Trading Articles

Investment Candles By Thomas N. Bulkowski

Which candlesticks work best as reversal or continuation patterns? Find out here. Investment-grade candlesticks work as reversal or continuation patterns at least two-thirds of the time (66%), and they are plentiful. By “plentiful,” I mean that I sorted a list of 103 candlestick patterns by how often they appeared in the Standard & Poor’s 500 from August 1996 to August 2006. I split the list and discarded the rare ones. That left just 13 candle types, which I describe here.

CONFIGURATION AND DEFINITION

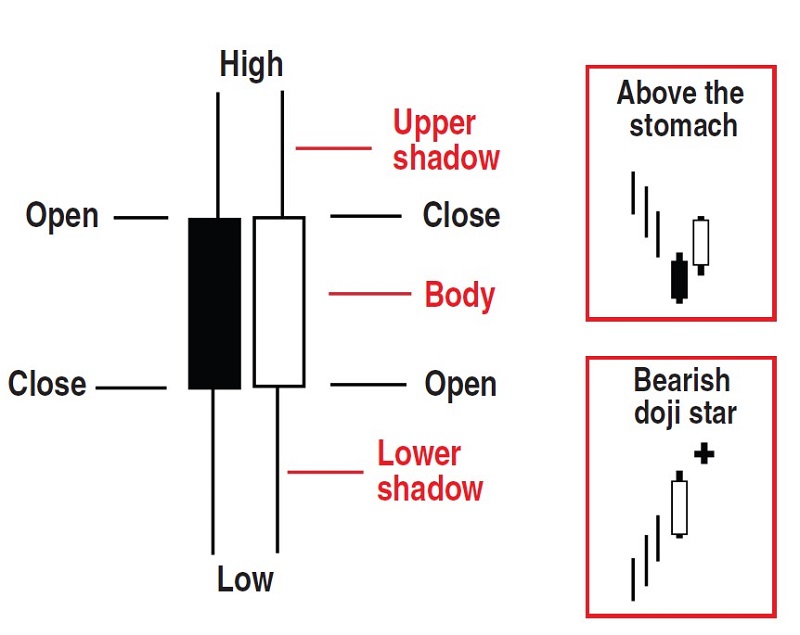

Before I discuss the performers, let’s review the configuration. Figure 1 shows two candlesticks, one black and the other white. The price bar’s high is at the top of the candle, and the low is at the bottom. Between those two extremes are the opening and closing prices, the order of which determines the candle body’s shade. The thin bars at either end are the shadows or wicks, with a body sandwiched in between. A candle need not have a shadow, and the body can be a flat line as in a four-price doji. In those situations, all four prices are the same.

If price closes lower than the open, the candle is shaded (shown as black in the figure). If price closes above the open, then the candle is clear (white in the figure). Candle color is not a representation of price closing higher or lower than the previous day. In the discussion that follows, the numbers pertain to results from a bull market only, not a bear market. A candle line is a single price bar.

I chose to define a close above the top of the candle pattern as an upward breakout and below the bottom of the pattern as a downward breakout. The thinking behind this definition is that a reversal candlestick should reverse the prevailing price trend immediately. After the breakout, a continuation candle should see the price trend resume the trend direction leading to the candle pattern.

Defining a reversal in this way is like having your mom tell you to pick up your socks from the floor. She doesn’t mean do it within the next three days or a week. She means Now! If a candle acts as a reversal, then signs of that behavior should occur promptly. You might think that having the closing price at the end of the candle pattern means an immediate break-out the next day. That’s wrong. A gravestone doji has the closing price at the bottom of the day’s range, and yet it takes an average of three days to close lower. A dragonfly doji is the opposite of a gravestone because the closing price is at the bar’s high. It takes an average of three days to break out upward.

The point is this. During those three days, there is plenty of time for price to reverse if it is going to. A true reversal will pick up their socks when their mom says so, and not wait until Dad comes home.

“ABOVE THE STOMACH”

Figure 1 shows an example of the above the stomach candle pattern. The three thin vertical lines are my way of marking the price trend leading to the start of the candle pattern. In this case, it is downward, meaning that the candle must appear in a short-term downtrend. Following the trendlines is the two-line above the stomach pattern. It begins with a black candle on the first day followed by a white candle that opens and closes at or above the midpoint of the black candle’s body. This pattern works as a bullish reversal 66% of the time in a bull market.

BEARISH DOJI STAR

Figure 1 also shows an example of a bearish doji star, one of the lucky 13 performers. It forms in an uptrend, and the two-line candle begins with a tall white candle. “Tall” means a height above most other candles leading to the appearance of the doji star. Following the tall white candle is a doji, which is a price bar in which the opening and closing prices are the same or nearly so. The body of the doji must be above the prior bar’s body, but the shadows can overlap. That’s the only tricky thing about this candle pattern. Avoid unusually long shadows on the doji.

The bearish doji star is supposed to act as a bearish reversal, but it doesn’t to the tune of 69% of the time in a bull market. In other words, price continues moving higher in more than two out of three contests. You may roll your eyes, but remember that all price has to do is close above the top of the pattern to stage an upward breakout. Even so, tests on this candle show that it takes three days to close above the top of the doji.

BEARISH ENGULFING

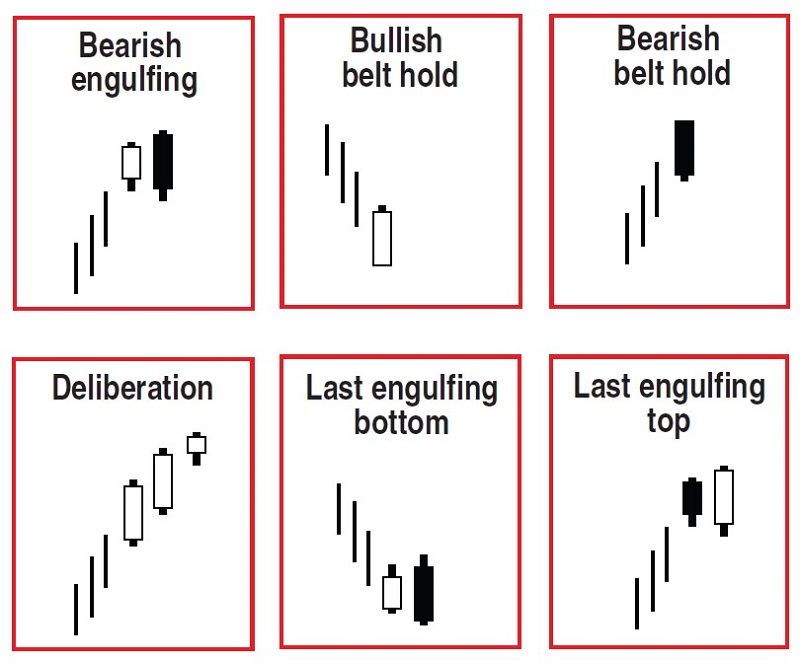

Figure 2 shows a bearish engulfing candlestick that lives up to its name. It’s supposed to act as a bearish reversal and it does, but more about that later. The bearish engulfing candlestick is a two-line pattern that must form in an upward price trend. The first candle line is white and the second is black. The body of the black candle engulfs the body of the first, meaning the opening price is above the prior bar’s close and the closing price is below the white candle’s open. The body does not have to engulf (overlap) the shadows, only the body. Either the tops of the bodies can be the same price or the bottoms, but not both. The bearish engulfing has one of the highest reversal rates: 79% in a bull market.

BULLISH AND BEARISH BELT HOLD

Figure 2 shows the bullish and bearish belt hold candles. The belt hold family is one of the few single-line candles that do not act randomly. For the bullish belt hold, look for the candle to appear in a downward price trend with a tall white candle. The opening price should be at the low (meaning no lower shadow) and price should close near the bar’s high.

The bearish belt hold has the identification guidelines reversed. Price must trend upward, leading to the candlestick. Price opens at the high for the bar and closes near the low, leaving a tall black candle to print on the chart. The bullish belt hold acts as a bullish reversal 71% of the time, and the bearish belt hold reverses the short-term trend 68% of the time.

DELIBERATION

The deliberation is another candlestick that is supposed to act as a reversal but doesn’t. That’s probably due to its height. It’s far easier to break out upward from this three-line candle, since price closes near the top of the candle. Identification is trickier for this one than for the other candles discussed so far. An uptrend must precede formation of this candlestick pattern. The first two candles are tall white ones. The last candle in the pattern is a small-bodied candle that opens near the prior bar’s close. Each line’s open is above the prior open, and the close is above the prior close.

Suggested Books and Courses About Candlestick Patterns

The candle is supposed to act as a bearish reversal, but testing found it is a bullish continuation 77% of the time. Look for price to close above the top of the pattern (a continuation of the uptrend) more often than it closes below the bottom (a trend reversal).

LAST ENGULFING, TOP AND BOTTOM

Figure 2 shows the last engulfing top and bottom patterns. First up: bottoms. What’s the difference between a bearish engulfing pattern (top left inset in the figure) and the last engulfing bottom? Answer: The price trend leading to the candlestick. In the last engulfing bottom, the price trend leading to the candle is downward. The first bar is a white candle followed by a black candle whose body engulfs the prior candle’s body. The black candle need not engulf the shadows of the white candle.

The last engulfing bottom is supposed to act as a bullish reversal, but it is really a bearish continuation 65% of the time. The last engulfing top is a two-line pattern, with the first candle being black followed by a white candle. The white candle’s body overlaps or engulfs the prior candle’s body, not including the shadows. As you might have guessed, this supposedly bearish reversal actually acts as a bullish continuation 68% of the time.

RISING AND FALLING WINDOWS

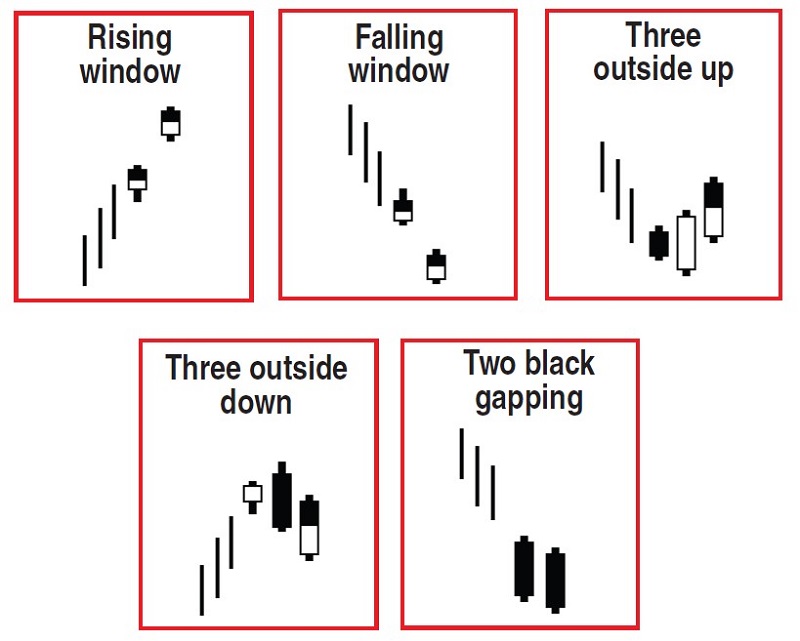

A rising window is a bullish gap in an upward price trend, and an example appears in Figure 3. Candle color is not important, which is why I show half-shaded candles. Look for the high price on the first bar to be below the low on the second bar, leaving a gap or window on the chart. A rising window acts as a bullish continuation pattern 75% of the time, as measured using the candles surrounding the gap.

A falling window is also a gap, but some call it a bearish gap. I show an example of this in Figure 3. The low price in the first candle of the pattern remains above the high of the next bar’s price. A falling window appears in a downward price trend and it acts as a bearish continuation pattern 67% of the time.

THREE OUTSIDE UP AND DOWN

The three outside up and down candle patterns are bullish and bearish engulfing candlesticks, respectively, with price confirming the pattern by closing higher (three outside up) or lower (three outside down). The price trend leading to the candle pattern is as shown in Figure 3, along with the candle color. The last day of the three-line patterns can be any color.

The three outside up candlestick acts as a bullish reversal of the short-term downtrend 75% of the time. The three outside down is a bearish reversal 69% of the time.

TWO BLACK GAPPING

The fi nal performer in our candlestick circus is the two black gapping candle pattern, as shown in Figure 3. As the name suggests, it includes two black candles with a downward price trend leading to them. The high price of the fi rst black candle remains below the low of the price bar, leaving a falling window on the chart. The next day shows another black candle, with the high of this bar being below the prior bar’s high. The two black gapping pattern acts as a bearish continuation 68% of the time.

CLOSING POSITION

The candlestick patterns discussed here are the best-performing reversal or continuation patterns in a bull market. Each works as described at least 66% of the time and are as plentiful as fl eas on an untreated dog housed outside. Before you rush to your nearest stock market and shop for these patterns, realize that high reversal or continuation rates are not the same as how well price performs after the breakout. To learn about the best candlesticks for price performance, read my next article, “Top 10 Candles That Work.”

Thomas Bulkowski is a private investor with 30 years of experience and considered by some to be a leading expert on chart patterns. He is the author of several books, the most recent of which is Encyclopedia Of Candlestick Charts. His free website and blog have more than 500 articles dedicated to price pattern research and can be found at www.thepatternsite.com.