Trading Articles

Rethinking Diversification By Dirk Vandycke

Although diversification is a popular method of managing risk when it comes to financial investments, it is often undifferentiated. Here in this first part of a two-part series, we’ll take an in-depth look at the concept and determine if it is indeed a good way to manage risk. When you go back in history, you’ll find that human beings have been groomed not to take chances in physically hostile environments. We are genetically tuned to fear risk. Uncertainty means risk and implies lack of control, and it is this lack of control that makes it difficult to trade the markets. But there’s no reason to fear risk in the markets — well, perhaps there is but it’s far less than we subconsciously believe. Without uncertainty, the financial markets wouldn’t exist and the positive aspect to risk is that it equals opportunity. Instead of fearing risk, perhaps we should try to respect it, get to know it, and try to contain it. We all know that we shouldn’t put all our eggs in one basket. In order to reduce our risk, we should diversify our assets. But does that really work? Let’s find out.

Why We Diversify

The reason we spread risks among different investments is to lower the risk in each individual one. Putting aside correlation issues, it’s a technique that works fairly well. Take the pooling of risk in the insurance industry as an example. It’s a clear payoff for insurer and underwriter. The insurance company gets paid a premium to spread a certain risk over a lot of people. Statistics tells us it’s difficult, if not impossible, to estimate the risk of one person having a catastrophe in his or her life. It’s easier to estimate the risk of people sharing such a fate when you have a larger number of people to monitor. It makes it easier to estimate the odds.

It’s comparable to tossing a coin. Though it’s impossible to know, with certainty, how many tails will emerge if a coin is tossed 10 times, you still expect, on average, to toss five heads and five tails. But in reality, you could toss zero tails or 10 tails. But if you toss a coin, say, 10,000 times, you very likely will toss close to 5,000, given you’re using a fair coin. This is because each throw’s impact decreases as you increase the number of throws. For example, throwing twice gives each throw a 50% impact on the end result. Throwing 10 times means that each throw only has a possible impact of 10% on the overall result. Based on this logic, spreading your risk seems to make a lot of sense. Now let’s apply this idea to the stock market and see if diversification lowers risk.

How Would You Define Risk?

Risk is commonly understood to mean the possibility of losing (part of) your investment. What if you make $100 in the stock market and subsequently lose it? Most people wouldn’t consider it a loss; they would think of it as a wash. In reality, that’s only mental accounting rearing its ugly head. When it comes to risk, there are two types of risk. One is systematic risk or market risk and the other is unsystematic or idiosyncratic risk. Systematic risk can be avoided by diversification, whereas unsystematic risk can’t be avoided through diversification. There’s also systemic risk, which is the risk of a system meltdown. That type of risk leaves everybody with a total loss and, not to worry, I will not be discussing this type of risk in this article.

Defining risk in terms of diversification makes it impossible to determine the relationship between risk and diversification. For example, when an index moves down, it is generally considered market risk, which cannot be eliminated through diversification. All boats are lifted with the tide. If the price of a leading stock in a certain sector falls because of idiosyncratic news relevant only to that company, it’ll likely drag the price of your stock in that same sector down with it. This type of risk may have been avoided through diversification provided you diversified in non-correlated assets. But correlation isn’t constant. It increases as stocks start trending because if, for example, the S&P 500 index starts rising, it is likely that most of the stocks that make up the index will also rise.

Suggested Books and Courses About Psychology and Risk Management

I think it’s safe to say that diversification lowers some idiosyncratic risk, but it’s not clear to what extent the risk is reduced. It’s also not obvious where idiosyncratic risk stops and systematic risk takes over.

Diversification And Profits

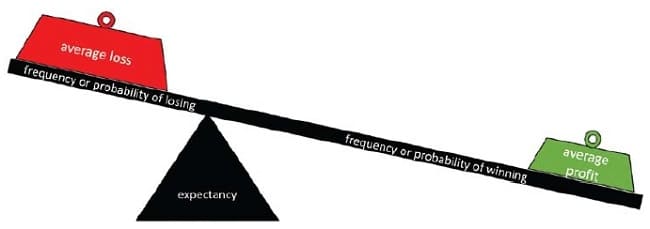

Ask yourself, “Are you in the markets to win or to avoid losses?” If you bring profits into the equation, you’ll need to know where they come from. The average return per trade is made up of four components in two dimensions. First, there’s the profitability dimension given by the frequency of winning and losing. Next, there’s the average loss and average profit, from which you can determine the profit/loss ratio. This gives you the average amount of profit you make for each dollar you lose. Here’s the formula to determine your average return:

Average return = [P(profit) * profitavg] – [P(loss) * lossavg]

The expected return in trading is the probability of having a winning trade times the average profit of winning trades minus the probability of having a losing trade multiplied by the average loss for losing trades. The values in the formula are far from constant, but that doesn’t mean it’s worthless.

Even though it’s impossible to know what will really happen in the markets, you can control your losses. By doing so, you improve the profit/loss ratio of your trading results. You need to cut your losses by a certain threshold. For example, if you cut each loss to 3% it would mean that your average loss would never be greater than 3%. Similarly, you can protect your winners without selling them at a specific price target. This will increase your average profit and increase your winners.

The formula I have presented in this article can best be depicted as a balance scale, such as what you see in Figure 1. Think of the weights on the scale as position sizing and risk management. Think of the scale as your analysis. Successful trading is about manipulating the weights and not the scale. Successful traders know that expectancy is the mathematical form of cutting losses and letting profits run. Most will admit that strictly following this concept is the main reason for their success. If you know how to handle your winners and losers, having as few as 30% winners can make you a fortune.

If you know how to handle your winners and losers, having as few as 30% winners can make you a fortune.

Confront Your Losses

It is general human nature to avoid taking losses just because we don’t like to lose. If we sell our losses, it is similar to admitting that we were wrong. The other extreme is that we sell our winners because we’re afraid they might turn into losers. This leads you to doing the opposite of what expectancy tells you to do.

Expectancy is a crossroad between risk, profit, and diversification. If it makes mathematical sense to accumulate winners and cut your losses short, then over time, you should see your winners growing and your losses getting weeded out. Instead of diversifying, concentrate on the investments that prove to be winners. Define your risks before placing a trade. In many cases, we don’t even have to estimate risk anymore. When you diversify, you’re avoiding your losses instead of trying to win. In part 2, I’ll run a Monte Carlo–style experiment to see if returns are systematically better without diversification.

Dirk Vandycke has been actively and independently studying the markets since 1995 with a focus on technical analysis, market dynamics, and behavioral finance. He regularly writes articles and develops software, some of which is available at his co-owned website, www.chartmill.com. Holding masters degrees in both electronics engineering and computer science, he teaches software development and statistics at a Belgian University. He’s also an avid reader of anything he can get his hands on.