Trading Articles

Introducing The Modidor Spread By Jay Kaeppel

Here’s a strategy that involves modifications to the standard iron condor spread. The world of option trading is an ever-evolving one. While the basic strategies have been around for a long time, the search for useful adjustments and enhancements to these fundamental strategies is an ongoing process. The more closely traders look at traditional strategies, the more opportunities they are likely to find. This article details a strategy that involves modifications to the standard iron condor spread, dubbed the modidor spread.

THE GENESIS OF THE MODIDOR

One of the unique uses of options is the ability to generate income from a portfolio. Very often, investors will sell covered calls against an existing stock position. If the stock price is below the strike price of the call at the time the option expires, then the investor gets to keep his stock position as well as the premium he received when he wrote the option. Another distinctive use of options is the ability to make money even if the underlying security is going nowhere. There are several strategies that a trader can use to attempt to achieve this objective, and among them is a strategy referred to as the condor. Specifically, we will look at a version of this strategy known as the iron condor. Essentially, the purpose of entering into an iron condor spread is to establish profitability a certain distance above and below the current price of the underlying security. Then as long as the underlying security remains within this price range, the position can earn a profit. An iron condor is a four-legged position that involves:

- Selling an out of the money call option (selling a call option with a strike price that is above the current price of the underlying security)

- Buying a further out of the money call option (buying a call option with a strike price that is higher than the strike price of the call option sold)

- Selling an out of the money put option (selling a put option with a strike price that is below the current price of the underlying security)

- Buying a further out of the money put option (buying a put option with a strike price that is lower than the strike price of the put option sold).

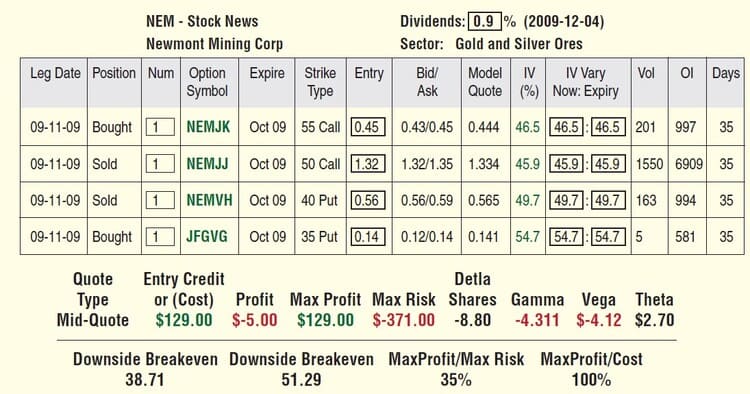

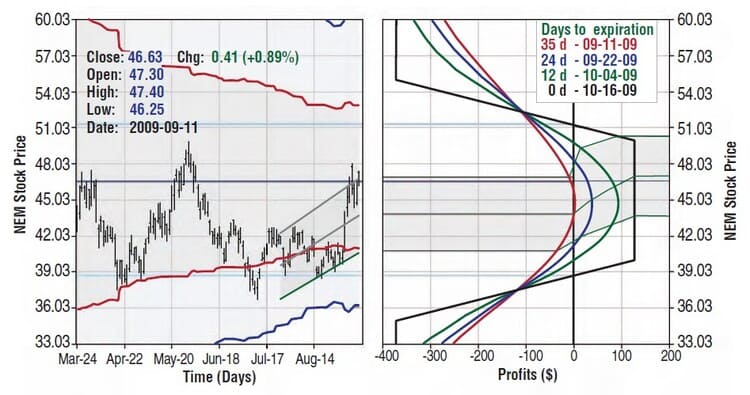

Most typically, these four legs of the trade will be entered into simultaneously to create a completed position. However, investors always have the option of attempting to “leg in” to a trade — that is, entering into different legs of the trade at different times. Legging in can result in a better overall reward-to-risk ratio for a given trade, but this also entails certain risks if the underlying security behaves in an unexpected way before all four legs are established. An example of a standard neutral iron condor appears in Figure 1. The risk curves for this trade can be seen in Figure 2. There are several key things to note about a typical iron condor:

- Limited profit potential. The profit potential for this trade is limited to the amount of credit taken in at the time the trade is entered. For our example trade, the maximum profit potential is $129 and will be realized if the price of Newmont Mining Corp. (NEM) stock is between the strike prices of the call and put that were sold (50 and 40, respectively).

- Limited risk. A trader’s risk is limited once all four legs are entered into. In our example, the maximum risk is $371 and would only be realized if the trader held the trade until expiration and the price of NEM stock were at or above the strike price of the call that was sold, or at or below the strike price of the put that was sold (55 and 35, respectively).

- Inverted reward-to-risk ratio. In most cases, entering into an iron condor means assuming a maximum dollar risk that exceeds the maximum profit potential. In our example, we are risking $371 in the hope of making $129. A trader would accept this inverted reward-to-risk ratio because he or she feels the probability is great that the underlying security will remain within the established profit range and that the likelihood of experiencing a loss equal to the maximum potential risk is extremely low.

- A profit range defined by two breakeven prices. As long as the underlying security stays between the two breakeven prices, the trade will ultimately make money. In our example, the breakeven prices are $38.71 and $51.29. As long as NEM is between these two prices at the time of option expiration, this trade will show a profit.

In sum, the standard iron condor offers some clearly defined advantages and disadvantages. The iron condor is also a frequently used strategy among experienced option traders. As mentioned previously, however, as part of the natural progression of traders seeking to maximize their advantage, variations of standard strategies such as the iron condor have become more mainstream. One variation of the iron condor is the modidor spread strategy.

Suggested Books and Courses About Forex and Stock Trading

WHAT IS THE MODIDOR?

The modidor spread is simply a modified version of the iron condor. This strategy came about through a process of experimentation as veteran traders strove to find a way to skew reward-to-risk ratio more in their favor. While there is no official inventor of the modidor spread, the name itself was created by John Broussard, Mitch Genser, Nick Gazzola, and Christina Nugent-Dubios, all Optionetics instructors. There are several key differences between the iron condor and the modidor. To better understand these, let’s look closer. The most notable differences between an iron condor spread and a modidor spread are:

- With a standard iron condor, the strike prices for the call and put options are typically the same number of strikes away from the current price of the underlying security. For example, if the underlying stock is trading at 37.50, an iron condor would most likely be established by selling either the 40 call and the 35 put (one strike out of the money) or the 45 call and the 30 put (two strikes out of the money). In our example NEM iron condor spread, we sold the strike closest to five points out of the money (with the stock at 46.53, we sold the 50 call and the 40 put). With a modidor, it is not uncommon — although not required — to sell options an unequal number of strikes away from the current underlying price. As we will illustrate later, the purpose of establishing a modidor is to skew the reward-to-risk profile in one direction or the other. At times, selling nonequidistant strikes can help in this effort.

- With a standard iron condor, the distance between the call bought and sold is typically the same as the distance between the put bought and sold. The key difference for a modidor is that the distance between the strike price of the call bought and sold differs from the disparity between the distance between the strike price of the put bought and the put sold. As we will see, this is what gives the risk curves for the modidor its unique shape relative to the risk curves for a standard iron condor.

- The iron condor has a profitable range with breakeven points above and below the current price of the underlying security and equal amounts of dollar risk on each side of the trade. On the other hand, very often a modidor spread can be established whereby only one side of the trade has actual downside dollar risk. If a modidor spread with two breakeven points is established, then one side has more dollar risk and the other has significantly less dollar risk.

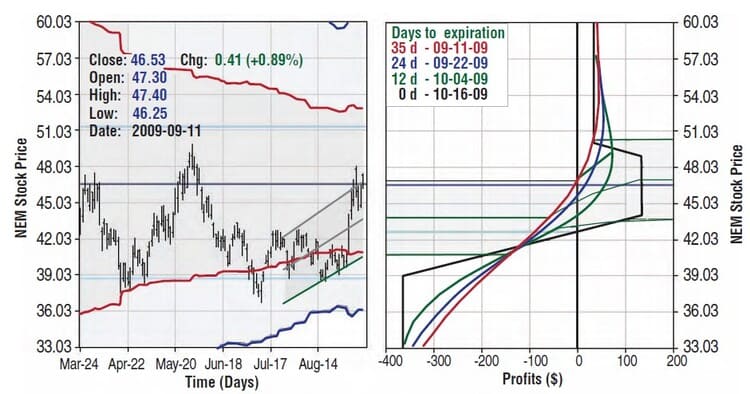

To illustrate, look at an iron condor versus a modidor spread on a given security. Instead of entering into the neutral iron condor depicted in Figures 1 and 2, let’s say that a trader felt there was an upside bias to NEM stock and wanted to enter a trade with a slight upside bias. By making the same trade but utilizing different strike prices, a trader might end up considering the trade shown in Figure 3. In this case, instead of selling:

- The 50 call and buying the 55 call as we did in the iron condor example, this trade sells the 49 call and buys the 50 call (one strike closer to the price of the underlying and only a one-point difference between the option sold and the option bought).

- The 40 put and buying the 35 put as we did in the iron condor example, this trade sells the 44 put and buys the 39 put (four points closer to the price of the underlying, but still with a five-point spread between the option sold and the option bought).

The risk curves for this modidor spread appear in Figure 4. The marked differences, as well as the similarities, between the risk curves displayed in Figures 2 and 4 are easy to note. Most important:

- The iron condor will make money if NEM stays between 40 and 50 through option expiration. The modidor will make money as long as NEM is at any price above 42.64.

- In these examples, the modidor has a few dollars more of profit potential and a few dollars fewer of risk. This will not always be the case when comparing potential trades for a given security.

- Both trades make the maximum profit if the underlying security remains between the strike prices of the options sold. In most cases, the modidor will have a narrower maximum profit price range.

Nevertheless, the key advantage to a properly constructed modidor is that all (or most) of the risk is on one side of the trade. The holder of the NEM iron condor example spread must be concerned if the price of NEM stock falls below 38.71 or if it rises above 51.29. The holder of the modidor spread shown in Figure 4 only needs to be concerned if NEM drops below 42.64. As long as NEM holds above that price, the spread holder knows that a profit will result.

A MODIFIED CONDOR

Many experienced option traders look for opportunities to generate income by writing options. One possibility involves writing naked options. However, this entails the assumption of unlimited risk (and potentially large margin requirements for stock and stock index traders). As a result, more often than not, traders selling to generate option income will utilize some form of a spread trade, whereby one option with a greater value is sold while another with a lesser value is purchased. This results in a net credit (that is, the trader takes in premium) and as long as the underlying security does not move beyond a breakeven point, the trader can anticipate keeping all or some of the initial credit.

It is not uncommon for traders looking to generate option income to spend a lot of time searching for stocks that are going nowhere and try to take advantage of that situation by establishing a profit range with breakeven prices above and below the current price. At times, however, the opportunity may exist to skew the risk curves in a particular direction for a stock or index that is trending higher or lower. Doing so holds the potential of being able to establish a position with a high probability of profit because:

- All (or most) of the dollar risk will be on one side of the trade

- The breakeven price for the trade may give the underlying security some room to move against the preferred direction and still generate a profit.

The modidor spread is a relatively new iteration in the long-term evolution of option trading strategies. Like many other possible strategic choices, beauty is in the eye of the beholder. There may be times when entering into a modidor spread makes perfect sense and offers significant advantages over other more traditional strategies such as the iron condor. At other times, a more traditional approach may be preferable. In any event, option traders would be wise to consider alternatives when assessing the trading possibilities in a given situation. The modidor spread appears to warrant some meaningful consideration.

Jay Kaeppel, an independent trader, is the author of Seasonal Stock Market Trends.