Wyckoff 2.0: Structures, Volume Profile and Order Flow

$9.95

With the publication of this new content we give continuity to the first book “The Wyckoff Methodology in Depth“, where all the analytical tools that this methodology addresses are presented in a clear way, as well as the more theoretical aspect in the study of the behavior of financial markets. In Wyckoff 2.0 we will go a step further and address more complex concepts; we will review the doubts most commonly raised by students of the methodology and incorporate new tools based on the information provided by the volume data that will be very useful, such as the Volume Profile and Order Flow. I strongly recommend that before starting the study of this book you have previously internalized all the concepts covered in the first one, since everything seen is taken as understood and, if not, it could cause some confusion or lack of understanding. By reading this book. You will learn:

- Sophisticated concepts and complex questions of the Wyckoff Methodology.

- The B-side of the financial market: the current trading ecosystem.

- The matching of orders: the real engine of the market.

- Advanced tools for volume analysis: Volume Profile operating principles and Order Flow basics.

- To build your own trading strategy step by step.

Contents:

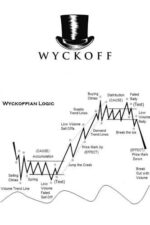

- ADVANCED CONCEPTS OF THE WYCKOFF METHODOLOGY

- RESOLVING FREQUENTLY ASKED QUESTIONS

- TODAY’S TRADING ECOSYSTEM

- THE IMPORTANCE OF VOLUME

- VOLUME PROFILE

- ORDER FLOW

- WYCKOFF 2.0

- CASE STUDIES

Wyckoff 2.0: Structures, Volume Profile and Order Flow By Rubén Villahermosa pdf

| Author(s) | |

|---|---|

| Format | |

| Pages | 342 |

| Publication Year | 2021 |