The Day Trader’s Bible: Or My Secret In Day Trading Of Stocks

$7.71

The Day Trader’s Bible Contained within are the results of a lifetime of studies in tape reading. It’s a pursuit that is profitable…but it’s not for the slow minded or weak hearted. You must be resolute…strength of will is an absolute requirement as is discipline, concentration, study and a calm disposition. May your efforts bear fruit and strengthen your will to persevere.

Introduction:

If Tape Reading were an exact science, one would simply have to assemble the factors, carry out the operations indicated, and trade accordingly. But the factors influencing the market are infinite in their number and character, as well as in their effect upon the market, and to attempt the construction of a Tape Reading formula would seem to be futile. However, something of the kind (in the rough) may develop as we progress in this investigation, so kind an open mind because we have many secrets, tricks and tips to reveal that are not in the pocket of the average day trader.

What is Tape Reading? This question may be best answered by first deciding what it is not.

- Tape Reading is not merely looking at what the tape to determine how prices are running.

- It is not reading the news and then buying or selling “if the stock acts right.”

- It is not trading on tips, opinions, or information.

- It is not buying “because they look strong,” or selling “because they look weak.”

- It is not trading on chart indications or by other mechanical methods.

- It is not “buying on dips and selling on peaks.”

- Nor is it any of the hundred other foolish things practiced by the millions of people without method, planning or strategy.

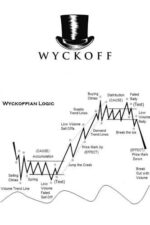

It seems to us, based on our experience, that Tape Reading is the defined science of determining from the tape the immediate trend of prices. It is a method of forecasting, from what appears on the tape now in the moment, what is likely to appear in the immediate future. Tape Reading is rapid-fire common sense. Its object is to determine whether stocks are being accumulated or distributed, marked up or down, or whether they are being neglected by the large investors.

The Tape Reader aims to make deductions from each succeeding transaction — every shift of the market kaleidoscope; to grasp a new situation, force it, lightning-like, through the weighing machine of the mind, and to reach a decision which can be acted upon with coolness and precision. It is gauging the momentary supply and demand in particular stocks and in the whole market, comparing the forces behind each and their relationship, each to the other and to all.

A day trader is like the manager of a department store; into his office are submitted hundreds of reports of sales made by the various departments. He notes the general trend of business — whether demand is heavy or light throughout the store but lends special attention to the products in which demand is abnormally strong or weak.

Contents:

- Getting Started In Tape Reading

- The Stock Lists and Groups Analyzed

- Trading Rules

- Volumes and Their Significance

- Market Technique

- Dull Markets and Their Opportunities

- The Use of Charts as Guides and Indicators

- Daily Trading vs. Long-Term Trading

- Various Examples and Suggestions

- Obstacles to be Overcome Potential Profits

- Closing Trades (as important as opening trades)

- Two Day’s Trading – An Example Of My Method Applied

- The Principles Applied to Longer Term Trading

The Day Trader's Bible: Or My Secret In Day Trading Of Stocks By Richard D. Wyckoff pdf

| Author(s) | |

|---|---|

| Format | |

| Pages | 116 |

| Publication Year | 2001 |

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.