Articles

Dividends And Premiums By Teresa Fernandez

Plan carefully and you’ll be surprised at how much you can reap only using Bollinger bands and Excel. In this era of volatile markets and pessimistic investors, we need to do something different to stay ahead. No matter what anyone says, no matter what’s happening, there is nothing sure in these markets — except time. So why not use the passage of time to our advantage? We need to hold our stocks to collect dividends, and we need to let time pass to allow those covered calls to expire worthless.

CAPITAL GAINS OR DIVIDENDS?

As a rule, people buy stock for one of two reasons: capital gains or dividend yield. A stock like Apple (AAPL), a company that has mountains of backorders for its iPad and the latest generation of its iPhone, is expected to explode in price once this bull market gets going. Since its products appeal to all generations, currently we accept that the company does not pay dividends. But when the market crashes, the way it did in May 2009, stocks that do not pay dividends like AAPL and Google (GOOG) suffer the most. With no dividends, these stocks are the first ones that mutual funds dump when the market makes their managers uncomfortable. GOOG dropped from $595 last April to $481 when the Dow Jones Industrial Average (DJIA) was at 9700, a drop of nearly 20% in six weeks.

On the other hand, a stock like Altria (MO), like others in mature industries, is not expected to move much, regardless of what the market is doing. When the DJIA was at its recovery high of 11206 last April 26, MO was at $21.44. When the DJIA was at its recent low of 9726 on June 8, MO was at $20.27 — merely a decline of 5% — while the DJIA declined by 13%.

MO has a dividend yield of 7%, higher than many stocks. Although its price will not skyrocket anytime soon, we also know that a crashing market will barely hurt it. While the market dithers and decides what to do, we can increase returns on stocks like MO, beyond collecting dividends, by writing covered calls against the stock. Conceptually, this is easy to understand. But to do this year after year successfully is easier said than done. But it can be done if you have a plan.

Doing this blindly will result in a frustrating experience of high premiums with stocks called away time after time. Another problem is the prevalent attitude of the premiums being too low, meaning it isn’t worth the trouble. If the story of our stock is upbeat and their products and/or service are in demand, we don’t want our stocks called away, because we want those dividends. Timing the writing of covered calls is key to success here, and the timing plan must be followed in a disciplined manner. My guide in this? Bollinger bands.

BOLLINGER BANDS

Bollinger bands, invented by John Bollinger, are a technical analysis tool that evolved from the concept of trading bands in the 1980s. Bollinger bands consist of three bands converging around the closing prices of stocks: a middle band, which is usually the 20-day moving average (MA); an upper band, usually two standard deviations above the 20-day MA; and a lower band, usually two standard deviations below the 20-day MA.

The purpose of the bands is to define relative highs and lows of the stock. When the stock price reaches the upper band, it is perceived to be relatively high and expected to go down toward the 20-day MA, or the middle band, and perhaps to the lower band. When the stock price touches the lower band, it is perceived to be relatively low and is expected to move up toward the 20-day MA, and perhaps to the upper band. When the bands lie close together, a period of low volatility is expected in the near future. When the bands are far apart, a period of high volatility is expected. The Bollinger bands can be calculated as follows:

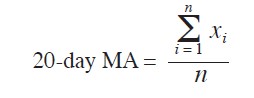

1. Calculate the middle band or the 20-day MA for each day of the period covered. The formula is:

where:

- MA = Moving average

- n = Number of days in the MA, which is 20

- x = Closing stock price of that particular day

The formula says: For every day, the 20-day MA equals the sum of the closing stock price of that day plus that of the 19 previous days, divided by 20.

2. Calculate the standard deviation (SD). The formula:

The SD is calculated in four steps:

- a. Calculate deviation as price minus 20-day MA

- b.Square the deviations

- c.Calculate 20-day average of the deviations

- d.Calculate the SD by taking the square root of (c).

3. Calculate the upper band. The formula:

Upper band = 20-day MA + 2SD

The formula says: For every day, the upper band equals the 20-day MA plus two standard deviations.

4. Calculate the lower band:

Lower band = 20-day MA – 2SD

For every day, the lower band equals the 20-day MA minus two standard deviations.

USING BOLLINGER BANDS

The rules in using Bollinger bands are:

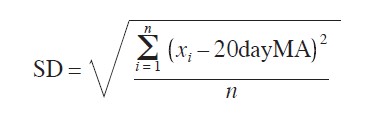

1. Writing covered calls should be done on stocks whose 50-day MA is trending up and whose 200-day MA is at least close to trending up, or still trending up but looking as if the uptrend needs a rest. Deciding on where the stock’s trend is based on the 50-day and 200-day moving averages is a judgment call, based on the trader’s experience with moving averages. For example, if the 200-day MA is still trending down, but the 50-day MA is trending up and close to crossing the 200-day MA on the upside, that would be considered close to trending up. Or if the 200-day MA is still trending up but the 50-day MA has started to trend down, that would be considered still trending up but looking as though the uptrend needs a rest. Since we are holding stock, we want their prices to go up as much as possible. That is, after all, the primary reason we hold stocks — for their capital gain.

Writing covered calls against a stock in a downtrend is a losing proposition. Your covered calls may make money, but you will lose more when stock prices go down. Dividends plus option premiums will not make up for losses of a stock whose price is dropping.

2. Apply to stocks with betas of between zero and 1, the lower, the better. Beta is a measure of the correlation of a stock’s returns to the market’s returns. A beta of 1 means the stock moves with the market; greater than 1 means the stock moves up more when the market is up, and down more when the market is down. A beta of greater than zero but less than 1 means when the market is up the stock moves not as much, and when the market is down the stock also moves down but not as much. And finally, when the beta is negative, the stock inversely follows the market — up when the market is down and vice versa.

Suggested Books and Courses About Investment

Simple Principles of Investment

Original price was: $15.00.$7.50Current price is: $7.50.Patterns of Speculation: A Study in Observational Econophysics

Original price was: $11.29.$5.65Current price is: $5.65.Mindset Secrets for Winning: How to Bring Personal Power to Everything You Do

Original price was: $22.36.$11.18Current price is: $11.18.There are many websites that publish stocks’ betas, the most popular being finance.yahoo.com. When you get there, key in the stock’s symbol. On the left-hand menu, click on “Key statistics”; the beta is at the top of the right column of the next window. Stocks with high betas usually have higher option premiums, but writing covered calls on stocks with high betas risks the stock being called away. These stocks tend to explode, or drop like a rock, not the type of stocks amenable to writing covered calls on.

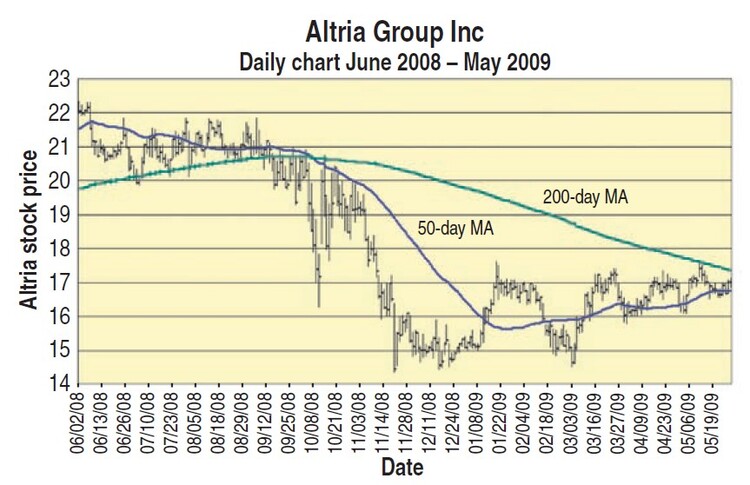

3. Sell the calls when the stock price touches the upper band after the price has gone below the 20-day MA. A stock that hovers around the upper band and moves up and down without touching the 20-day MA (the middle band) may be in a strong uptrend and break out above the upper band. In this case, give the stock a chance to break out on the upside without being held back by a covered call.

4. Sell calls only up to four months out. It is too difficult to predict the stock price for a longer period than that.

5. If it looks like your stock might get called away, leave it alone and let it happen. Do not buy back the call you sold and sell one with more premium to make up for the cost of buying back the call. Your stock getting called away will result in a profitable transaction. You can always buy back the stock, or another stock, at a future date, and sell covered calls again.

FIGURE 1: ALTRIA GROUP (MO) FROM JUNE 2, 2008 TO MAY 19, 2008. Note that the 50-day MA has started to trend up and is at the point of crossing above the 200-day MA.

Example: Say you purchased 100 shares of Altria Group (MO) at $17.10 on May 29, 2009. Figure 1 shows the chart of MO in May 2009.

- Rule 1: MO’s 50-day MA has started to trend up and is at the point of crossing over above the 200-day MA. This qualifies as close to trending up.

- Rule 2: MO’s beta is 0.38.

- Rule 3: Since June 2009 to June 2010, we were able to sell covered calls four times. Figure 2 shows MO’s price action during that period with corresponding Bollinger bands.

FIGURE 2: USING BOLLINGER BANDS. Points 1–4 represent where covered calls were sold.

The numbered points on the chart indicate the dates when the covered calls were sold. In point 1 it was June 9, 2009, and the stock price was at $17.40. A September 19 call was sold at $0.15 per share or $15 per contract, expiring on September 18, 2009. Price at expiration was $17.96, which means the calls expired worthless, with the full profit on selling the covered call the premium of $15, minus commissions of $8.95, or $6.05. Most people would think a transaction of $6.05 was not worth the trouble.

If you’ve never done this, it takes some time to set up your Excel spreadsheet. You have to download the data (I use finance.yahoo.com), sort the data so the earliest appears first, and set up your columns. My columns are:

- 20-day MA

- Deviation (closing price minus 20-day MA)

- Deviation2 (remember to square the deviations)

- 20-day average of deviation2

- Standard deviation (square root of 20-day average)

- Upper band (20-day MA + 2 standard deviations)

- Lower band (20-day MA – 2 standard deviations)

- High minus upper band (if positive, time to sell a call. Sell only if the next column turned negative after the previous signal to sell a call. This shows price touched the 20-day MA.

- Low minus 20-day MA

- 50-day MA

- 200-day MA

Lay out everything so you understand what you’re doing. And yes, it helps to be proficient in Excel.

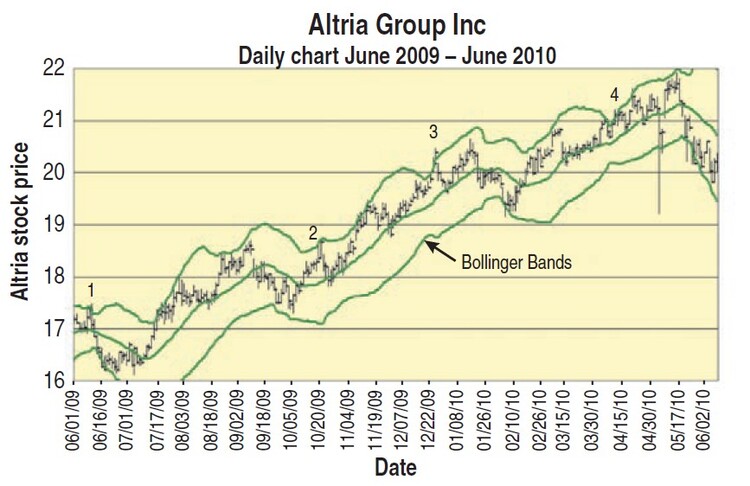

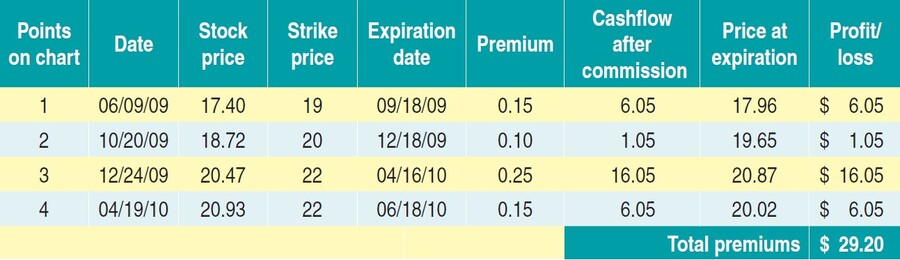

FIGURE 3: CALLS WRITTEN ON MO, JUNE 2009–JUNE 2010. Adding the $29.20 to dividends of $135 gives a total of $164.20. Let us not forget to add the capital gain of $289.05, which results in a 25.4% return.

- Rule 4: The September 16 calls were sold since the July calls didn’t have enough value to cover commissions, and December ones were too far out.

- Rule 5: As it worked out, MO stock was never called away, and all four transactions wherein calls were sold were profitable. Figure 3 shows the results of the four transactions.

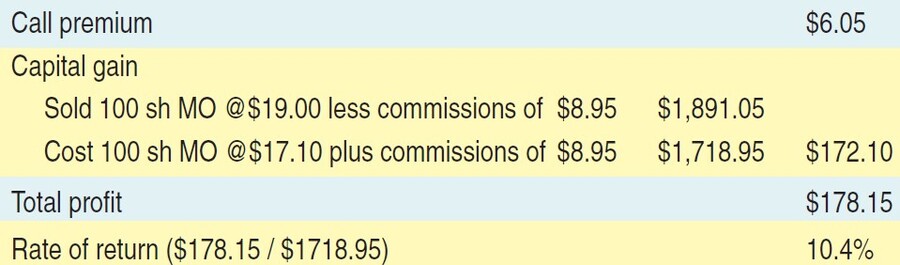

Do you see on column 9 how those premiums add up? Add to the $29.20 the dividends of $135 collected for the year that gives a total of $164.20 total cash inflow, or a return of 9.6% ($164.20/($1,710 + $8.95 commissions). This is certainly better than certificates of deposits or Treasury bills. Add to that the capital gain of $289.05 and it gives a total of $453.25, or a total return of 25.4%. What if the September 19 call you wrote on June 9, 2009, resulted in the stock getting called away? Results are displayed in Figure 4. Results are still pretty good. Once you set up your Excel spreadsheet for one stock, the rest will take only a few minutes each to set up. On a daily basis, you need update only those whose prices are close to when calls can be written. Updating will take even less time.

FIGURE 4: STOCK CALLED AWAY ON SEPTEMBER 19 CALL. This still results in a 10.4% return.

Teresa Fernandez is a private investor and technical analyst of the US stock market. Since earning an MBA in finance from the Wharton School of Business, she has researched disciplines that can be used by the ordinary investor to make money in the stock market. Fernandez has taught her philosophy of disciplined investing since 1997.