Trading Articles

The Chain of Command By Robert Krausz

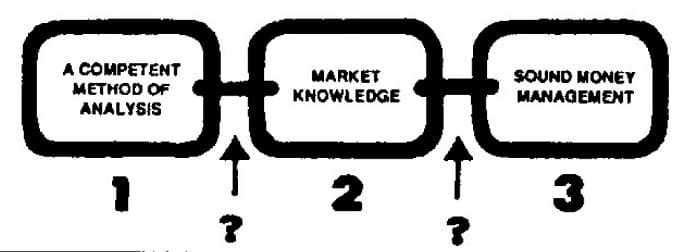

You are looking at the Golden Chain that is owned by every successful trader on Planet Earth-there are no exceptions. If we examine the chain link by link, we find that each link is of equal importance and all three depend on each other. If one is dropped or is weaker than the others, the entire chain collapses. When the three links in the chain are checked out and the trader feels convinced that he has all under his command and still loses money, that is when the true importance of the small interconnecting links is realized. The question marks in the above illustration become gigantic and overbearing. When the trader finally realizes that discipline is not enough to hold the chain together and that P.S.M. (Psychological Self Mastery) is required to transform a chain of burden into a chain of command, only then can confident trading begin. First let us examine the links in the chain.

LINK #1–A COMPETENT METHOD OF ANALYSIS

A competent method of analysis, otherwise known as a good trading method. Without this you are dead in the water. The question has to be asked, “What can be classified as a competent method?” The word that counts is competent. Many books have been written on this subject, mostly of no use at all to the full-time trader or investor. I will list what I, as a professional trader, consider to be the essential features of a competent methodology:

- The methodology should show you clearly when the contract you are tracking has gone into a trendrun.

- Advance warning setting up when the trendrun is possibly aborting.

- Sufficient warning that congestion may be ending and a trendrun may commence, with an indication of the direction of that trendrun.

- It should keep you in that trendrun for the maximum time possible (naturally keeping this within the frame of reference of the methodology).

- The technique should help to define support and resistance areas to enable the trader to buy support and sell resistance, and not to rely on breakout trading which tends to follow the herd instinct.

- All of the above points should be applicable to any time period that suits your TPT (Traders Psychological Temperament). What is the point of using a trading technique that only works on the daily barchart, when your TPT is clearly suited to the hourly time period? Not only will you lose money, you will finish up in the losers corner together with 90 percent of all commodity traders.

Please realize that we are discussing here the minimum requirements. the features of placing stops correctly has not even been mentioned. The speed with which you can become aware of being incorrect is also an important part of a good technique. The whole essence of a workable methodology is to provide the trader with a frame of reference that enables him to act under virtually any market condition, and that action should be more often correct than not.

LINK#2–MARKET KNOWLEDGE

Having market knowledge may sound corny or even childish, but how many of you really know how the markets actually work? Have you ever been on the trading floor in Chicago or New York or London? If not, why not? Even G.P.’s visit their local hospital sometimes.

Do you know the other players in the game their strengths, their weaknesses? What is their role in the markets? Which of them are market movers? Do you know who are the market makers in the commodities you trade? Have you ever shaken the hand of the floor trader who actually places your orders? Do you know why sometimes your order can not be filled, even though it traded through your price point? What are the most important segments of the trading day? How can all of the various government figures effect your contract? Are you aware of the difference between cash and futures of your preferred commodity? Do you know your brokers birthday?

LINK #3–SOUND MONEY MANAGEMENT

Sound money management is a big subject; some people consider this to be a part of competent technical trading technique. Some small portions, such as stops, could possibly be, but your trading ability will increase if you master this as a separate subject. This is bottom line stuff, and if you want to stay in the game for years to come, this subject has to be mastered. Unfortunately, this has been a much neglected matter in books, seminars and magazines. Why, I do not know.

Suggested Books and Courses About Psychology and Risk Management

The basic concept (what ever your approach) has to be to place only a portion of your trading capital at risk each time you commit yourself to a trade. What percentage of your capital are you prepared to place? For how long? How much are you ready to lose each time you enter the market? Thirty percent at risk, or even 80 percent? Does it depend on how strong each trade is? It must be obvious that these questions have to be answered before any funds are committed to the market. There you have the three links that make up the chain of command. Do you have all three under control and the discipline to carry it out and still you are losing in the markets, or just breaking even? Perhaps a tiny profit for the large risks you are taking? So what is wrong? Are we talking about the old greed and fear syndrome? No, it goes much deeper than that. The name of the game is confidence. Not the surface, shallow confidences of the showman, but the deep, solid confidence that comes only from knowledge of our own behavior during the stress of trading.

Instead of examining our trades, we should check how we reacted to a small loss. Were we too euphoric over a good profit? Was our judgment correct when we found ourselves on the wrong side of the market? This kind of self analysis may eventually lead to P.S.M. This road is very long, but there is a shorter and more sure route. What we are saying here is that confidence in our knowledge of links one, two and three is the foundation, but the glue that holds all three together is confidence. The question marks in the illustration are most appropriate, as virtually every trader at some point in his trading life reaches the question mark stage. Is P.S.M. possible to a degree where confidence is automatic, without taking ten years to reach it? The answer is yes. The human brain does not care whether you are a large or small trader, the lack of confidence is registered day after day in the same area of your brain. The more it registers as such, the more stressful your trading becomes, and the more stress, the greater the imprint on the brain. To achieve P.S.M. this imprint has to be erased, and until it is erased, stress-free confident trading on regular basis is very hard to achieve.

To understand this process, we need at least a general idea as to how the mind works (of course, the writer is aware that it is more complicated than the description here, but for this purpose, a simple explanation must suffice). Actually, the brain is a large muscle, there are two spheres: the left brain and the right brain. Each side has its own function. The left side handles mostly logic, numbers, linearity and analysis. The right brain on the other hand does a totally different kind of job imagination, music, color, conceptualization and rhythm. The left brain is also responsible for keeping us safe and in control. If you doubt this, have a couple of vodkas and see what it does to your Left brain. If we are to erase the unwanted imprints from our brain (and this absolutely has to be done if we are to change our low level of confidence), then it is necessary to access the part of the brain that can do this job for us quickly and efficiently. Furthermore, it is not enough to erase the imprints we do not need, but they have to be over ridden with positive images that will bring about P.S.M.

Our brain emits from the second we are born (some may say even before), a brain wave energy that can be, and is, measured. During our normal every day activity, our brain emits 14-21 cycles per second. This is universally called the beta level. The next level below this is called alpha, and here the brain waves drop down to 7-14 cycles per second. We have a still lower level called theta, but we are not concerned with this here. The reality is that, although during the alpha level our cycles drop to the 7-14 range, the actual energy rises. This can be put to use. What we have to realize is that while we are at beta level, our conscious mind is in full control of our activities. In fact, it is your conscious mind that stands as a guardian over all your actions, keeping you safe and filtering out the messages from your subconscious mind.

It is your right brain that tends to act in concert with the subconscious mind and it is your subconscious that we have to tap into to do the job in hand. Our primary purpose is to lower our brain waves to alpha level where the conscious mind is put to sleep so to speak, and is no longer acting as a guardian at the gate, and we can now gain access to the subconscious mind. Why do we want to do that? This is the seat of your memory, all of your actions and outside stimuli are recorded here since the day you were born. All of your good and bad habits emulate from here. If we want to change any of our behavior patterns, this is the place to start. We are extremely fortunate that the subconscious cannot differentiate between reality and imagination.

Therefore we can take advantage of this and tell our subconscious that we are already happy, confident traders and it will accept it as reality. Not only will it accept it but it will help with all its might to create that reality. Such is the nature of our subconscious mind. This is the reason why creative visualization! hypnosis/subliminal tapes work. Now it is up to us to create the situation where we can lower our brain waves to alpha level to access our subconscious in a relaxed state. Once this level of relaxation is reached the habit altering work can begin. I have worked with a number of traders and within four to six sessions of self hypnosis with creative visualization and goal setting the confidence level rises dramatically. From that point onwards the road becomes smoother, and the trader realizes what confident trading really means!