Geometry of Markets (Volume 1 and 2)

$29.83

| Author(s) | |

|---|---|

| Pages |

415 |

| Format |

|

| Published Date |

1993 |

GEOMETRY OF MARKETS is a compilation of all the RELIABLE technical approaches to TIME, PRICE, PATTERN & TREND analysis I have researched and studied or developed for my own use over the past 15 years.

Introduction:

Since the early days of man, scholars, philosophers, mathematicians and scientists have endeavored to prove that nature and the universe grow in harmony to some natural law of vibration. Sufficient proof exists that all forms of life and matter vibrate to some natural law of harmonics. In modern times such inventions as the telephone, radio and television rely on the vibration of invisible frequencies transmitted though another medium.

These vibrations cannot be seen, heard or felt by us yet they are part of our daily lives and we now take them for granted. Modern science indicates that all matter emits vibrations. Vibrations start from the Sun which is believed to control the universe and effect all things. Plants grow in harmony with cycles of the year, crops planted at specific times of the year grow more favorably than those out of harmony with their most favorably cycle.

Life itself evolves around cycles of the universe and the planetary aspects. The Moon creates a pattern of rising tides and feeding habits for marine life. Night becomes day and day becomes night, the oceans rise and fall, economic conditions expand and contract, the path of life continues to unfold in some strict relationship with the past. Since most of the natural occurrences in nature revolve and evolve around cycles and vibrations they can be accurately measured. The principles that apply in all forms of nature also apply to the markets, as these are merely a reflection of human nature and the ingenuity of man himself.

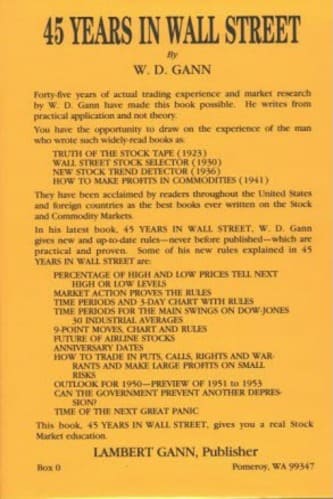

Some approaches outlined here are methods directly promoted by well known analysts such as W.D. Gann and RN. Elliott or their students as well as many other lesser known dedicated market experts. Many of the approaches detailed here are now held out to be public domain knowledge, just the same these methods have been a basis for further research and discovery given the advent of the computer analysis power we have experienced in the last decade.

Without the input of a dedicated few, those who understood that markets work to a structure dictated by their past activity, we would ever have been able to advance our knowledge in such a relatively short period of time. It is my aim here to demonstrate the validity for the use of TIME, PRICE, PATTERN & TREND analysis of markets as a LEADING TECHNICAL INDICATOR FOR PREDICTING CHANGE OF TREND.

In doing so, I will endeavor to illustrate and explain the uses of these lesser known technical techniques, their pitfalls and wars in which they can be enhanced to give better results. To succeed in the volatile trading environment we are experiencing from todays world of rapid communication requires a most sophisticated approach. The origins of the mathematical ratios and the numbers I hold out to be important to the time and price analysis of markets are explained in the appendices. If one can grasp the significance of the origins of these ratios and numbers it will provide a base for their successful use in the future.

It should be noted that every mathematical ratio or number employed in the analysis of markets, put forward in this text, has an ancient origin. In fact every ratio or number we will use m the analysis of markets has been enshrined in such ancient works as the Great Pyramid, the teachings of Pythagoras, Plato and Archimedes. Also the ratios we use are common to the structure of music, works of art, the interrelated motion of the planets and in general the natural growth of marine and plant life. The way in which we utilize these ratios and numbers is termed “philosophical geometry”.

To perform enlightened time and price analysis requires a medium from which to study market behavior. The GEOMETRY OF MARKETS medium is in the accurate charting of price movement in time for any commodity contract, stock price or price series we wish to trade.

The principles and methods outlined in this text will, without doubt, prepare the astute analyst for the future better than any other doctrine published on the technical analysis of markets. When used in conjunction with the knowledge of market momentum, wave structure and “market intuition” the results will be astounding. The road to success for the market analyst is in studying past time and price patterns, recognizing repetition and the strength of certain events. When similar patterns occur in the future they stand out and provide “set ups” for trading opportunity. The future in many ways is simply a repetition of the past. Price activity may not always be identical but, it will most surely be similar.

Recognizing opportunity is a prerequisite to success in the markets. Once you have an understanding of the geometric relationships that manifest themselves within market activity you will find that “trading set ups” Just keep coming one after the other.

Contents:

Volume 1:

- THE THEORY BEHIND TIME RELATIONSHIPS IN MARKETS

- THE SCIENCE OF MATHEMATICS

- IMPORTANT STATIC TIME ELEMENTS CAN SIGNAL A CHANGE IN TREND

- STATIC PRICE INCREMENTS AND LEVELS FOR SUPPORT & RESISTANCE AREAS

- DYNAMIC PRICE SUPPORTS AND RESISTANCES

- SQUARING PRICE FOR LOCATION OF FUTURE SUPPORT AND RESISTANCE ZONES

- DYNAMIC TIME SUPPORTS AND RESISTANCES

- CHART SCALING OF TIME AND PRICE

- FUTURE TIME SQUARING$ OF PRICE

- RATIO ANALYSIS OF PRICE RETRACEMENTS AND PRICE PROJECTIONS

- GEOMETRIC VIBRATION ANGLES

- EFFECTIVELY USING TIME SIGNALS FOR TRADE TIMING

- RECORDING STOCK OR COMMODITY PRICE HISTORY

- STEPS REQUIRED FOR COMPREHENSIVE TIME & PRICE ANALYSIS

- RULES FOR CONFIRMING IMPORTANT MARKET VIBRATIONS

- HELIOCENTRIC PLANETARY CYCLES

Volume 2:

- TIME & PRICE TOOLS

- REVERSAL PATTERNS

- TREND ANALYSIS

- ELLIOTT WAVE ANALYSIS

- CYCLES

- WINDOWS OF OPPORTUNITY

- TRADING FOR PROFITS

Geometry of Markets (Volume 1 and 2) By Bryce T. Gilmore PDF

15 reviews for Geometry of Markets (Volume 1 and 2)

Clear filtersOnly logged in customers who have purchased this product may leave a review.

Mylo Rojas (verified owner) –

This book goes deep into market cycles and time analysis. It’s not for beginners, but if you’re an experienced trader, you’ll find a ton of value here. Great resource overall.

Ellis Wilkerson (verified owner) –

I’ve applied the time and price techniques outlined here to both stocks and commodities, and my trading setups are now much more consistent. A fantastic resource for any trader.

Kehlani Lane (verified owner) –

The focus on geometric relationships in the markets is fascinating. Some of the topics are a bit dense, but if you put in the effort, the rewards are definitely worth it.

Bentlee Harding (verified owner) –

Bryce Gilmore does an incredible job explaining how mathematical ratios and vibrations govern the markets. I’ve used these techniques and noticed a significant improvement in my trade entries and exits.

Matias Evans (verified owner) –

An excellent resource for anyone who wants to delve deeper into technical analysis. It’s not just about the tools; Gilmore teaches you how to think like a market analyst. Highly recommend!

Eduardo Munoz (verified owner) –

Great concepts on price projections and support/resistance zones. It could use a bit more on practical implementation, but overall a very informative read.

Junior Dougherty (verified owner) –

I expected clearer examples, but it felt like I was reading a textbook. Not suitable for someone looking for simpler trading strategies

Ford Morrison (verified owner) –

“I’ve studied W.D. Gann and Elliott Wave before, but this book connects all the dots. The detailed explanation of vibration angles and planetary cycles has taken my market analysis to a whole new level.

Novalee Montoya (verified owner) –

This is not your average trading book. It’s packed with advanced insights on time and price, and every page offers something new to learn. I can see why this is a staple for so many professional traders.

Adaline English (verified owner) –

While I found the time and price theories interesting, it’s not as user-friendly as I hoped. There’s a lot of valuable information, but I had to re-read sections to fully grasp the concepts.

Rebecca Bates (verified owner) –

Solid content with well-researched techniques. My only critique is that some chapters felt a bit rushed, but the information is still incredibly useful.

Janiyah Sexton (verified owner) –

I really liked the content, especially the analysis of trend reversals and time signals. However, I wish there were more practical examples. Still, it’s a great addition to my trading library.

Alisson Case (verified owner) –

Gilmore’s approach to time and price analysis is unlike anything I’ve seen. It provides a perfect blend of ancient geometric principles and modern market trends. This is essential reading for traders looking for an edge.

Eliana Hebert (verified owner) –

The chapter on squaring price and time relationships is absolutely mind-blowing. I have been able to spot key reversals and trend shifts with a lot more confidence. A must-have for any serious trader.

Aniya Beck (verified owner) –

This book transformed my understanding of market patterns! Bryce T. Gilmore explains complex concepts in a way that makes sense for real-world trading. My timing and precision have improved tremendously!