Trading Articles

Trend Thrust Indicator By Buff Pelz Dormeier

This indicator defines the impact of volume on the volume-weighted moving average, emphasizing trends with greater volume. What determines a security’s value? Price is the agreement to exchange despite the possible disagreement in value. Price is the conviction, emotion, and volition of investors. It is not a constant but is influenced by information, opinions, and emotions over time. Volume represents this degree of conviction and is the embodiment of information and opinions flowing through investor channels. It is the asymmetry between the volume being forced through supply (offers) and demand (bids) that facilitates price change. Quantifying the extent of asymmetry between price trends and the corresponding volume flows is a primary objective of volume analysis. Volume analysis research reveals that volume often leads price but may also be used to confirm the present price trend.

TREND THRUST INDICATOR

The trend thrust indicator (TTI), an enhanced version of the volume-weighted moving average convergence/divergence (VW-MACD) indicator, was introduced in my book Investing With Volume Analysis. The TTI uses a volume multiplier in unique ways to exaggerate the impact of volume on volume-weighted moving averages. Like the VW-MACD, the TTI uses volume-weighted moving averages as opposed to exponential moving averages. Volume-weighted averages weigh closing prices proportionally to the volume traded during each time period, so the TTI gives greater emphasis to those price trends with greater volume and less emphasis to time periods with lighter volume.

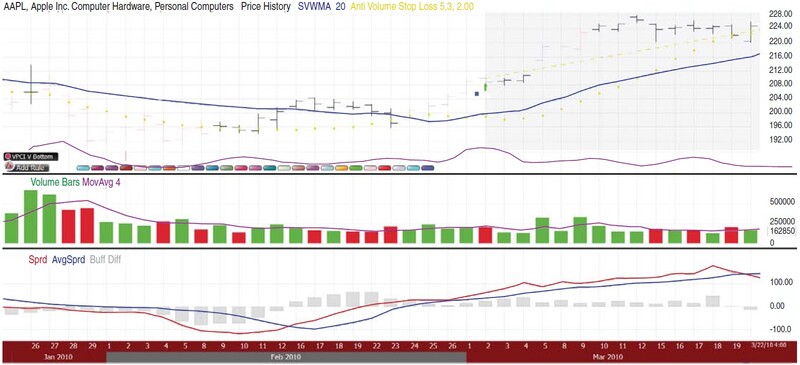

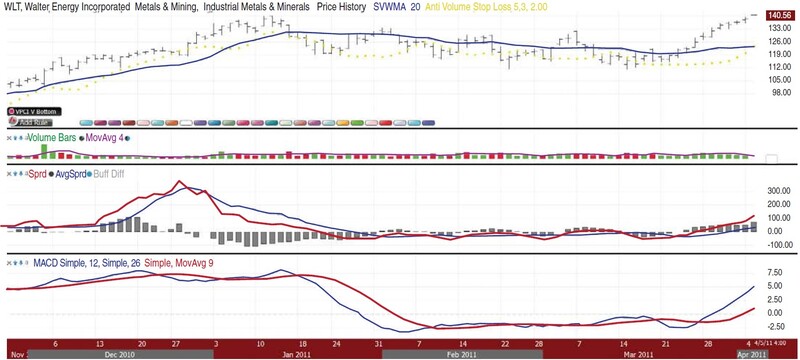

Like the MACD and VW-MACD, the TTI calculates a spread by subtracting the short (fast) average from the long (slow) average. This spread combined with a volume multiplier creates the Buff spread (see Figure 1).

PLUS VOLUME MULTIPLIER

Adding a volume multiplier further enhances the impact of volume changes to the Buff spread. The volume multiple is computed by dividing the short-term volume average (“short term” is defined as the same time period as the shorter volume-weighted price average) by the long-term volume average (“long term” is defined by the same time period as the longer volume-weighted price average). This volume multiple is taken to the second power and multiplied by the fast volume-weighted moving average to produce a volume-enhanced fast average.

Likewise, the reciprocal of the volume multiple is taken to the second power and multiplied by the slow volume-weighted moving average to produce a volume-enhanced slow average. This causes the fast average to become proportionally larger when volume increases and proportionally smaller when volume decreases. Similarly, the slow average becomes proportionally smaller when volume confirms price and proportionally larger when volume diverges from price. The Buff spread is then calculated by subtracting the enhanced short average from the enhanced long average. The net effect is a bigger, faster Buff spread when price and volume confirm each other and a smaller, slower Buff spread when price and volume diverge.

The calculation of the average Buff spread or signal line in the TTI is also enhanced with volume information but uses a unique adaptive moving average method. This adaptive average might alter the nine-period length (the standard number of periods used in the computation) of the average TTI signal line. When volume increases, the length of the average spread/signal line becomes longer, creating a smoothing effect. However, when volume decreases, the TTI signal line becomes shorter, emphasizing the more recent momentum. By structuring the adaptive signal line this way, the signal line tracks the Buff spread more tightly when volume does not confirm price. This should create faster countertrend signals.

However, when volume confirms price, the average spread/signal line is longer and looser. This widened distance of the average spread/TTI signal line from the Buff spread delays or negates countertrend actions. When the spread crosses over the TTI signal line or average spread, this represents accumulation among investors and is a buy signal. Similarly, when the Buff spread crosses under the TTI signal line (TTI average), this is a sign of distribution and thus, a sell signal (see Figure 2).

IDENTIFYING ACCUMULATION/DISTRIBUTION

Investors and analysts have been using price indicators to identify accumulation and distribution patterns. Could adding volume information to a traditional price-only indicator improve the identification of accumulation or distribution patterns and improve performance? Could using adaptive approaches employing volume analysis improve performance?

To find out, I had to conduct an accurate and measurable test. I tested this hypothesis via a trading system comparing two indicators. The first indicator used was the traditional MACD developed by Gerald Appel, and the second was the trend thrust indicator (TTI). Both indicators use the same price data as the 12-day and 26-day moving averages to generate buy and sell signals. The shorter-term 12-day moving average is more responsive to current price action and trend changes because it emphasizes more recent price changes. The longer-term 26-day moving average contains more information and is more indicative of the longer-term trend. Because its scope is broader, the longer-term moving average lags the signals given by the shorter-term moving average.

When a moving average curves upward, investors experience positive momentum. The opposite is true when the moving average curves downward. The difference of the long and short moving averages is the spread; the spread represents an instrument’s current momentum. As with the moving average, when the spread curves up, it signals upward momentum in the underlying issue, and when the spread curves down, it signals downward. When an average of the spread is created, it represents the trend of momentum.

An indication of distribution is given when the spread falls below the average spread, creating a sell signal. Likewise, when the spread crosses above the average spread, it represents accumulation among investors and is a buy signal (Figure 3).

So which indicator, the MACD or the TTI, produced the best signals? If our technical analysis volume theories are correct, then we can expect the volume-enhanced system to show improved trading results. Because the TTI is different from the MACD only by the introduction and manipulation of volume information, if the TTI outperforms the MACD, it might be logical to conclude that volume adds important information in forecasting future price movements.

THE STUDY

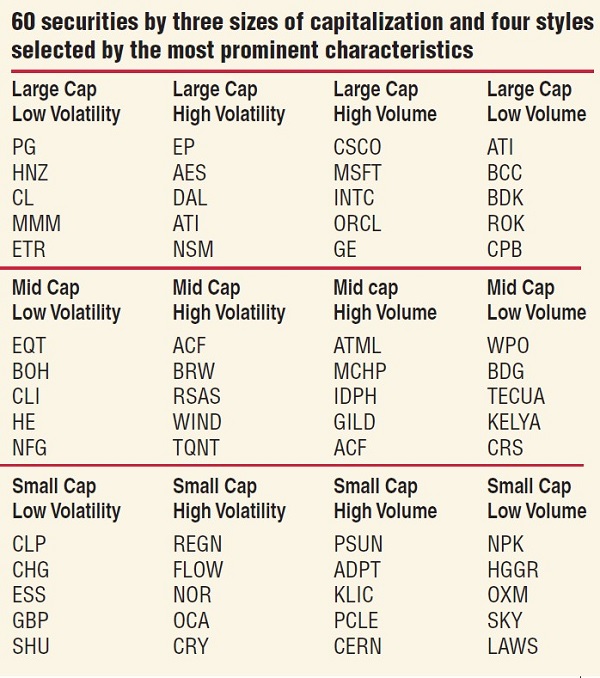

Not only did I need to establish a method to tally the results, but I was also concerned about the significance of the sample being studied. A reliable test must be both unbiased and comprehensive, and it must use the scientific method of empirical and measurable evidence. To do so, the test was broken into several comprehensive parts. Securities were selected across three areas of capitalization: small as measured by the Standard & Poor’s Small Cap Index, medium as measured by the S&P 400, and large as measured by the S&P 100. Equally impor-tant were the trading characteristics of each security. Thus, securities were further broken down into the characteristics of volume and volatility.

When these traits were combined, a total of 12 groups were formed: small-cap high volume, small-cap low volume, small-cap high volatility, small-cap low volatility, mid-cap high volume, mid-cap low volume, mid-cap high volatility, mid-cap low volatility, large-cap high volume, large-cap low volume, large-cap high volatility, and large-cap low volatility. To ensure unbiased results, five securities were backtested in each of these 12 subgroups for a total of 60 securities. To add credibility, the five securities representing each group were selected by identifying leaders of various characteristics.

Thus, the five highest-volume and lowest-volume securities, and the five highest-volatility and lowest-volatility securities of each of the three capitalization groups were used in this study (Figure 4). Securities that were duplicated were reused only once, and securities that lacked sufficient history were removed and replaced with the next best-suited issue. I used these 60 securities, 12 groups, four types, and three categories in testing our hypothesis.

To keep the system objective, both long and short system–generated trades were taken into account in our test. A long position was taken when the spread crossed above the average spread, and a short position was entered when the spread crossed under the average spread. A $10,000 position was taken with each cross. Commissions were not included.

For large-cap stocks, the testing period used was October 3, 1991, through June 11, 2003, for a total of 3,000 trading days. Because small- and mid-cap issues had shorter histories, 3,000 trading days reduced the number of securities eligible when identifying the issues by the characteristics studied. Two thousand trading days were substituted for these issues, making the testing period August 3, 1995, through June 11, 2003, for the small- and mid-cap issues.

RESPONSIVENESS

Does volume lead price? In theory, volume increases should precede significant price movements, giving faster downside and upside signals. This has been a tenet of technical analysis since the days of Charles Henry Dow. By weighting the moving average with a price-leading indicator such as volume, you should be able to identify the trend more quickly and exit sooner when the trend ends. The more signals a system produces, the more responsiveness is demonstrated.

In measuring responsiveness, one drawback is the adaptive feature of the TTI signal line. The adaptive features of TTI are designed to increase the responsiveness of sell signals when volume confirms price drops and to expedite buy signals when volume confirms upward price moves. However, when volume diverges from an upward price move, the buy signal given by the moving average of the spread is delayed, or it might possibly negate a buy signal. Likewise, when volume diverges from downward price drops, the adaptive feature slows or possibly negates many sell signals.

Suggested Books and Courses About Trading With Indicators

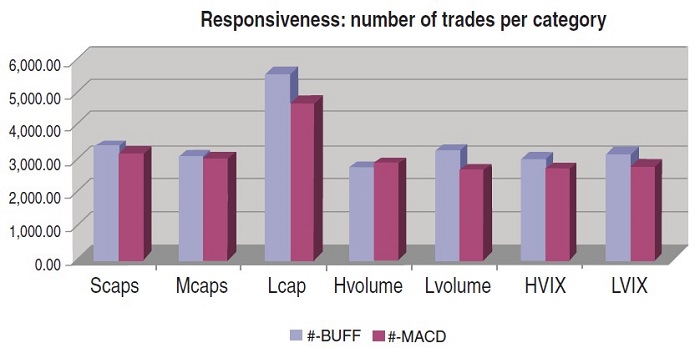

This feature is designed to reduce the number of false or bad signals based on volume theory and should diminish the total number of trades in the TTI. But because volume leads price, the TTI produced more trades across large-, mid-, and small-cap stocks. Across the four styles, the TTI produced more trades in three, including the low- and high-volatility issues and the low-volume issues. How-ever, the MACD produced more trades in the high-volume category. When examined across the 12 subgroups, the TTI produced more trades in nine. The mid-cap high-volatility issues and the mid- and small-cap high-volume issues were the exceptions (Figure 5). Overall, of the 60 securities tested, the TTI produced on average 200 trades per security compared with 181 trades by the MACD, for an improvement in responsiveness of nearly 10%.

RELIABILITY

It’s good if an indicator can generate earlier entries, but it is far more important for that indicator to be reliable. Generally, there is a tradeoff between reliability and responsiveness. Short-term moving averages are likely to generate more false signals due to market volatility, but short-term moving averages position a trader in the movement of the trend quicker. Usually, longer-term moving averages are more reliable. However, the drawback is that longer-term moving averages position the trader in and out of the trade later, leaving profits on the table. Technical analysts have explored ways to optimize this trend-following tradeoff by weighting the average with time or by adding more moving average parameters (multiple moving averages). These modifications have not improved system performance, however.

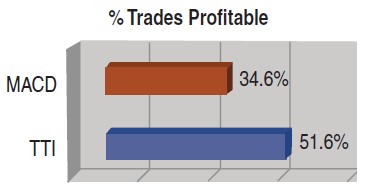

According to technical analysis theory, volume weighting should improve both TTI and MACD for two reasons. First, volume should affirm price movements on heavy volume. Second, when diverging from price, volume gives later signals, % Trades Profitable if any at all. Thus, if correct, inputting volume information into price averages should not only produce quicker signals, but more reliable ones as well. I have tested the reliability by percentage of trades profitable using the MACD compared to the volume-enhanced TTI. The results support our volume analysis hypothesis (Figure 6).

The TTI produced a higher percentage of trades profitable in all 60 securities. To put this into context, of the 60 securities, the highest-profitability ratio produced using the MACD was with the security OXM (Oxford Industries). Using the MACD, OXM turned a profit 42.96% of the time, which was the best reliability of the securities tested with the MACD. In contrast, with the TTI, the least reliable result produced with any single security was with ATML (Atmel). ATML was profitable 42.18% of the time, making it the least reliable of any security tested with the TTI. Overall, the MACD produced an average profitability ratio of 34.67%, and the TTI produced an average profitability ratio of 51.61%. Using the traditional MACD as a standalone indicator, we can expect a bit over a third of the signals to be profitable, whereas over 50% of the trades produced by the TTI produced a profit.

ROFITABILITY

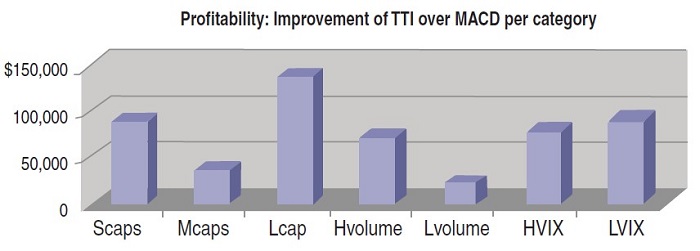

A study of this nature is incomplete without determining which indicator, Macd or Tti, made the most money. Next, I review the data again in terms of this factor to determine the merit of volume information. Analyzing the results of three capitalization classes, the Tti outperformed the Macd. In the small-cap category, the Tti outperformed the Macd by $88,400. It also produced greater profits in all four midcap subgroup issues (high volume, low volume, high volatility, and low volatility). In the mid-cap sector, the Tti produced $35,865 more than the Macd. The Tti was able to outperform the Macd in three of four mid-cap subgroups, in the low-volume and high- and low-volatility issues. In the large-cap sector, large-cap low-volume stocks were the only subgroup that performed better with the Macd. Overall, large caps using the volume-enhanced Tti produced $137,138 more than the Macd (Figure 7).

Next, I compared the TTI’s profitability to the MACD by the four styles. Again, the TTI produced more profitable results in all four style groups. The TTI produced $72,125 more in the high-volume group, $21,199 more with low-volume issues, amassed a $90,550 improvement with low-volatility stocks, and bettered the MACD by $77,529 in high-volatility category. In total, the TTI made $261,403 more than the MACD. That breaks down to an average improvement of $4,356 per issue using the TTI.

A way to measure risk-adjusted profitability is through a ratio known as the profit factor, which calculates how many dollars a trading strategy made for every one it lost. The ratio is calculated by dividing gross profits by gross losses. The MACD was again outperformed in all seven major groups, with the TTI registering higher profit factors across small-, mid-, and large-caps, as well as low- and high-volume and low- and high-volatility issues. Of the 12 minor groups, the TTI produced greater average profit factors in 10 of the 12, with mid-cap high-volume and large-cap low-volume being the exceptions. The volume information with the TTI improved the profit factor of the MACD by more than 10%.

POWER OF VOLUME

Overall, the TTI is more effective than a price-derived trend indicator. Volume information confirms price trends. In addition, investor accumulation and distribution patterns are better identified with volume confirmation. Likewise, trend accumulation and distribution patterns diverging from volume flows should be discounted. In comparing the MACD and the TTI, volume consistently increased performance across all major areas in this study. Investors employing volume information would enter a winning trade sooner while increasing the probability of making a correct investment decision.

Buff Pelz Dormeier is an expert in the field of volume analysis and founder of VolumeAnalysis.com. He is the developer of volume weighted moving average (VWMA) as well as a host of cap-weighted volume-based breadth indicators. A Chartered Market Technician, he received the 2006 Charles Dow Award recognizing research papers breaking new ground or which make innovative use of established techniques in the field of technical analysis. This article was taken in part from Investing With Volume Analysis.