The Wyckoff Methodology in Depth: How to Trade Financial Markets Logically

$9.95

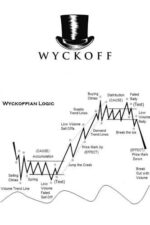

The Wyckoff Methodology tries to identify that professional intervention to try to elucidate who is most likely to be in control of the market and enable us to pose judicious scenarios of where the price is most likely to go. This book is a Technical Analysis approach based on the study of supply and demand; that is, on the continuous interaction between buyers and sellers. The approach is simple: when well-informed traders want to buy or sell, they carry out processes that leave their traces on the chart through price and volume.

This is the cornerstone of the methodology, which makes it stand above any other form of technical analysis; and that is because it is the only one that informs us about what is really happening in the market in a logical manner. This approach is based on a real underlying logic through its 3 fundamental laws:

- Law of Supply and Demand. It is the true engine of the market. You will learn to analyze the traces left by the interactions between the major traders.

- Law of Cause and Effect. The idea is that something cannot happen out of the blue; that for the price to develop a trend movement (effect) it must first have built a cause previously.

- Law of Effort and Result. It is about analyzing price and volume in comparative terms to conclude whether the market actions denote harmony or divergence.

It is a universal analysis approach, where its reading is applicable to any financial market and over any time frame.It is recommended to analyze centralized markets such as stocks and futures where volume is genuine and representative; as well as assets with sufficient liquidity in order to avoid possible manipulation maneuvers.

Contents:

- HOW MARKETS MOVE

- THE WYCKOFF METHOD

- THE THREE FUNDAMENTAL LAWS

- THE PROCESSES OF ACCUMULATION AND DISTRIBUTION

- EVENTS

- PHASES

- TRADING

- CASE STUDIES

The Wyckoff Methodology in Depth: How to Trade Financial Markets Logically By Rubén Villahermosa pdf

| Author(s) | |

|---|---|

| Format | |

| Pages | 248 |

| Publication Year | 2019 |