Forces Which Make Prices

$15.80

“Forces Which Make Prices,” written by Warren Fayette Hickernell, is one of the foundational works in early market theory, exploring the underlying factors that cause price movements in speculative markets. Originally published in the early 20th century, this volume delivers a remarkably clear and structured framework for analyzing price behavior through the interaction of economic forces, public psychology, commercial interests, and speculative activity.

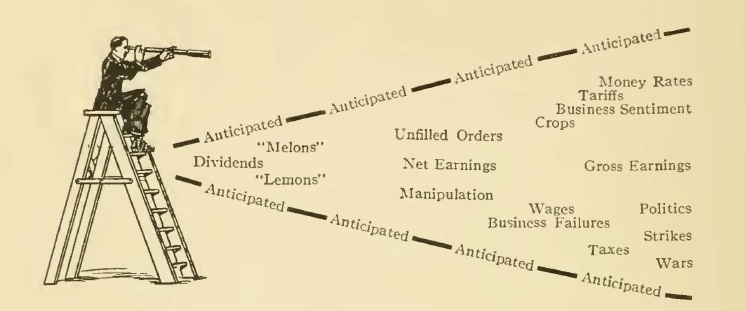

Hickernell demonstrates that prices do not rise or fall arbitrarily but respond to definable pressures—demand, supply, expectations, liquidity, manipulation, and crowd behavior. Through a disciplined and thoughtful approach, he dissects the conditions that foster market trends, the catalysts behind turning points, and the reasons why prices often move ahead of news.

His treatment of manipulation, commission houses, business conditions, and the dynamics of speculation forms one of the earliest comprehensive explanations of how real market forces—not predictions, rumors, or tips—shape price structure. The writing is concise, orderly, and deeply insightful, making it indispensable for students of classical market behavior.

This book remains a timeless guide for anyone studying the roots of price action, the psychology of speculation, and the structural forces that continue to influence modern markets.

✅ What You’ll Learn:

- The fundamental economic and psychological forces that drive price movements.

- How demand, supply, and expectation interact in real markets.

- Why markets often fluctuate before news becomes public.

- How speculative manipulation works and how large interests move markets.

- The influence of commission houses and commercial operations on prices.

- How crowd psychology creates trends, accelerations, and reversals.

- A framework for judging market tone and interpreting price behavior.

- Principles of successful trading rooted in understanding cause and effect.

💡 Key Benefits:

- Builds a strong conceptual foundation for reading markets without indicators.

- Helps traders recognize the real forces driving trends and reversals.

- Enhances analytical judgment and disciplined decision-making.

- Provides timeless lessons on speculation, risk, and crowd psychology.

- Complements modern price action methods with classical theory.

👤 Who This Book Is For:

- Intermediate to advanced traders seeking deeper insight into price formation.

- Price action traders who rely on behavior, not indicators.

- Students of market psychology and early Wall Street theory.

- Analysts who want to understand why price moves, not just how.

- Anyone studying classic speculative literature.

📚 Table of Contents:

- Buying and Selling Zones

- Market Moves

- Price Moves from the Inside

- Twenty Years in the Stock Market

- From Gross to Dividends

- Looking Ahead

Forces Which Make Prices By Warren Fayette Hickernell

| Author(s) | |

|---|---|

| Product Type | Ebook |

| Format | |

| Skill Level | Intermediate to Advanced |

| Pages | 60 |

| Publication Year | 1919 |

| Delivery | Instant Download |