlesticks charts provide the mechanism for maximizing returns, entering and exiting positions at the exact times. Returns on managed money can be greatly enhanced utilizing Candlestick signals.

Second, established positions can be better protected by monitoring the Candlestick charts. Once a company has been researched and a position has been put in place, a strong candlestick “sell” signal can warn investors that a severe change may have occurred in the fundamentals of a company. It would allow for a quick review of the company’s operations to see if a change of status had occurred. As in the Enron situation, all the good news from the company was not verified by what the accumulative actions of the investment community was thinking. The charts showed selling. Something did not match.

Candlestick signals have been around for hundreds of years. They were introduced into the U.S. investment community twenty–five years ago. New teaching methods are making candlestick signals very easy to learn and use. Whether to use them as a high profit investment program or to use them for monitoring your existing portfolio, every investor should utilize the powerful aspects incorporated in the signals. Being able to see what stocks are doing versus relying upon what “the professional sources?” are telling you, could keep you from ending up with a worthless retirement plan someday.

Stephen W. Bigalow is author of “Profitable Candlestick Investing, Pinpointing Market Turns to Maximize Profits”. He can be reached at www.candlestickforum.com,