Trading Articles

An Investment Strategy For Everyone By Robert Fischer

After the huge losses in the recent past, many investors are asking themselves whether there are possibilities of participating on the stock and futures exchanges with reduced risk. In the following method, I will show a trading strategy which will work for everyone who is willing to invest the time and has the skill and patience to execute the trading strategy described here. In the following method, I will show a trading strategy which will work for everyone who is willing to invest the time and has the skill and patience to execute the trading strategy described here.

Systematic Investment Strategies

The most important decision every investor has to make—other than choosing a reliable investment tool—is what kind of risk he or she can live with. The problem with most investors is that they only think about the chances, not about the risk involved. Being invested in the long term automatically means that huge equity swings may occur, but that no work is involved. If we look to reduce the risk in a portfolio, than there is, in my opinion, only one way to achieve this in the long run:

Make the investment decision yourself; Analyze every product in the portfolio individually; Always work with a predetermined stop-loss protection; Work with profit targets or trailing stops; The PHI-Ellipse as an Investment Tool.

The PHI-ellipse is a very little-known investment tool, which is closely connected with the Fibonacci sequence. Whenever the name Fibonacci comes up, many investors think of ‘magic rules’ which cannot be defined; exactly the opposite is true. In our books ‘The new Fibonacci Trader’ and ‘The new Fibonacci Trader Workbook’ , we introduce Fibonacci trading tools such as PHI-spirals and PHI-ellipses which analyze investors’ behavior expressed in price patterns. Working with the Fibonacci trading tools is equally important to working with technical or fundamental trading tools. The big advantage gained by working with a PHI-ellipse is that price moves are no longer random, but can be used for profitable trading.

The disadvantage of working with PHI-ellipses is that—other than the fact that it is an unknown trading tool—they can only be drawn using a computer. On my website, www.fibotrader.com, I offer every investor the opportunity to work with the Fibonacci trading tools (on a trial basis, free of charge) on more than 1 ,000 products online on daily or intra-day data, in order to get used to these unique trading tools.

Working with the PHI-Ellipse

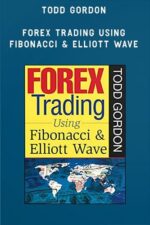

In general, it can be said that investing with the PHI-ellipse means buying low and selling high. This does not mean that we will always catch the lowest low of the highest high. But it is very important to understand that we will always invest against the direction of the main trend. The basic structure of the PHI-ellipse is always the same, although it can be longer or shorter, thinner or thicker. The strength of the PHI-ellipse is that it can be adjusted dynamically to price patterns and can identify those which would not be detected normally. In order to be able draw the correct PHI-ellipse, we need at least three points: the starting point and two side points. The PHI-ellipse can always be drawn when wave 3 is at least as long as wave 1.

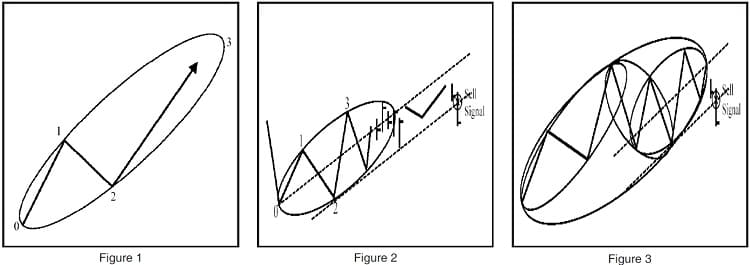

In the figure 1, a PHI-ellipse in a 3-wave price move is shown. At the same time when we can draw a PHI-ellipse with three points, we focus on the final point. The second side point of the PHI-ellipse has to be adjusted over time; the final point is variable as long as the second side point is not established. The final point of the PHI-ellipse is confirmed by the market price. We have to wait until the market price reaches the final point and then breaks out of the parallel to the median line of the PHI-ellipse. This is shown in the following figure 2.

The PHI-ellipse can be applied to any data compression. The thinner the PHI-ellipse, the more difficult it is to find the correct final point. The further the two side points are apart, the safer it is to determine the trend change of any product or market when the final point of the PHI-ellipse is reached. A very important turning point is reached when we can envelop three smaller PHI-ellipses with a larger PHI-ellipse.This is shown in figure 3.

The steeper the angle of the PHI-ellipse, the bigger the price correction will be, once the end of the PHI-ellipse reached. It is very important that we always stay invested in products with a high volatility and market participation such as the S&P500 Futures Index, the DAX Futures Index, major cash currencies, or stocks with a large market capitalization.

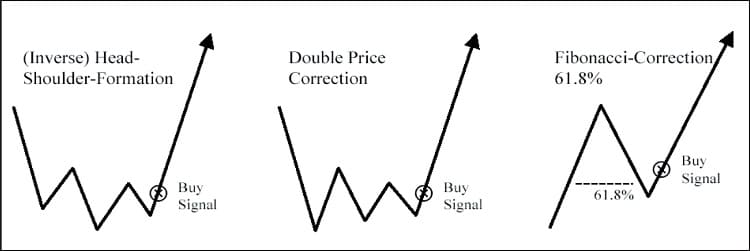

Analyzing Price Patterns to Confirm a Trend Change

The final point of the PHI-ellipse is not the only element which confirms when the market price breaks through the parallel to the median line of the PHI-ellipse. We will add a second element to make the analysis even safer. Most of the time, trend changes can be identified on price patterns. From the many price patterns available, we want to select three which appear very often, have a good chance of profit and can be executed easily by every trader. See Figure 4.

These price patterns can be applied to all products and markets systematically and are, therefore, to be used on different products, in order to be diversified. It is very important that all three price patterns be used in combination. If executed systematically, the combination of PHI-ellipse and the price patterns give reliable trading tools. The equity curve will be very stable if the investor is well diversified.

Suggested Books and Courses About Fibonacci Trading

Practical Application of the Trading Strategy to the DAX Futures Index

An investment strategy is only valid if it can be applied systematically to different products and can be tested on historical data. In general, this is the reason why technical indicators are used. It is a very little known fact that using price patterns can achieve the same goal. We applied the price patterns shown above to real time trading—and they worked very well. The combination of price patterns and PHI-ellipse cannot be programmed, but this combination offers increased profit potential to the skilled investor; therefore, we describe it here.

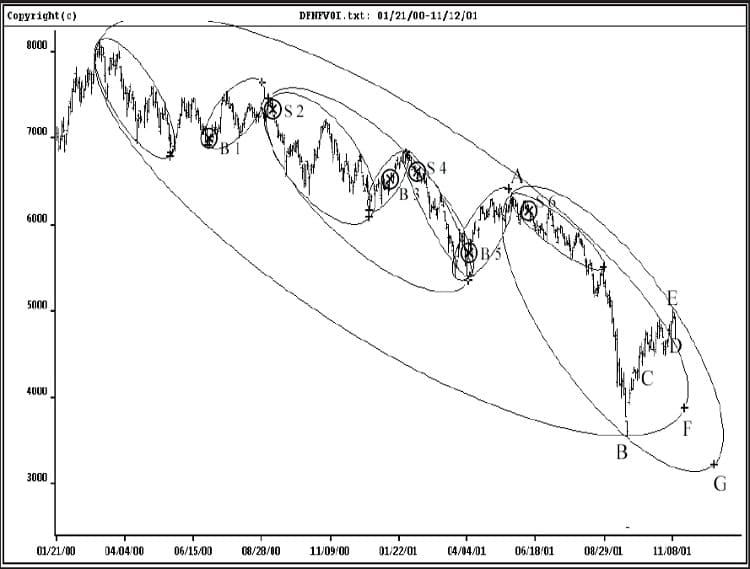

To show how our investment strategy works, we look at the trading signals on the DAX Futures Index in the time between February 2000 and November 200 1 . During this time, we had six signals which are all based on the same parameters. The combination of price patterns and PHI-ellipse reduced the number of trades dramatically without reducing the profit potential. The three parameters are Wait for the end of the PHI-ellipse; Wait for the break of the parallel to the median line of the PHI-ellipse; Confirmation of one of the three price patterns. See Figure 5.

B 1 , B 3, B 5: Buy Signals—S 2, S 4, S 6: Sell Signals

Where are we today?

With the sell signal S 6, the investor would have participated on the dramatic drop of the DAX Futures Index down to about 3,600 points. At the low point B, we did not have a buy signal, because the final point F of the PHI-ellipse was not reached. The profit-oriented investor could have covered his short position at point C, where we had a buy signal out of a price pattern. In hindsight, we know that this would have been the correct decision. Following our investment strategy, we would have covered the short position at point D, where the market price left the PHI-ellipse.

Right now we are in the PHI-ellipse at the starting point A and the two side points B and E, along with the end point G. While points A and B remain stable, points E and G are still unstable and have to be adjusted according to price moves in the future. Each PHI-ellipse consists of a 3-wave price pattern. If we look at the PHI-ellipse at our position, we can see that we are still in wave 2, which constitutes the correction, and that Wave 3 is still ahead of us. Right now, we expect wave 3 to go back at least to 4,200 points, but this depends on when side point E is finally established. But even if wave 3 brings the DAX Futures Index back to 4,200 points, we will only get a buy signal if we identify one of the three price patterns; the market price breaks out of the PHI-ellipse; the market price breaks the parallel to the median line of the PHI-ellipse.

Waiting for the best entry point takes patience, discipline and skill. It is also very important to remember that the recommended trading strategy is only one of the many possibilities to invest. We have attempted to supply a trading tool that can be used by anyone and which is easy to understand and to execute, does not give too many trading signals, and can be applied to many different products. Because the PHI-ellipse can only be drawn by a computer, we offer this trading tool on our website www.fibotrader.com to every investor who wants to make his own trading decisions. We will update our analysis weekly.

Robert Fischer is author of the new book Fiboancci Trader: Tools and Strategies for Trading Success.