Articles

Price And Volume Disconnect By L.A. Little

If prices are moving higher and higher, why are they doing so on less and less volume? Technical analysis tends to consider price, volume, and time as its main components. Trend has always been viewed as a derivative of price, although some technicians, including me, utilize volume as part of trend definition as well (see sidebar, “Definitions”). What has become a regular feature of the market for the past year is that prices move higher and higher on less and less volume. How can this be?

HIGHER PRICES, LESS VOLUME

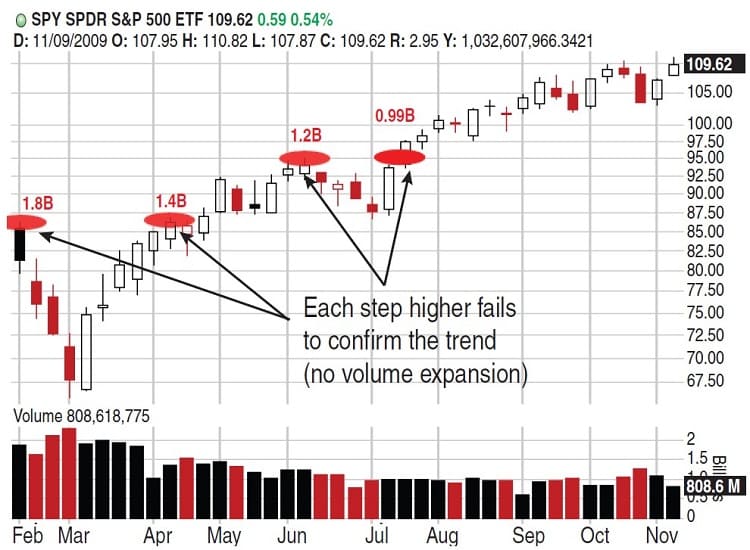

Take the Standard & Poor’s 500 SPDR exchange traded fund (ETF) (SPY), which is a broad measure of the New York Stock Exchange (NYSE). At each step of the way, since May 2009, volume has failed to confirm the trend, even though the market continues to climb (Figure 1).

FIGURE 1: HIGHER PRICES, LESS VOLUME. Since April 2009, volume has failed to confi rm the trend, yet the market continues to march higher.

DEFINITIONS

Suspect Trend — When the current price trades lower (downtrend) or higher (uptrend) than the previous swing point price and volume contracts, the trend is suspect.

Trendline — A trendline is a charting technique where a technician applies a line to a chart in order to represent the trend in a given security. The act of drawing a trendline is as simple as drawing a straight line that follows a general trend. Trendlines are used as a visual aid to highlight an underlying trend.

How can prices move higher with less volume? Logically, when you think of higher prices, you think of a greater number of buyers than sellers. But that is not the same thing as an expanding number of buyers. This very important concept is at the heart of what we are seeing today. It is a warning sign and is a direct consequence of suspect trends.

PRICE CAN MOVE HIGHER WITH FEWER BUYERS

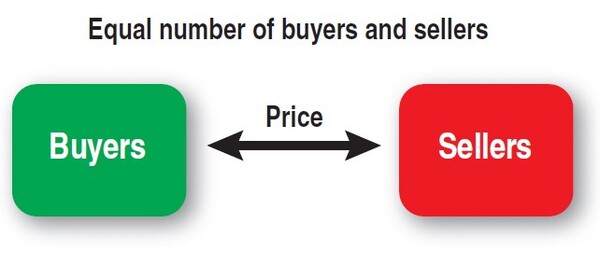

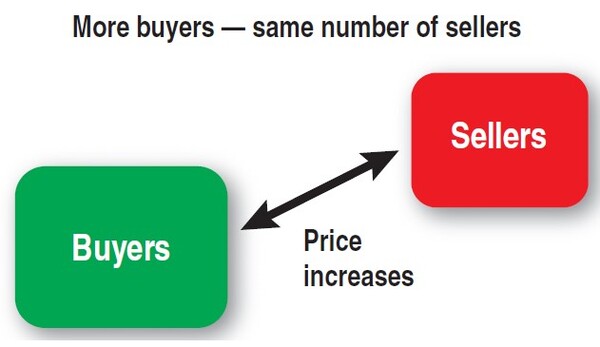

When there is an equal number of buyers and sellers, price is approximately equal: It doesn’t move up or down (Figure 2). Normally, when you see prices increase you picture the marketplace to be like what is represented in Figure 3.

- FIGURE 2: EQUAL NUMBER OF BUYERS AND SELLERS. When there are an equal number of buyers versus sellers, price is approximately equal: It doesn’t move up or down.

- FIGURE 3: MORE BUYERS, SAME NUMBER OF SELLERS. Typically, when there are more buyers, you expect prices to increase.

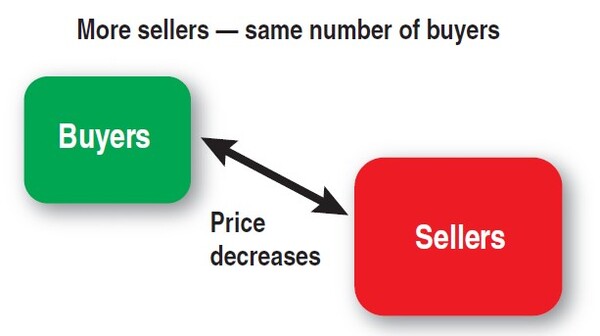

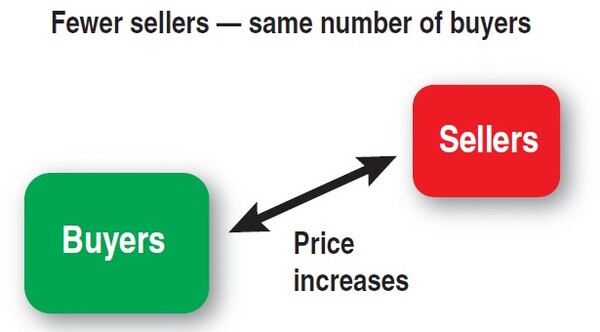

If prices decrease, you picture the marketplace in a like fashion, just in the opposite manner (Figure 4). Over longer periods of time this is what typically happens: Buyers expand when prices move higher and sellers expand when prices move lower. There is, however, another explanation as to why prices rise, one that most market participants do not consider. Consider the graph in Figure 5. Here you can see that it is quite possible for prices to move higher with the same number of buyers — you just need there to be fewer sellers.

- FIGURE 4: MORE SELLERS, SAME NUMBER OF BUYERS. If there are more sellers, then you expect prices to decrease.

- FIGURE 5: FEWER SELLERS, SAME NUMBER OF BUYERS. It is possible for prices to move higher with the same number of buyers. There just needs to be fewer sellers.

And that is what we have witnessed since April 2009. What we are witnessing in the marketplace is not an equal number of buyers, but a shrinking pool of buyers. Prices still rise, though, because the number of sellers has shrunk at a faster pace. For the sake of completeness, Figure 6 shows the alternate case where prices decline. As you can see, it’s not because there are more sellers — again, it’s because there are fewer buyers.

FIGURE 6: FEWER BUYERS, SAME NUMBER OF SELLERS. When prices decline, it’s not because there are more sellers — just fewer buyers.

CONSEQUENCES OF A SUSPECT PRICE ADVANCE

What does this mean for you, the trader? First and foremost, it gives you the context to understand why volume is important when you are considering trend. If an uptrend is not confi rmed by an expansion in volume, then what you have is the same number of buyers or, worse, fewer buyers. When price rises, it does so because there are even fewer sellers! The same is true of a downtrend where volume does not expand. In that case, you have the same number of sellers (or possibly less) but even fewer buyers.

Suggested Books and Courses About Trend Trading

Once you realize that the market is printing higher prices without volume confi rmation, then you truly are at greater risk of the trend reversing and doing so both quickly and violently. The same is true of a downtrend. It doesn’t provide you with a timetable as to when it will occur, just that it almost certainly will. If you understand this is a real possibility, then you can take precautions.

In the case of SPY, this uptrend is suspect and has been since April 2009. When it fi nally corrects, it will be a long trip back whence it came. With the Federal Reserve holding interest rates at zero percent in order to recapitalize the banks, it could take even longer for this to play out, although there continue to be equity price distress signals in 2010. Whatever the case, it’s important to realize what is driving this activity. Knowledge is an asset. Eventually, interest rates will rise and when they do, this “bail out the banks” policy and suspect advance will meet their demise. You should have your plan ready for when that day comes.

L.A. Little is an author, professional trader, and money manager who writes daily at www.tatoday.com. He also writes a daily technical analysis column for TheStreet.com’s paid subscription site, Realmoney.com. He still contributes regularly to TheStreet.com’s free site as well as producing videos for that site. His book, Trade Like The Little Guy, shows small traders how they can consistently profi t in the markets.