Trading Articles

Forex Trends And Pairs By James Chen

Combine currency trading with the trend and take advantage of the pairing requirement in the forex markets. In order to trade forex effectively from a trend-following perspective, a trader should accept two arguments: First, that the concept of trend, or price momentum, exists. Second, that fundamental price strength can be paired with fundamental price weakness. I will explain both premises in detail, along with a method for applying them to trading the forex market.

TREND STRENGTH

Trend is essentially price momentum. Trend theory mirrors that of physical inertia, which states that an object in motion tends to stay in motion. Price that has a clear and significant direction continues that way until such time that something happens and the direction changes. The concept of trend provides a sound basis for Dow theory and the discipline of technical analysis as a whole.

Traders who follow the prevailing trend are simply attempting to profit from taking the path of least resistance. Price momentum is assumed to be in the direction of the established trend. Of course, this does not always hold true (for example, when a trend ends), but it is the most reasonable assumption given the relatively limited information of past price action.

PAIRING STRENGTH AND WEAKNESS

Once the premise of trend is accepted by the forex trader, the second premise of strength/weakness pairing can be addressed. The forex market is unique in many ways, not least of which is that all currencies are traded in pairs. Currencies cannot be traded individually as single financial instruments, only as pairs of relatively priced instruments. For example, the euro cannot be traded in isolation the way a single stock or futures contract can. The euro must be traded against another currency. Therefore, the traded instrument becomes EUR/USD (euro against US dollar), or USD/JPY (US dollar against yen), or GBP/CHF (British pound against Swiss franc), or any one of the many tradable currency combinations available. Buying, or going long, the EUR/USD is the equivalent of buying the euro while simultaneously selling the dollar. Selling, or going short, the EUR/USD is the equivalent of selling the euro while simultaneously buying the dollar.

Perhaps more than any other aspect of forex trading, the pairing requirement makes this financial market dramatically different from any other. The primary result is the ability of forex traders to couple the strength of a given currency with the weakness of another. At first glance, traders who are more accustomed to other markets such as equities or futures may not recognize the potential advantage of this unique characteristic. But to any trader who has some significant experience in trading forex, the advantage should be clear.

While any financial market may allow traders the ability to buy strength and/or sell weakness, only the forex market, with its paired instruments, allows traders the ability to buy extreme strength while simultaneously selling extreme weakness. This has the effect of magnifying, even doubling, the possibilities of a directional position, thereby creating a possible high-profit trading opportunity. The strongest curren-cies can be identified and paired with the weakest, to increase the possibility of choosing the correct directional bias as well as take advantage of the strong trends that occur frequently in the forex market.

IDENTIFYING STRENGTH AND WEAKNESS

Once the two premises of trend and strength/weakness pairings are embraced, the forex trader must formulate a method for identifying strength and weakness in currencies. This can be accomplished by one of two primary means: technical analysis and fundamental analysis. From a fundamental perspective, many macroeconomic factors, central bank policies, political considerations, and the like would need to be compared for each currency in order to identify strong currencies. Besides the complexities involved, it is a practice rife with subjectivity and conjecture.

Suggested Books and Courses About Forex Trading

Technical analysis provides a simpler and more objective approach to identifying and comparing strength and weakness in the individual currencies. Strength and weakness are supremely relative variables in that a currency is only strong or weak when compared to others. So this methodology begins with a basket of benchmark currencies for comparison purposes. Perhaps most useful is a basket of some of the most prominent and liquid major currencies, including the US dollar, euro, Japanese yen (JPY), British pound, Swiss franc, and perhaps the Australian dollar (AUD) and Canadian dollar (CAD).

Once the benchmark basket is chosen, all tradable currencies (including those in the basket itself) can then be compared based upon the single most objective and revealing attribute of any financial instrument: price. More specifically, all tradable currencies can be compared to those in the basket to determine price trend direction and the magnitude of price movement within a given time period.

At that point, the currency that compares most favorably overall, in terms of net percentage price change against this basket, can be deemed the strongest. The currency that compares least favorably can be deemed the weakest. The currencies can then be paired, strongest with weakest, to create trend-trading opportunities (that is, in one trade of a currency pair, a trader would go long the strong currency while simultaneously going short the weak one). This approach to trading forex can be used on any time frame, as trends occur on all time frames in the forex market.

A EURO EXAMPLE

Here’s an example of how this approach works. Let’s assume that our benchmark basket consists of five major currencies: USD, EUR, JPY, GBP, and CHF. Our job now is to find the strongest and weakest tradable currencies in terms of price trending when compared to this basket. To do that, we can use the percentage price change of the currency pairs over a given time period. For this example, we could use one week’s worth of price data. But we could just as easily use one month, one day, or even one hour of price data for comparison, as trends occur on all time frames and different traders are accustomed to trading different time frames.

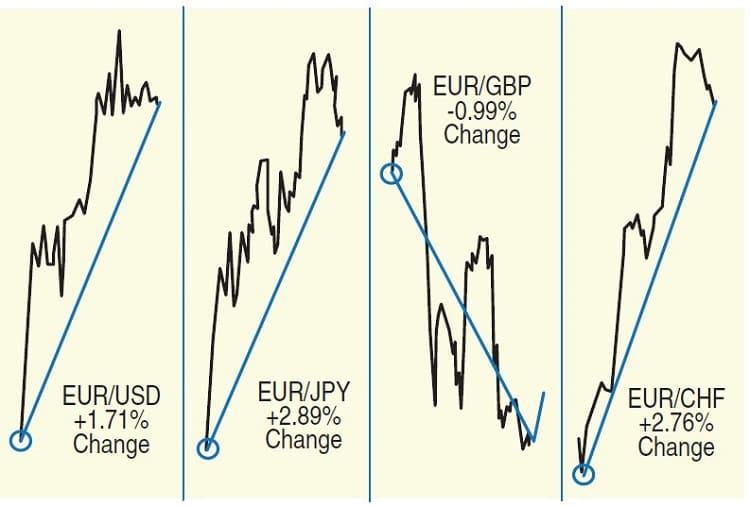

If we are testing the strength/weakness of EUR, for example, we would simply compare the price change of EUR against all of the other currencies in the basket from the same day and time in the prior week to the present for the most recent week’s worth of price change data. This would entail looking at the percentage price change from last week to this one for Eur/Usd, Eur/Jpy, Eur/Gbp, and Eur/ Chf. Only four currency pairs are listed here because Eur cannot be compared to itself.

As another example, if we are testing JPY strength/weakness, we would measure price trending and percentage change over the same period for USD/JPY, EUR/JPY, GBP/JPY, and CHF/JPY. Although this method of percentage price change comparison is not precise due to variations in weightings for different currency pairs, it works well enough for identifying relative strength and weakness in currencies. See the EUR example in Figure 1.

Once this comparison is accomplished, you need only to compare the net appreciation or depreciation of all the tradable currencies in question against the basket of benchmark currencies. So let us assume that after comparing all of the tradable currencies against our basket in terms of price trending for the past week, we find that EUR has appreciated the most on a net basis against the basket of currencies, while JPY has depreciated the most on a net basis.

Knowing that of all the tradable currencies, the EUR price trend has been the most net bullish against the basket within the past week and the JPY price trend has been the most net bearish, the forex trader in our example can then make a reasonable assumption. If the current prevailing trends continue, the best possible way to exploit those trends would be through a long (buy) EUR/JPY trade position. This position consists of a long position in EUR, which is the strongest currency against the benchmark basket, along with a simultaneous short position in JPY, which is the weakest currency. Again, the trader is buying extreme strength (as measured by a benchmark currency basket) while simultaneously selling extreme weakness.

THE STRONGEST OR WEAKEST LINK

Trade entry opportunities can be identified when currencies are used to gauge strength/weakness trending against a benchmark basket. Strength/weakness pairings can also prove useful for trade exits. When substantial changes are detected in the relative strength/weakness of the currencies in the pair — that is, the currencies’ trends are ending or reversing — the trader can then cut his or her positions according to risk management criteria tied to the strength/weakness variable. Trading forex using this approach allows traders to exploit the trends that occur in currencies as well as take advantage of one of the key defining characteristics/advantages of forex trading — strength/weakness pairing.

James chen is chief technical sterategist at FX Solutions, a global leader in foreign exchange trading. He is also a registered Commodity Trading Advisor (CTA) and a Chartered Market Technician (CMT). Chen is the author of Essentials Of Foreign Exchange Trading and Essentials Of Technical Analysis For Financial Markets. He contributes daily and intraday technical analysis to key financial media and is a frequent speaker at trading seminars.