Trading Articles

Predicting Market Trends Using the Square of 9 By Chris Kakasuleff

The square of nine popularized by W. D. Gann is very reliable in determining market trends. It is a useful market tool in almost all markets including stock indexes, stocks, commodities, and options. The numbers in the square of nine can be used as price levels of support and resistance, and most importantly as time units. These numbers can be used to count minutes, hours, market days, calendar days, weeks, months, and years.

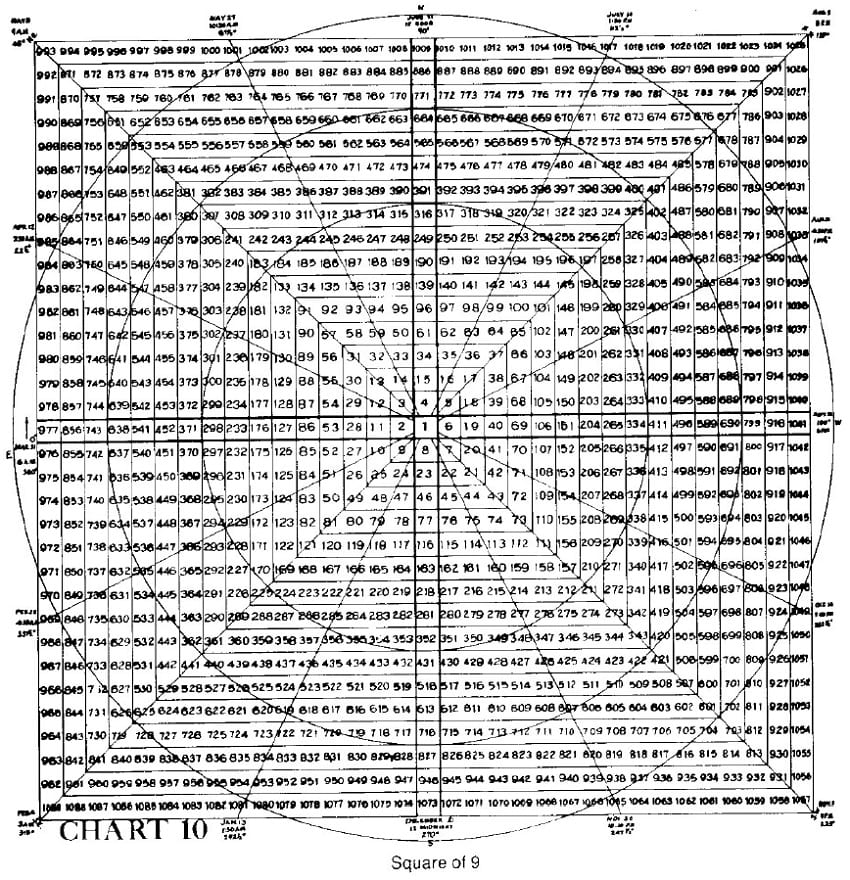

First let’s understand how the square of nine is constructed. In our illustration you see a spiral of numbers starting with one in the center, and then a commencement of numbers in a clockwise spiral that can go into infinity. In a clockwise spiral that can go into infinity. In addition overlaid on these numbers is a 360 degree circle. This circle is divided by 8. but can he divided by 16, 32, etc. When the circle is divided by 8. you have eight 45 degree angles. These angles are 0-45-90-135-180-225-270-315 degrees. Numbers from 2-11-26. etc. are on the 0 degree angle. Numbers from 3-13-31. etc. are on the 45 degree angle. Numbers 4-15-34. etc are on the 90 degree angle. Please study which numbers correspond to the balance of each 45 degree angle on the 360 degree circle.

Now that you have a fair understanding of the construction of the square of nine, lets utilize its magical powers and turn its numbers into calendar days. To begin we must decide where we’re going to count calendar days from. For best results, it is important to count the days from major market bottoms, or you may count the days from the birth or commencement of trading on any stock or stock index. In the stock market you could count the days from the first or commencement of trading on any stock or stock index. In the stock market you could count the days from the birth of the New York Stock Exchange on May 17th. 1972. Using this date could be tedious, hut rewarding. Another important date would be the all time modern low of the Dow Jones Industrials Average on July 8, 1932. You could experiment with the Dow low on December 6, 1974.

Suggested Books and Courses About Gann Trading Methods

Probably the most useful low to count calendar days from, is the most recent major bear market low on August 12, 1982. Therefore in our example on how to utilize the square of nine, we are going to count calendar days from August 12, 1982.

First some rules and guide lines are in order here. Rule one is when the market has reached a high or low on a particular angle, then expect another high or low on the same angle in the next cycle. The next cycle is a continuation of the spiral of numbers around the circle, until they reach the same angle. As you can see in our illustration of the square of nine, the numbers 9, 25, 49, 81, etc all are at the end of each spiral therefore ending each cycle. An example would be if the market made a low on the 28th day in cycle 3 on the 0 degree angle of the square of nine, you would look for another low at 53 days on the 0 degree angle in cycle 4.

Another rule to follow is that market action or trends in the current cycle between the angles will generally follow the market trends that occurred in the prior cycle, between the same angles. If you have a low in the market on the 28th day in cycle 3 on the 0 degree angle and a market high on the 40th day on the 180 degree angle also in cycle 3, you can expect similar market action in cycle 4.

Rule three is the fact that at times you will be what I call psychological inversions. You will be expecting a low, as predicted on a particular angle in the last cycle, but instead on the same angle in this cycle you get a high, what you do here is invert or reverse all the highs and lows from the last cycle. If you had a low often 28 days of cycle 3 and a high at 40 days on cycle 3. but on the 0 degree angle of cycle 4 the market makes a high instead of a low then expect the market trend to be reversed. You should now expect a market low on the 180 degree angle in cycle 4, just the reverse of cycle 3 on the 180 degree angle where the market topped out. When the market reverses again, reverse the cycles back to their former pattern. In overcoming this aspect of the square of nine in trading its fairly simple to just watch the trend between the angles. IF the market action is the opposite from what it was doing in the prior cycle, the trend may be reversing.

The first date we’ll be calculating is April 10th, 1987 which is 1702 days from August 2, 1982. This date is on the 0 degree angle in cycle 211. To determine what may happen around April 10th, we need to refer back to the 0degree angle of cycle 20. By utilizing a hand calculator you will find that in the last cycle 1541 days is on the 0 degree angle and this corresponds to October 31, 1986. Thus 5 days later the Dow peaked at 1899 on November 5th. Therefore in this cycle we should expect another high on the same either side of 5 days. And sure enough the magic of the square of nine produces results again, as on April 6th, 1987, 4 days before 1702 days on the 0 degree angle, the Dow reached an all time high that held for more than two months.

Lets move ahead to the 45 degree angle in cycle 21. We find the number 1723 which equals May 1st 1987. In the last cycle 1561 days was on the 45 degree angle and the date was November 20th, 1986. Two days earlier the Dow bottomed on November 18th. In this cycle the market reached a low 4 days earlier on April 27, 1987. Another remarkable revelation. Before we move on to a few more examples, its important to realize that as more and more time passes from a major bean market low, the number of days between each 45 degree angle grows farther apart. Therefore its important after several months from a major low to divide the circle by 16. This gives you 16 angles between calendar days at 22 1/2 degrees apart.

This begins us at the next example. On August 25, 1987 the Dow closed at its all time high at 2722. The number of days that passed from August 12, 1982 was 1839. which is precisely on the 292 1/2 angle. On March 10th 1987 in the last cycle at 1671 days the Dow made a short team top also exactly on the 292 1/2 degree angle.

Of course there were many major factors contributing to the top on August 25th. These areas follows, August 12, 1987 marked 60 months from the low on August 12, 1982. A geometrical angle gaining 32 points per month crossed 2700 in August 1987. Also 52×52 equals 2704 the square of 52. A very important natural number. This all pointed to a major change of trend in price and time. However, I’m getting ahead of myself, as this is information for my readers in future articles.

Did the square of nine predict the great crash on October 19, 1987. We’ll as noted on April 27th the Dow reached a low 4 days early on the 45 degree angle. In the next cycle on the 45 degree angle, 1893 days equals October 18, 1987 which fell on a Sunday. The next day the Dow crashed 500 points. Of course we cannot discount the help of another major cycle at that point. As two trading days earlier on October 15th marked the end of 270 weeks, or three quarters of the cycle of 360 weeks from the low on August 12, 1982.

An interesting side line on the square on nine is to realize that all angles on the cardinal squares are in harmony. That would be the 0-90-180-270 angles, and also the fixed squares 45-135-225-3 15 angles are in harmony. Let’s see if this idea can produce anything of consequence. Well October 8, 1987 was 743 days from the September 25, 1985 lows. The number 743 is on the 0 degree angle. Also October 5, 1987 was 371 days from the September 29, 1986 low. The number 371 is on the 0 degree angle. October 8th, 1987 was marked 281 days from the December 31, 1986 low. The number 28l is on the 270 degree angle. And finally October 5, 1987 marked 139 days from the May 19th low. The number 139 is on the 90 degree angle. Between October 15th and October 9th the Dow lost 158 points, the biggest losing streak in history up to that point.

One more example of our system using calendar days produced another bulls eye on November 10, 1987. This date falls one day after 1915 days which is on the 90 degree angle in the prior cycle the Dow closed at a low on May 20, 1987, two days earlier than 1744 days.

Suggested Books and Courses About Market Cycles

This is all hindsight now, isn’t it dear reader. Therefore can the square of nine really look into the future to predict tops and bottoms? Let’s put the reputation of the square of nine on the line, by predicting a market trend in the Dow after this article has gone to print. As noted earlier on August 25, 1987 the Dow reached an all time high on the 292 1/2 degree at 1939 days. In the next cycle on the 292 1/2 degree we find 2014 days have passed and the calendar date will be March 5, 1988. On this date we will expect the market to reach a high give or take a few days. Don’t forget, watch out for psychological inversions. They could be dangerous to your bank account, so March 5. 1988 may turn out to be a low.

In my next article I’m going to write excerpts from an unpublished book that I’m writing about the application of the natural cycles of 45-52-144, and 360, and translating these numbers into days, weeks, and months. This article will teach you the mechanics of the division of time, and the application of the information to stock market prediction. I’ll touch on a pet theory of mine as to how these cycles are actually a time gauge for the manifestation al all events on the planet earth, thus giving us an understanding of the mechanisms of the Kharmic Wheel of Life. W. D. Gann proved the validity of this himself, by predicting in advance, World War II, the participants, when it would start, and when and how it would end, by using these very cycles. Until next time.