Trading Articles

Straightening The Curves By Austin Passamonte

Consistently making a small profit on one contract is the first step to becoming a successful trader. Here’s a strategy that shows you how to do that using crude oil contracts as an example. Axioms and clichés have made their way around the trading world for eons. They are now commonly accepted as gospel, and a lot of them are true. But others such as “Trade every signal, take every trade without exception, trade well and profits will follow” are common beliefs that are only partially true at best. The world of swing or trend trading, where entry signals and actual price movements are scattered or limited, is an entirely different world from short-term or intraday trading. Working between the bells of the pit or the GLOBEX sessions of the electronic markets offers numerous potential price swings inside each period of operation.

That said, it is not like anyone can expect to trade every minute of every day with real opportunity all the way. Financial markets only offer limited profit potential inside any given period of operation. Long-term cumulative results can be broken down into bell-curve distributions of data. One end of the curve represents low-volatility, limited-range sessions, while the opposite end represents high-volatility, wide-range sessions. That leaves the fat part in the middle, which represents a majority of sessions where price ranges, volume, and volatility levels fall inside some degree of assigned historical norm.

A few sessions from long-term samples will be dull, low-range, and light-volume events. Little opportunity for solid profit potential exists inside those sessions. Trade entry signals confirm with no follow-through of favorable price movement. Those are the days where nothing but chop-and-pop, drift-and-grind tapes wind their way across the screens all session. On the other end, we have those wide-range, high-volume, wild-volatility sessions where entry signals flash all over the place. One big move follows another and every trade signal precedes big-profit moves every which way. Day(s) like those can offer an entire week’s, if not an entire month’s, worth of potential profits.

DON’T RUN AFTER EVERY TRADE

Wild times and dull times in any financial market are memorable. It is our nature to recall unusual or extreme events. But the majority of times fall into the category of average, run-of-mill type price behavior. Most sessions fall into the body of a bell curve, which is the fat part where price movement remains inside historical norms. Day after day, we can expect price movement to contain some sort of average range with limited distance covered by price. Overtrading is usually a result of unrealistic expectations of the market. Those who attempt to trade through every wiggle and twist of the markets throughout the trading day (and overnight sessions too) are working without a defined edge. Financial markets only offer brief windows of inefficient “opportunity” for profits through any period, regardless of their personal trading approach. Sideways congestion for mean-reversion trades taken at extremes or directional markets offering trend-type trades are in each case only available in limited fashion.

Trying to force the issue or impose your will on any financial market never works. More often than not those traders find themselves trying to catch highs or lows during trend periods or directional swings during sideways congestion periods. No one can be all things in any market, nor can anyone catch every possible price move available.

START SMALL

Retail traders think along the lines of trading one-lot futures contracts forever while squeezing every possible cent from each price move. That fixation soon becomes a prolonged quest to take every possible trade setup. From picking high and low turns to trend continuation setups to quick counter-trend fades on pullbacks against the trend, most retail traders try to amass an array of tactics and tools that point out every tick and trade.

Those who survive that stretch of their starry-eyed discovery period emerge with the realization that no one is perfect. All traders make operational errors almost every day; all traders experience net-loss sessions, and all traders are on a never-ending path of continual learning and discovery. This profession is much more about maximizing a few correct actions and decisions than it is about being right all the time. The few who survive their trip eventually realize that successful careers are not built on trading one contract of anything for a gazillion points or cents each day. They turn their attention to the real path of success, which is to add to their contract size through the process of deliberate, methodical account growth over time.

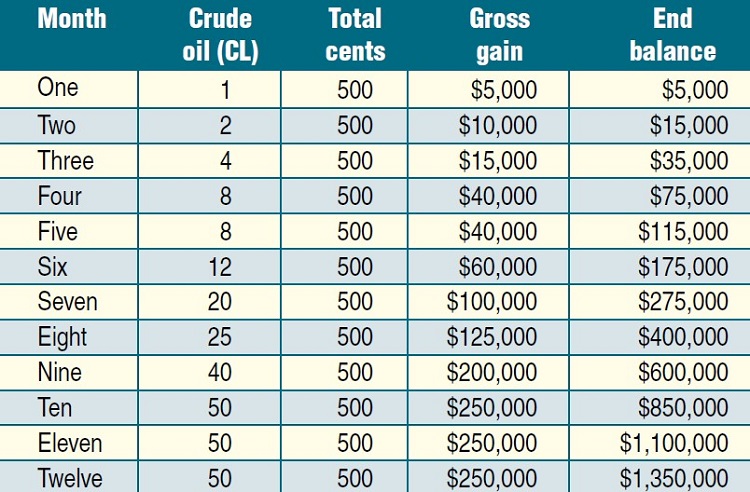

In the world of crude oil futures traders, being able to accomplish the feat of averaging +500 cents per calendar month on a long-term basis may not seem like much. But considering that crude oil futures commonly offer one or more price swings that exceed +100 cents each day, you could make several thousands of cents each month. The data in Figure 1 assumes just one constant amid a bunch of variables: the ability of a futures trader to book +500 cents (ticks) per calendar month (on average) for each single crude oil (CL) contract traded. That’s the only meaningful goal to fixate on. If you do that consistently, month over month, you can add to your contract size as account balance permits.

With a beginning account balance of whatever amount seems reasonable and prudent, the ability to grind through each trading day, week, and month to arrive at the destination of +500 cents CL per contract would result in a gross gain of +$5,000 per CL contract before costs. How you realize this amount is a different story. Hopefully, you do it using a disciplined and methodical approach. The point is it can happen mathematically. You start with one contract and move to two, then four, then eight, then more. By adding to your contract size and grinding out +500 cents per contract each month, you’ll find that the law of mathematics takes over and your trading results will improve.

Suggested Books and Courses About Commodity and Futures

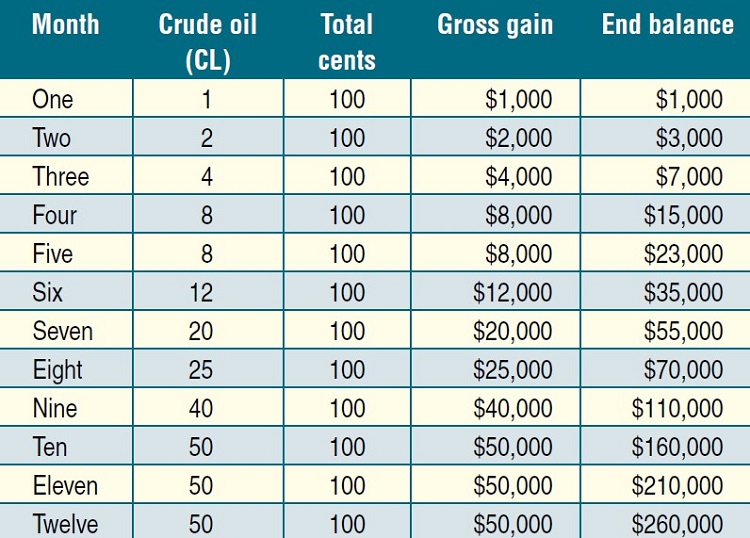

You don’t have to make +500 cents per contract. You can even do well if you are able to consistently book 100 cents per CL contract on a monthly basis (Figure 2). It goes without saying that anyone who wants to make a serious income needs to focus on consistent performance and then incrementally adding to their trade size.

EXPECT HURDLES ALONG THE WAY

Let’s not forget that grinding out consistent gains includes unexpected variables that no one can control. Power outages, Internet outages, exchange feed connections, and market halts due to sudden economic or global news are a few factors many of us have experienced in real time more than once. There are also the proverbial “fat-finger” trade errors that blast price action through unimaginable spikes or slams before returning to the norm. Unlike artificial or accidental trades that usually get undone in the world of stocks, errant trade orders in the futures world are usually left to stand.

The brief but extreme and sometimes unbelievable price moves will work greatly in our favor or catastrophically against us, depending on our prudent use of stops. Most traders bristle at the mention of “random chance” involved in this profession because they would like to believe that all things are under control. But that’s simply not the case. We can adjust our business plan approach to manage all conceivable happenings possible. Some things simply cannot be controlled.

We have trending markets, sideways markets, and volatile markets. There are news events, exogenous events, individual distractions, and errors. These are all part of the long-term ride, but day in/week out, all of it tends to average out. Your primary objective is to reach (or surpass) a reasonable monthly goal and gradually increase trade size. Mathematically speaking, it is simple. Realistically speaking, it all depends on your trading approach.

MAKE THE SMART CHOICE

Do you want to strive for every last cent possible from every possible trade while turning one contract? Or do you want to focus and concentrate on sustained performance and increase your contract size gradually? There is no mathematical difference in whether you trade one, two, or five futures contracts. What matters is your ability to make consistent profits.

Austin Passamonte is a full-time professional trader who specializes in emini stock index futures and commodity markets. His trading approach uses general technical analysis and proprietary chart patterns. He trades privately in the Finger Lakes region of New York.