Trading Articles

The Expiration Trade By Joe Luisi

In this world of algorithmic trading, how can an independent trader stand a chance? Here’s one way you can trade options to get an edge in the markets. We have all heard that 70% to 80% of all options expire worthless. Many of us have purchased options, only to watch the market move in the direction we anticipate and still lose money as the option we bought drops to zero. I’m not sure whether the percentage of options that expire worthless is correct and there have been articles published about that statement in general, but the one thing I do know is that all out-of-the-money options expire worthless. The key is to determine where that “out of the money” is.

SO WHAT’S YOUR EDGE?

The exciting thing about selling options is that you can stack the odds in your favor to get an edge in the markets. But edges are hard to find, even more now with so many supercomputers looking at patterns and algorithms trading in fractions of a second. In such an environment, is it even possible for an independent part-time trader to get a leg up in the market?

Successful option selling requires determining where the market won’t go. Can you sell an option with only one week till expiration and make money? How about limiting your risks?

LET’S TAKE A LOOK

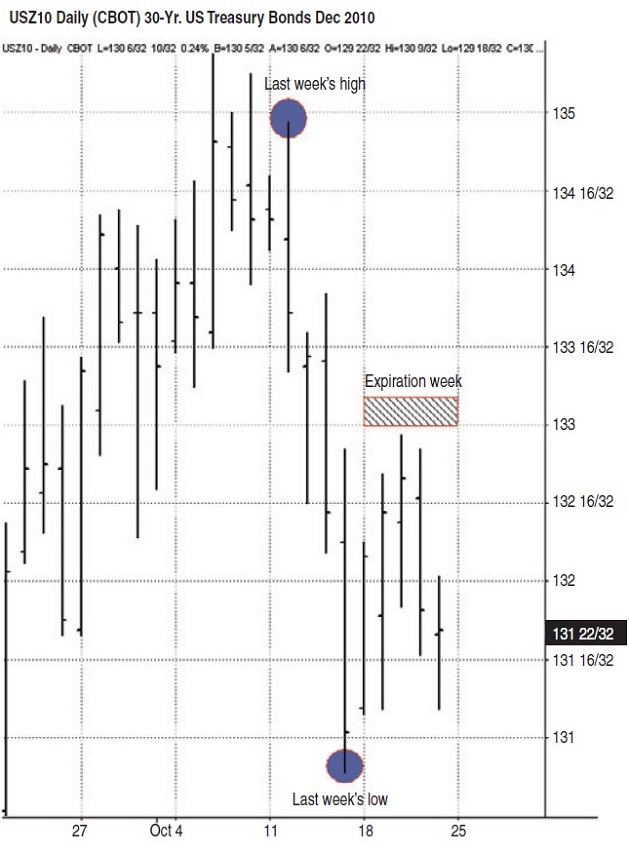

The November US Treasury bond options expired on Friday, October 22, 2010. They are based on the December futures contract prices. How are we going to stack the odds in our favor? We have limited our time to holding the position for a maximum of five days. We are looking at selling slightly out-of-the-money options, which represent time value only. That time is diminishing rapidly. If we are right, the option will be zero at the close on Friday. So essentially, we are putting time in our favor. Let’s start out by looking at the daily chart of the December T-bond contract (Figure 1). Here, you see a short-term selloff, with the market closing lower the last seven sessions. The market closes near 131.00.

There are a few scenarios that could occur in the following week. Due to the extreme four-point sell-off in a short period of time, there is a chance the market could rebound the following week. Or the market could continue moving lower, which would mean that a downtrend would emerge. In another scenario, given that it was such a wide-ranging week, some consolidation with the market trading within the previous week’s range might be possible inside the week.

OPTION TRADING STRATEGY

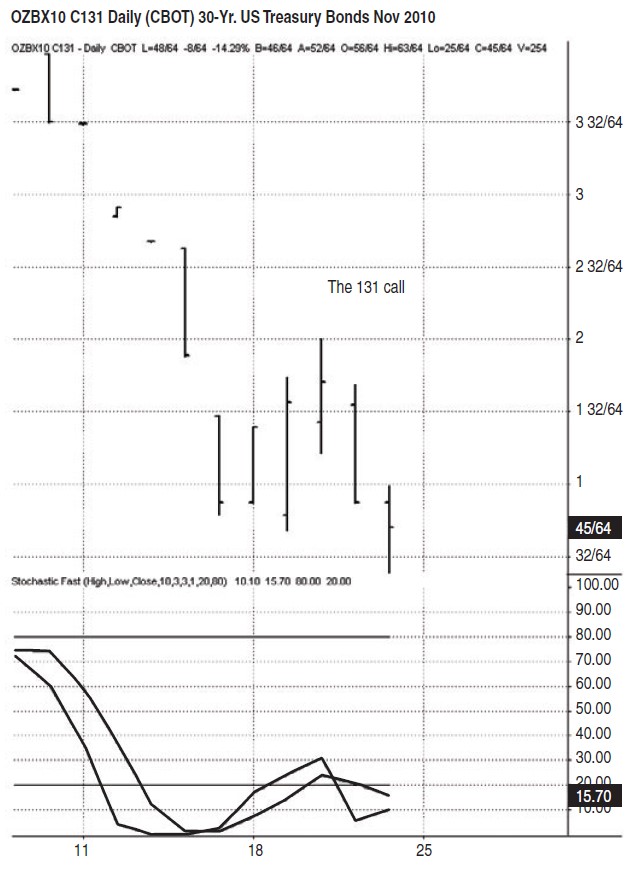

Given these scenarios, is it possible to design an option selling strategy to take advantage of the coming expiration? Let’s take a look at the option chart in Figure 2. The November 131 call (at the money) on Friday closed at 45/64. Looking at the simple 10-day stochastics of the option price (lower panel) reveals that we have an oversold condition. The 10-day stochastic fell to as low as 2.22 and appears to be trying to move higher. You have to be careful with options when the stochastic goes below the 20 level because it could stay there a while as the option loses its value.

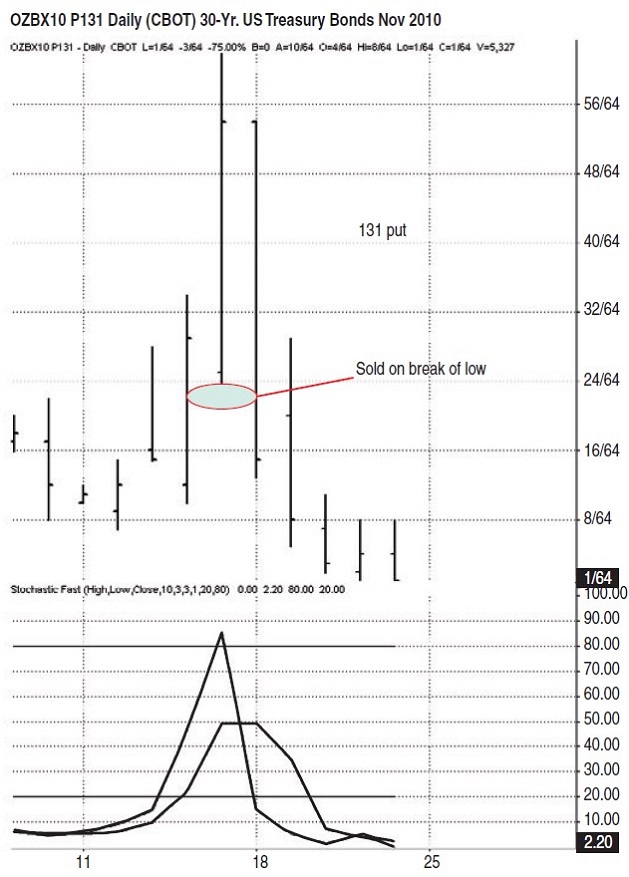

If you look at the November 131 put (at-the-money) in Figure 3, there is something interesting happening. The 10-day stochastic has reached an overbought level of 85. So upon initial analysis for the upcoming week, I would lean toward the market either rebounding higher or trading sideways.

Suggested Books and Courses About Trading Options

You’re not going to jump into a trade unless the market tips its hat in your favor. So here is a game plan for the following week: If you are correct in your assessment and the market trades higher or even sideways, the 131 put should move lower and eventually trade to zero as Friday expiration approaches. If you are wrong and the market continues to move lower, then the option will continue to move higher. The low of the day on Friday for the November 131 put is 22/64, so you will look to sell this option if it trades at or below 22/64. To control your risk, you will want to buy back the option if it doubles in price (44/64) and you can purchase the 129 or 128 put for cheap insurance.

HERE’S HOW IT PLAYED OUT

On Monday, the market rebounded to close at 132.05. The 131 put sold off and we would have entered a short position at 22/64, which was the low of the previous Friday. Now that you have an open trade, you need to manage that trade. Since the amount of premium collected wasn’t very high, you can skip the insurance of purchasing the 129 put, which you could have purchased for five ticks. Instead, you decided to watch the market and would have exited the position if the option doubled in price to 0.44 ticks. As the bond market further rebounds on Tuesday and Wednesday, your option is in good shape, trading as low as two ticks. Rather than wait till expiration Friday and any potential risk of a strong reversal, you look to exit at any price below four ticks, thus giving you a nice profit on a quick trade (only three to four days).

Now, what happened to the 131 call? Since the 131 put broke Friday’s low first, this was the option you decided to trade. You wanted to see which low in option price broke first but you were leaning toward the put because you were expecting a rebound week in the bonds. As you can see with the 131 call in Figure 2, a close below the previous week’s low did not occur until a few days later. Although the low was broken on Tuesday on an intraday basis, price did rebound higher and closed in the money.

TO RECAP

In a market in which the small trader is the classic underdog, you have to work the odds so you can get an edge where you can. You can do so by looking at the previous week’s price action and forming an opinion on where the market will go the following week. After you do so, look at at-the-money or slightly out-of-the-money puts and calls and determine which option breaks down first to determine if there are any over-bought/oversold conditions. After that, place your protection by either purchasing an option for insurance or having your exit point firmly in place to get out if you are wrong.

Joe Luisi is a professional part-time trader and heads up JAL Trading LLC.