Trading Articles

More Power To The Subordinates By Martha Stokes

There are primary indicators and there are subordinate indicators. Often we get caught up in the primary indicators and fail to see certain patterns within them. Here’s how applying the subordinates can help you see something that could give you the edge. Traders are always looking for ways to streamline their stock analysis process to make it more efficient and productive. One great way to speed up your indicator analysis is to tweak the way you use your indicators. There are two classifications of indicators, primary and sub-ordinate (also known as sub- or child indicator).

PRIMARY INDICATORS

Among the 250-plus primary indicators, there are a number of main categories:

- Trend

- Quality

- Accumulation/distribution

- Oscillators

- Flow of funds

- Velocity/momentum

- Hybrid

- Cycle

Each of the primary indicator categories defines the function and use of the indicators. Hybrid indicators, for example, are the new indicators written in the past three to four years for the modern automated market. Hybrids lead price, actually moving in advance of it. Subindicators play a key role in faster, more reliable chart analysis, regardless of which category of indicator you use. They are especially important and useful for histogram indicators and single-line indicators. Primary indicators can be placed alongside each other in the same indicator chart window for comparison between the two indicators and for confirmation of harmonious or disharmonious trends, patterns, and angles. All primary indicators are analyzing price and time, volume and time, or price, time, and volume in a unique formula. Some primary indicators are period-based, while others are cumulative.

SUBINDICATORS

What separates subindicators from primary ones is that the former are applied to the latter to employ the formula of the primary indicator in order to derive the line for the subindicator. While a primary indicator is a formula for smoothing market data, subindicators are not based on pure price, time, or volume, but the derivative comparison. This makes subindicators extremely effective in exposing more information about the primary indicator, which can, at times, lead price and in particular the explosive price action of momentum or velocity. Subindicators define and expose:

- Convergences between the primary and subindicator

- Divergences between the primary and subindicator

- Crossover patterns for signals

- Angle of ascent or descent of the primary indicator

- Overextended patterns for nonoscillator types of indicators

- Averaging for exposure of above- or below-average patterns

- Levels of trough and peak patterns

- Extreme patterns that precede bottoms or tops

- Improving price action within a consolidation, platform, or sideways pattern

- Exhaustion patterns between the primary and subindicator.

By applying a subindicator to a primary one, you can significantly improve your stock chart analysis by allowing the subindicator to reveal patterns that are not easily seen. Let’s look at how subindicators improve the analysis of the most popular indicators used today.

The relative strength index (RSI) is very popular during sideways market conditions and bottoming phases. Most traders limit its use to overbought and oversold conditions as a single-line oscillator. But all traders know that when a stock is forming an intermediate- or a short-term bottom, energy builds within the sideways price action of the bottom and stocks tend to move with sudden momentum that is hard to catch. As an oscillator, the RSI has the ability to reveal momentum price action energy when you apply a subindicator to assist you in finding these patterns.

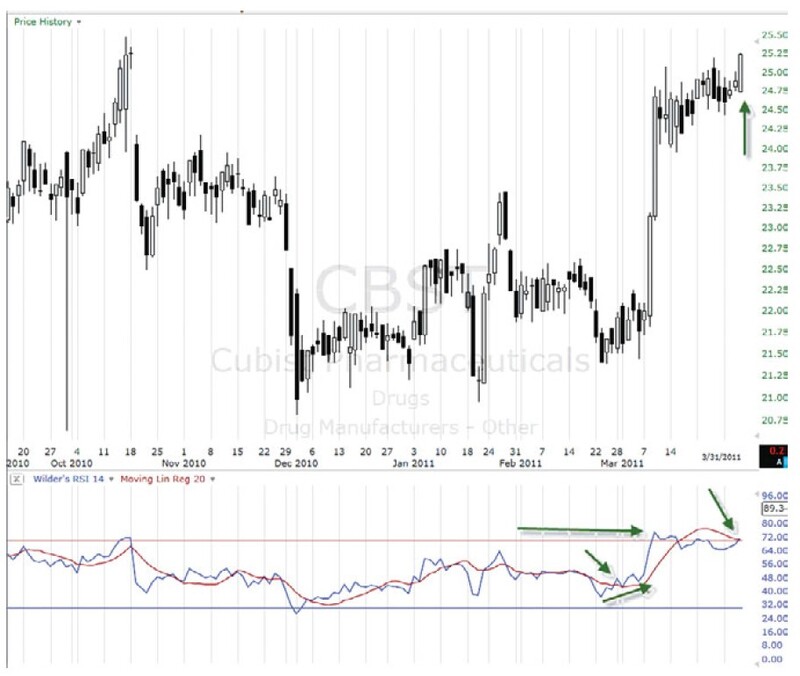

Figure 1 shows RSI (14) as it is typically used. Normally, a midtrend bottom lasts three to six months, with several tests of the low. By itself, RSI makes it difficult to see changes in the oscillator pattern. By adding a moving linear regression subindicator to RSI (Figure 2), the internal pattern of price is revealed.

We can now see that RSI is actually moving more aggressively, even though the candle bars do not appear to be. Along with the moving linear regression, RSI shows:

- Higher lows on RSI that are angling upward

- A crossover of RSI over the moving linear regression line.

Figure 3 shows a convergence between the primary indicator, RSI, and the sub-indicator, the moving linear regression line. This pattern forms prior to a sudden move. The two indicators will cross and form a divergence as price accelerates upward.

Another wonderful subindicator that can be used for identifying tops and bottoms before the final low or final high is rate of change (ROC). The ROC is a subindicator that is extremely useful in certain situations.

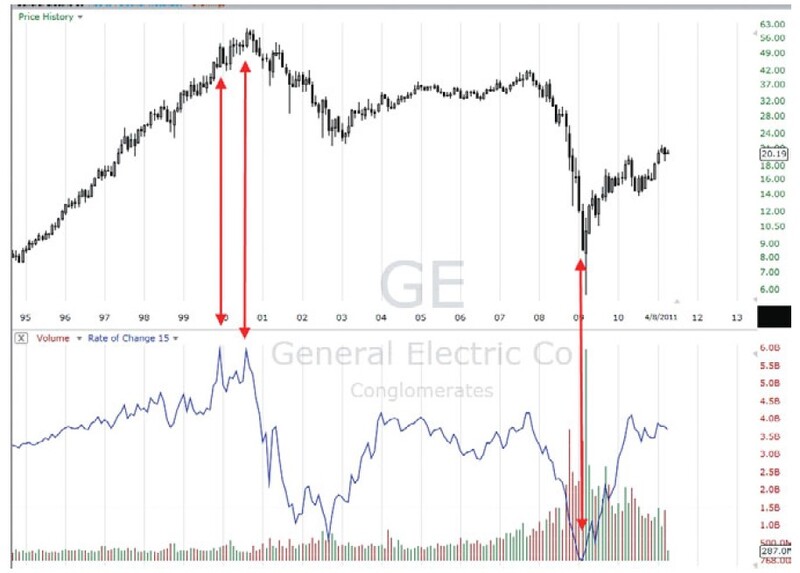

Figure 4 is a monthly chart showing ROC as the subindicator applied to the volume bars. It signals early that volume has reached an exhaustion pattern preceding the extreme price high of 2000 and it exposes the exhaustion pattern of volume prior to the final low of 2009. When applied to volume bars during extreme conditions, ROC can be useful in preparing for a long-term top of an exhausted bull market or a long-term bottom of an exhausted bear market.

The most effective use for ROC to find exhaustion patterns on monthly volume bars is to use this tool to find bottoms and tops prior to the major moves. This indicator set works extremely well on industry and sector indexes to expose the top weeks in advance of the final high and weeks ahead of the final low (Figure 5). By knowing that the industry is reaching a peak or trough, traders can build watchlists in preparation for the change to the primary uptrend or downtrend.

Another subindicator that works extremely well for quickly determining a change of trend on the short-term trend is linear regression lines (LRL). These lines are straight-line subindicators that can be applied to any primary line indicator. The formula is today’s close minus X number of periods ago — in this case, days.

Suggested Books and Courses About Trading With Indicators

By using two LRLs applied to the primary indicator such as Chaikin’s money flow (CMF), the angles of ascent and descent are clearly defined and you can also determine if the shorter-term trend is angling up faster than the longer-term trend. In addition, determining where the two lines intersect and which line is above the other quickly expose whether the indicator is moving up more rapidly on the short-term time frame. This eliminates the need for tedious and time-consuming drawing of trendlines. The LRLs appear and move with the indicator to which they are applied.

Figure 6 displays the Chaikin money flow with the LRLs showing that as this stock was moving in a platform price pattern, money was flowing into the stock prior to the move up. The LRLs help traders see these patterns, which allow for earlier entries into platforming stocks.

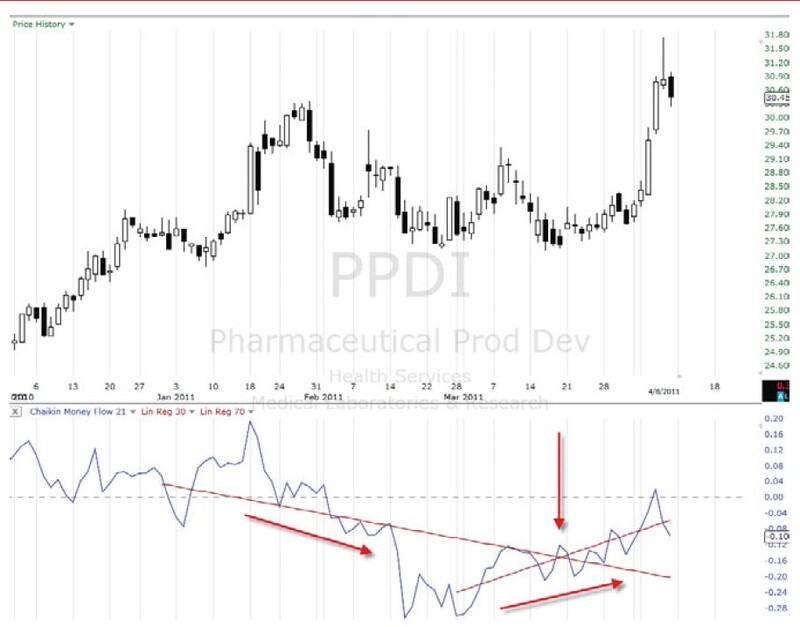

Figure 7 shows Pharmaceutical Product Development Inc. (PPDI) with the CMF and LRL. This combination exposes when the bottom shifted from downward action to upward action within the bottoming sideways price pattern. This aids in entering bottoming stocks sooner. CMF with LRL exposes that money from funds is flowing into the stock even before the stock begins the move out of the short-term bottom.

In Figure 8, the CMF with LRLs on the chart of Nabors Industries (NBR) show that money flow into the stock is diverging away from price. This means few large funds are moving into the stock. Even though price continued to move up, the risk is higher that the move will run out of buyers.

SUMMARY

Subindicators are useful tools to apply to primary indicators to help traders see patterns within the indicators that cannot be easily seen. A variety of subindicators can be used on various trend time frames. Subindicators work well on stocks, major indexes, industry indexes, exchange traded funds, and most charts. Choosing which subindicator to apply to each primary indicator depends upon:

- Your trading style

- The current market condition

- The correct primary indicators to use based on the first two criteria.

Subindicators include:

- Moving averages, simple and exponential

- Linear regression lines

- Moving linear regression line

- Channels and bands

- Rate of change

- Time series forecast

Subindicators are easy to set up by applying them directly to the primary indicator in your chart window. They are most effective when using one primary indicator per chart window.

Using these additional tools, which are available in most charting programs, allows you to expand your analysis while reducing the time you spend studying an indicator in relation to the price chart. All traders can benefit by employing subindicators, especially when using primary single-line or histogram indicators.

Martha Stokes is a technical analyst and lecturer for Techni-Trader stock market trading courses, workshops, and virtual classes. In addition, she writes several educational newsletters for active traders.