Articles

Trading Automated Spot Forex Systems By Joseph James Gelet

Want to trade spot forex? With proper risk controls, this method can be used like options to take a position in the market. Options offer traders a unique way to take a position in the market not offered by traditional markets. Options have certain features such as static cost of the option, which quantitative analysts and portfolio managers appreciate greatly. Options are considered sophisticated, and in many ways they are. Although it is easy for anyone to open an option account and trade, strategies involving options can quickly become complex.

Some exotic options are customized to meet the demands of traders who want to take specific views of the markets. One is the double no-touch, which pays off if the market does not touch the two outlying prices. This is betting that the market will stay within a range. During short periods of time, this can be highly successful, such as during a week where the market is waiting for news announcements and lacks volatility and volume. However, it is sometimes difficult to find liquidity for such short-term options, where an automated spot system would be valuable. It is more difficult to win using this strategy over a longer period of time, such as months. However, there are many reasons that the market will be in a defined trading range, so you should explore all possibilities.

GRID TRADING SYSTEM

A grid trading system, as it is referred to by foreign exchange traders, places orders above and below the market every specific number of pips (the number of pips can be adjusted according to the pair of currencies traded). You sell above the market and buy below. As long as the market is in a trading range, the strategy will never lose. Once the pair starts trending in either direction, the strategy will begin to open more and more losing positions until the total drawdown of the system becomes unmanageable or wipes out the account balances. Horror stories about accounts being wiped out and other personal experiences have allowed traders to brush off these systems as useless.

GRID TRADING STRATEGY

- Let’s say you start by buying and selling a currency pair with a grid leg of 100 pips.

- Assume price is at 1.0500. It then moves to 1.0600, a 100-pip move.

- Your buy position shows a gain of 100 pips and your sell position shows a loss of 100 pips.

- You cash in on your buy position, which adds 100 pips to your account.

- You buy and sell again at 1.0600.

- Assume price moves back to your original entry point, which is 1.0500.

- Your second sell position has now gained 100 pips and your second buy position shows a loss of 100 pips.

- You cash in on your second sell position.

- You now have cashed 200 pips.

- Your original sell position has now moved back to its starting point. In other words, you have broken even on this position.

- So far, you have gained 200 pips, lost 100 pips, and broken even, giving you a net profit of 100 pips.

USING THEM LIKE OPTIONS

These systems can be useful with proper risk controls and can be used like options to take a position on the market. The most important feature is account protection, or global stop-loss, that will close all trades if the open drawdown of the system is greater than what the value is set to. Let’s say it is set to 1% — the strategy will trade and win as long as the pair is in the range. The trader knows he is risking only 1% of his account, which is similar to a vanilla long call option, which would have limited risk (limited to the premium of the option) and unlimited reward.

If a trader has $100,000 in his account, he would be paying $1,000 to earn an unlimited profit. Of course, that’s theoretical. The trade will come to an end when the pair resumes trending. But theoretically, profit is limitless as long as the pair stays within the trading range. This is why options have such a high payout for in-the-money options. In this example, the trader will make $200 per trade (100,000 standard lot size x 20 pips x $10 per pip). Once five trades have closed, if there is no open drawdown, the trader has paid for his trades and all remaining trades are pure profit. The value of this strategy is that once 1% is made, the rest is pure alpha. The total loss is limited to 1%, but it could be 0.25% or 0.5% in the event that the trend forms before the trade pays for itself.

Suggested Books and Courses About Trading Forex

As long as the market stays in the range, the strategy continually profits. This can be compared to the time value of an option. Since this is a new type of trading, terminology does not exist to describe this for automated spot forex systems. While this strategy is similar to options, the trader isn’t actually paying a premium. It is simply the loss he is willing to accept to get into the trade. He is paying 1% to gain 3% or 10%. Two factors will determine the profitability of this strategy:

- The definition of the range, and

- The number of times the market moves up and down within this range.

By the latter, I don’t mean volatility, which is measured by the total amount the market goes up and down. When playing options, you should play both extreme ends of the curve:

- Low-risk, very low yield trades, such as delta-neutral option strategies that may take advantage of certain types of volatility

- Low-risk, low-probability, high-return black swan trades.

HERE’S AN EXAMPLE

Let’s say you applied a grid trading system on the euro/Swiss franc (EUR/CHF) pair on August 24, 2009, with a strategy stop-loss set to $25 or 0.25% (the account has US$10,000). The strategy placed 24 trades until it was stopped out on September 2, 2009, for a total profit of $7. The profit includes $25 in booked losses so the gross profit was roughly $32. The average profit per trade was $1.85, or 20 pips. Due to the account size, micro lots with a $1,000 size were used, with roughly 0.10 per pip.

This shows it is possible to execute this strategy successfully. This is a good trade with a good outcome. A wider stop-loss would have allowed the strategy to continue trading, but it served the account well by limiting the losses. While a $7 or 0.07% profit is not much, it happened in a period of two weeks using a low trade size for testing purposes. This is just one example of how to use a system like this, and of course, a larger size would have achieved a larger profit.

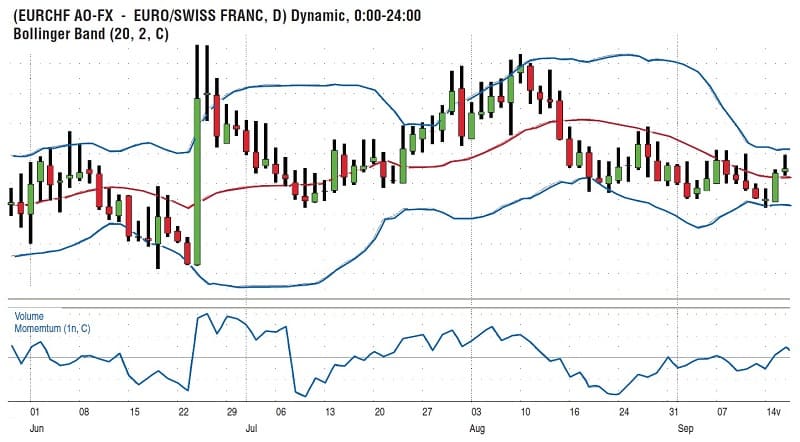

FIGURE 1: EUR/CHF. Since June 18, 2009, the EUR/CHF has traded between 1.5365 and 1.5105, which is a 350-pip range. You can use this range to set your grid levels.

By using a $10,000 mini contract instead of a micro, a $70 profit would have been achieved with a total $250 in risk. In this case, the math involved in calculating risk is similar to options in that the trader is risking $25 to gain back $25 and have a $7 profit with the potential to achieve $100 in profit or more. Of course, this strategy could not be applied to any currency pair under any conditions to get the same result. The pair chosen, and the market conditions, was highly dependent in achieving this result. However, the same is true for options. Randomly picking option strategies will not achieve a good result.

A trader using this system must identify a flat or ranging market by looking at the average volatility over the past five trading sessions, and calculating what he expects in the next five trading sessions in terms of volatility. This can be done either by experience or using indicators that identify a ranging market. Determining the range will depend on the currency pair. It should be compared to its historical behavior; any pair is always in a historical range, even if the width of the range is 4,000 pips. A range that wide would not provide ample opportunity for a grid trading system. In the case of EUR/CHF (Figure 1), since June 18, 2009, it trades between 1.5365 and 1.5105, a 350-pip range. Knowing the 350-pip range, the grid levels and account stop-loss can be set accordingly.

ON THE GRID

This strategy can be used together with other strategies. It can have an extremely short-term time horizon. For example, if the market is quiet due to an upcoming data release, a system such as this would trade well until the release is announced and the market starts moving. It’s difficult to trade when the market is not moving, but a strategy like this will serve this situation well.

Joseph James Gelet is the president of Elite E-Services, which develops automated systems for the forex market.